Palantir Technologies (NASDAQ: PLTR) Is in a Strong Buy Zone

Palantir Technologies (NASDAQ: PLTR) stock has been in a slump lately, but its fourth-quarter earnings report could be just what it needs to regain momentum.

We’ve been here before.

Often, in fact.

I’ve been following this company for the past five years and it’s been a holding in both my Crow’s Nest and Secret Stock Files portfolios.

When I first recommended the stock for Secret Stock Files in 2022 it was trading around $13 per share. Shortly thereafter it lost half its value falling to less than $7.00.

That put me in the uncomfortable position of having to go out to my subscribers and tell them to double down and buy more.

Thankfully, the move paid off as the stock soared to unfathomable highs, ultimately returning 1,530%.

I’ve been a fan ever since.

So when I see Palantir stock fall below a certain level, I routinely advise investors to buy the dip.

And generally speaking, that’s worked out well, as the stock is up 86% in the past year — despite a constant stream of criticism and concerns about an “AI bubble.”

However, Palantir has lost 21% of its value since late December, falling from a high of $194 to its current level around $152.

So here I am again, telling investors to buy the dip. And this chart will give you an idea why…

Palantir stock has fallen below $160 four times in the past six months, including this most recent sell-off.

And each time, it’s bounced back from that drop to climb back over $180, or even $190 in two out of three cases.

It’s almost like clockwork.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “Guardians of Growth: 3 Defense Contractors for Savvy Investors.”

It contains full details on the three companies that are set to provide explosive growth in the defense sector over the next Decade.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

So what’s behind this trend?

Well, Palantir usually sells off for a number of reasons.

Typically it’s one or a combination of the following things:

- Profit-taking

- A broader drop in the market — especially tech stocks (i.e., the Nasdaq)

- Concerns about an AI bubble

- Skepticism about the company’s business

- And criticism of its high valuation

But the thing about Palantir is that it has a habit of making its critics look like fools.

Again, they’ve been around as long as I’ve been covering the stock. And they were just as convinced that Palantir would lose half its value when it was trading at $30 as they are now that it’s trading around $150.

The Palantir critics are loud and extremely confident that it’s destined for a collapse.

Problem is, they’ve been wrong (REALLY WRONG) for the past five years.

Palantir stock gained 167% in 2023, 340% in 2024 and 135% in 2025 — despite its chorus of detractors.

And those gains have consistently been supported not just by sentiment and AI euphoria, but by earnings beats.

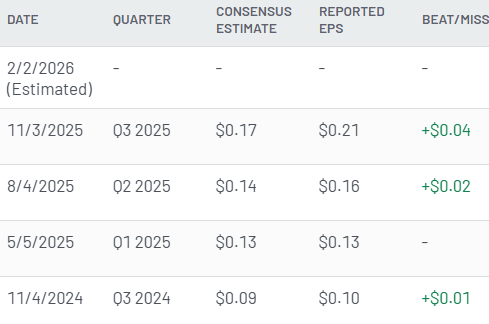

Indeed, Palantir earnings have topped analysts’ estimates in three of the past four quarters.

Most recently, Palantir’s third-quarter revenue totaled $1.18 billion compared with the $1.09 billion expected and EPS came in at $0.21 per share, ahead of the consensus $0.17.

The company also raised its full-year forecast, upping its total revenue projection to $4.4 billion and its pegging free cash flow between $1.9 billion and $2.1 billion

This is why the stock has been so volatile. Every time fears of an AI bubble grip the market and analysts proffer dire warnings about Palantir’s valuation and inevitable collapse…

It flips the script with exceptional results.

Now, Palantir is set to report its 4Q and full-year earnings after the market closes today.

For what it’s worth, Wall Street analysts anticipate adjusted EPS of $0.23, which would be a 64% improvement over last year and a 63% jump in revenue totaling $1.341 billion.

But if history is any indication, they’ll probably come out ahead… again.

Heck, even if they don’t, I wouldn’t change course. I’d come right back here and tell you to buy more.

Fight on,

Jason Simpkins

Simpkins is the founder and editor of Secret Stock Files, an investment service that focuses on companies with assets — tangible resources and products that can hold and appreciate in value. He covers mining companies, energy companies, defense contractors, dividend payers, commodities, staples, legacies and more… He also serves as editor of The Crow’s Nest where he analyzes investments beyond the scope of the defense sector.

For more on Jason, check out his editor’s page.

Be sure to visit our Angel Investment Research channel on YouTube and tune into Jason’s podcasts.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.