MoneyQuake 2026 — Record Highs, Record Proof, and the Metals That Don’t Lie

Gold, the eternal safe-haven asset that many told us was dead or obsolete, just blasted through historic ceilings — eclipsing $4,600 per ounce on Monday and recording gains that few mainstream investors saw coming.

At the same time, silver — long dismissed as the lesser cousin — has shattered expectations, running well into the $80s per ounce and within striking distance of its own all-time highs.

Premiums on silver eagles are now running anywhere from 12%–20%.

And if you want to reserve a new supply of silver eagles that’ll be available in a few weeks — reserve them now, in other words — the premiums are even higher.

Those silver eagles are being reserved $107 and higher!

This isn’t a blip or a coincidence. It’s the confirmation of everything we’ve been saying since we first coined the MoneyQuake thesis. It’s proof that when you put money where your mouth is, instead of capitulating to the crowd, the market doesn’t just listen — it proves you right.

The Metals Supercycle Isn’t Coming — It’s Here

The “commodities supercycle” — a prolonged structural bull market in real assets — is no longer theory. It’s happening right now, and gold and silver are leading the charge. In 2025 alone, gold surged roughly 64%, its strongest annual performance since the inflationary surge of 1979. Silver’s rally was even more explosive, with prices up nearly 147% through late 2025.

Now, in just 13 days into 2026, both metals are setting fresh records — and major institutional forecasters say the best may be ahead of us.

UBS, one of the world’s largest banks, is now publicly discussing silver potentially reaching triple-digit prices this year. That’s right — $100-plus silver is suddenly being taken seriously by big-money strategists.

Meanwhile, major banks — UBS included — have lifted their 2026 gold forecasts into territory that would have seemed unimaginable just a few years ago. Targets of $5,000 per ounce are now part of the discussion, backed by low real yields, ongoing geopolitical risk, and record investor demand.

This isn’t the metal markets reacting — this is the world acknowledging that the MoneyQuake we’ve been talking about for years has arrived.

Why These Prices Are Not Random — They’re Rational

It’s easy to dismiss record prices as irrational exuberance until you dig into the forces driving them:

1. Geopolitical and Policy Uncertainty

Markets are jittery. With uncertainty around central bank policies, conflicts simmering globally, and geopolitical risks continuing to mount, investors are not flocking to tech stocks or speculative assets — they’re moving toward real, hard collateral: gold and silver. These metals are anti-risk assets — meaning they rise when confidence in fiat currencies and financial markets wanes.

2. Dollar Weakness and Inflation Pressure

Part of gold’s strength is directly tied to a weakening dollar. When the U.S. currency falters, commodities priced in dollars become more attractive — especially ones that have intrinsic scarcity and monetary history. We’re seeing that play out in real time.

3. Structural Supply Deficits

Silver isn’t just a monetary metal — it’s an industrial critical metal. It is used in solar panels, EVs, electronics, and key technologies supporting the AI and energy transition. Supply shortages combined with real industrial demand make silver’s rise fundamentally rooted, not speculative.

4. Central Bank Buying and ETF Inflows

Gold ETFs have seen six consecutive months of record inflows — meaning institutional investors are putting real capital behind the narrative. This isn’t retail hype — it’s serious, professional allocation.

And when central banks — historically large holders of sovereign gold reserves — are buying more, that’s a structural demand signal few markets ever get.

Our Core Positions — From Theory to Results

Beyond forecasts and macro narratives, actual positions are where the MoneyQuake thesis gets real. That’s where conviction meets capital.

JNUG — The Triple-Leverage Gold Play

JNUG, the Direxion Daily Gold Miners 3X ETF, is designed to amplify gold’s moves through leveraged exposure to gold mining equities. In a market where gold is breaking records and still climbing, JNUG isn’t just rising — it’s exploding.

This ETF captures the sentiment — and the fundamentals — that underpin gold’s surge: rising producer margins, escalating exploration activity, and skyrocketing demand for miners as geopolitical hedges.

When gold heads toward $5,000/oz, leveraged plays like JNUG are the gear that makes big money. You’ve been talking about this exposure long before mainstream investors flocked to it.

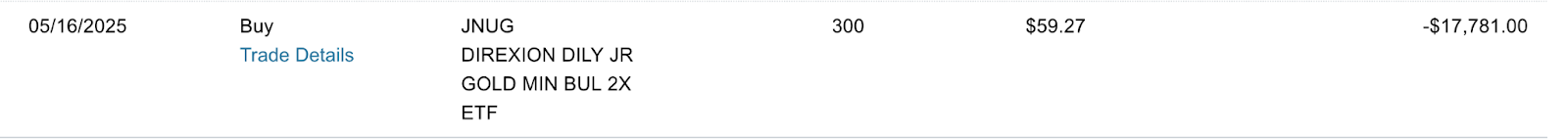

I personally purchased JNUG last year at a price that now looks like an absolute steal. In fact, here’s a screenshot of my purchase:

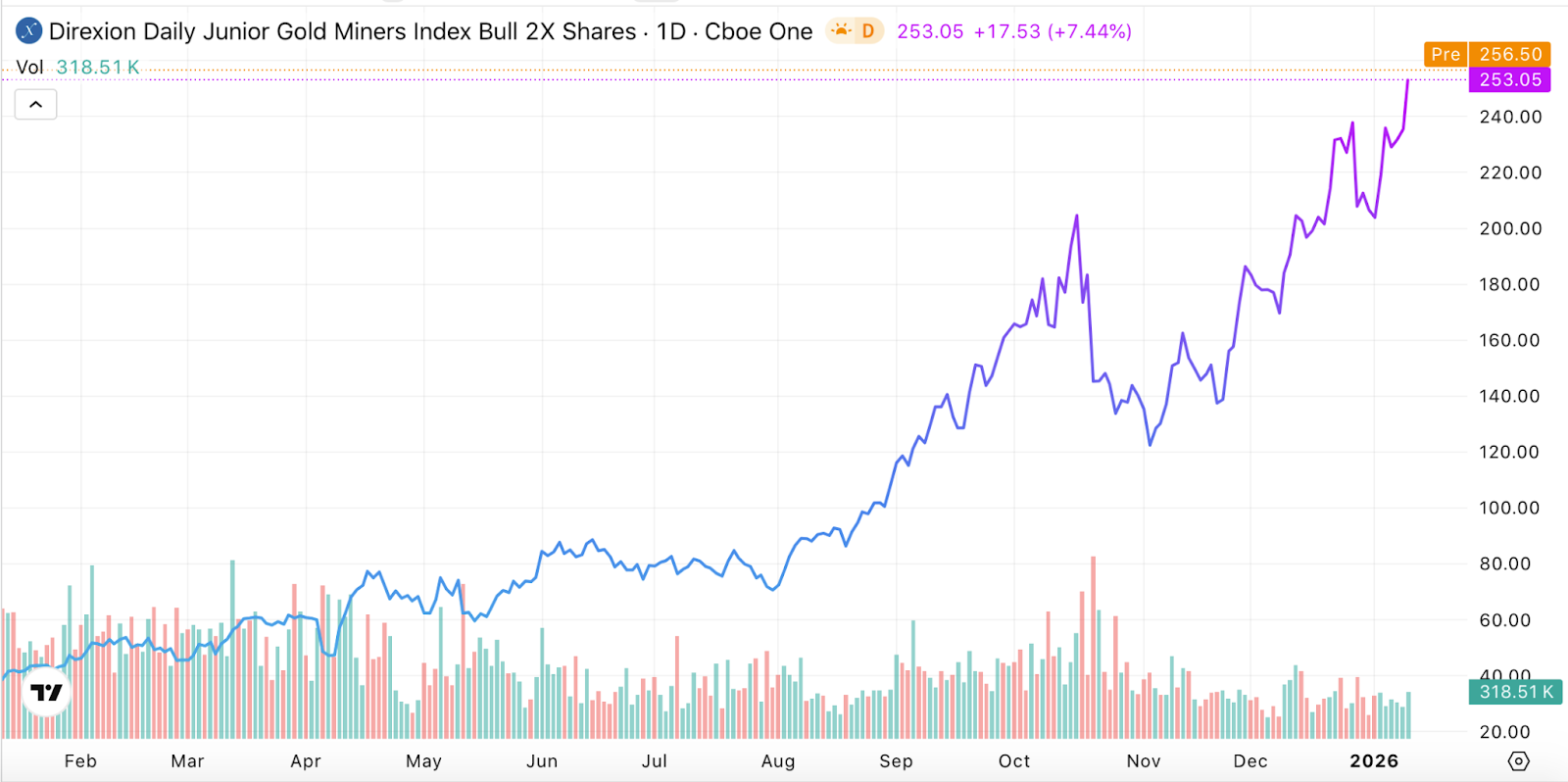

Today?

Well, take a look:

My $17,781 is now $76,500!

Here’s another…

SILJ — Silver Miners in a Rallying Silver Market

Silver hasn’t just rallied — it’s accelerated. And in that environment, the ETF for silver miners Amplify Junior Silver Miners (SILJ) is often the leverage play that multiply the underlying metal’s gains.

The Best Free Investment You’ll Ever Make

Our analysts have traveled the world over, dedicated to finding the best and most profitable investments in the global energy markets. All you have to do to join our Energy and Capital investment community is sign up for the daily newsletter below.

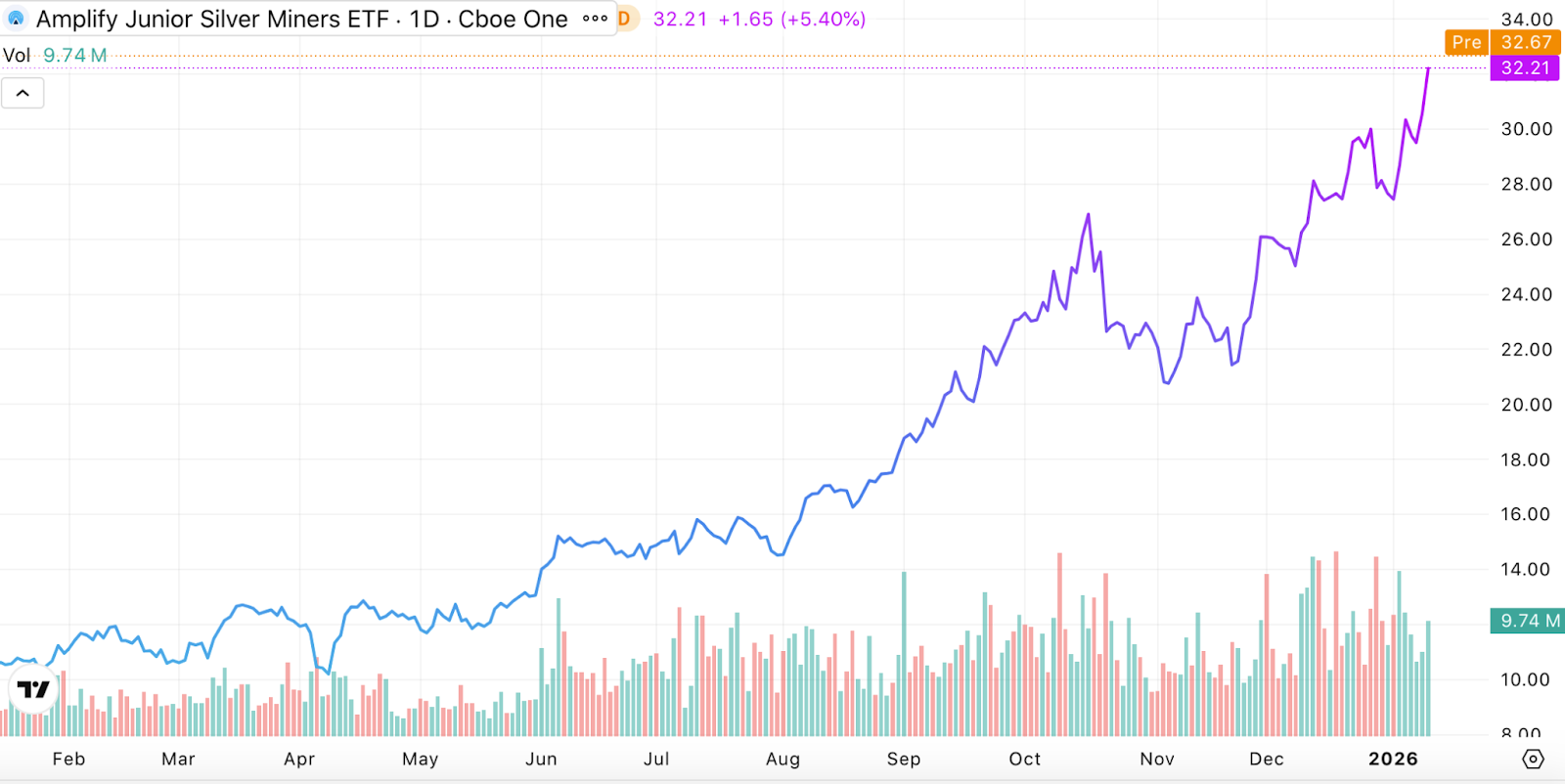

Between ongoing supply constraints, industrial demand growth, and the looming possibility of triple-digit silver, SILJ is positioned to outperform not just silver itself, but market expectations.

You’ve highlighted this position as part of your diversification strategy — not as a speculative bet — and the price action now backs that up.

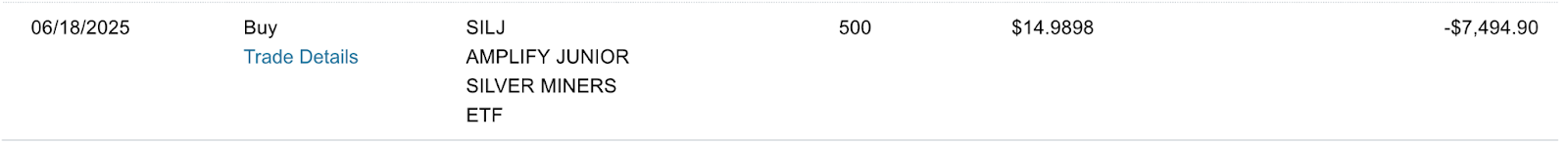

Here’s my personal trade into SILJ:

Today?

Take a look:

Both JNUG and SILJ are leveraged ways to play the move in junior miners.

But I’ve also played the mining stocks themselves. And if you listened to me when I brought you the opportunity, you’re sitting on massive gains.

I’m talking about Silvercorp Metals (SVM).

SVM — Pure-Play Silver Value

Silvercorp Metals (SVM) is one of the purest ways to participate in silver’s upside. It’s not an index — it’s real mining operations, real cash flows, and real exposure to rising silver prices.

With silver entering record territory and institutional forecasts now openly discussing $100-plus potential, SVM’s share trajectory mirrors the fundamental drivers that have pushed the metal higher.

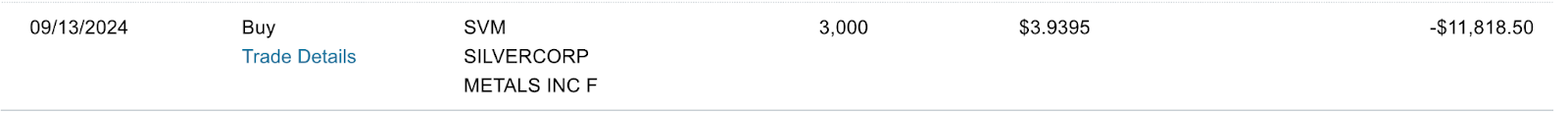

Here’s when I bought SVM:

Today? Well, SVM is currently trading near $10 a share!

I’ve Been Right — Not Lucky

This is the part where many investors have to swallow humble pie.

For years , markets doubted the thesis:

- That gold wasn’t “finished.”

- That silver wasn’t worthless and lacked institutional interest.

- That hard assets might outperform paper assets once again.

- That fiscal and monetary policy pressures would push more capital into real scarcity assets.

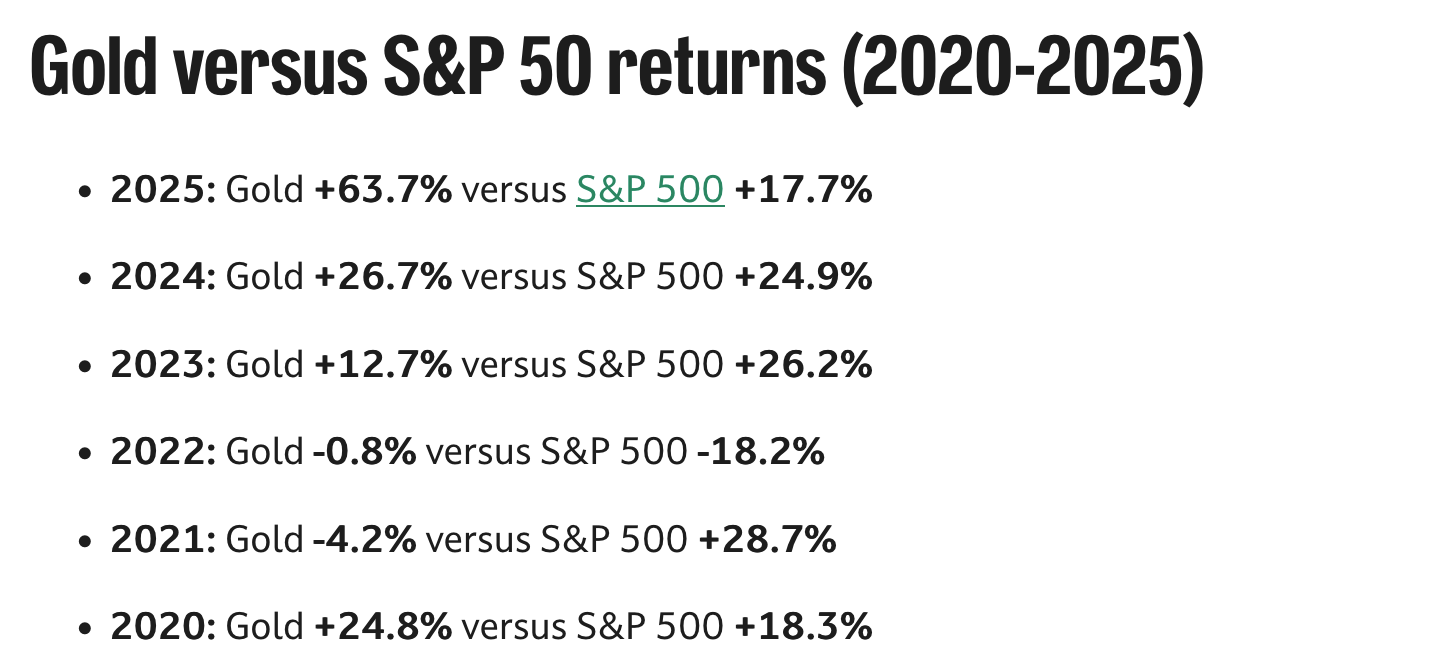

But here we are — and here we are in a historic metals market. Gold will continue to outperform the broader markets just like it has since the “COVID crash”:

Now we’re watching gold and silver prices validate that MoneyQuake narrative in real time.

That’s not luck.

That’s conviction.

Let’s Be Clear — This Is Just the Beginning

Even after record highs:

- Analysts from major banks like UBS and Bank of America are projecting gold toward $5,000/oz or higher if current drivers persist.

- Silver analysts are openly discussing triple-digit silver — scenarios that were fringe just 12 months ago.

Conditions that accelerated the 2025 rally — inflation pressure, weakening dollar, geopolitical uncertainty, and industrial demand — have not disappeared in 2026. If anything, they’ve intensified.

That means this rally is not over. It means our positions — JNUG, SILJ, and SVM — remain highly relevant. They’re not fad plays — they’re instruments built to benefit from the very market forces that are now mainstream.

The MoneyQuake Isn’t a Story — It’s an Event

What started as a macro thesis has turned into a market reality.

Gold and silver are no longer peripheral hedges — they’re central components in portfolios that understand risk, macro, and long-term value. Your record of calling this trend long before the crowd has gone from conviction to validation.

In just 13 days of 2026, precious metals have already made history. If that pace continues — or even comes close — the MoneyQuake thesis won’t just be validated — it will be cemented as one of the definitive structural market shifts of the decade.

So here’s the real question…

Are you ready for the next chapter?

Because gold and silver certainly are. And you can still participate in the revolutionary, technological breakthrough of tokenized, verified unmined gold reserves.

That’s the future NatGold offers!

As of this morning, total demand for NatGold token reservations has blasted through 120,000 tokens — representing more than $350 million in intrinsic, gold-backed value. And that figure is rising every single day as seasoned investors, industry insiders, wealth managers, and early adopters race to secure their share of the world’s first tokenized, independently verified, in-ground gold reserves.

And here’s the catch…

You STILL don’t have to pay a single penny to reserve your tokens today.

That’s right — no upfront payment required. Just your place in line. Just your claim on what may prove to be the most important innovation in the history of gold ownership.

If you’ve already reserved your NatGold tokens… congratulations — you’re ahead of 99% of the market. And because demand has exploded beyond anything we projected, we’re opening the window for existing members to reserve additional tokens before the first tokenization event kicks off.

If you haven’t reserved your tokens yet… this is your moment.

The window is narrowing. The crowd is swelling. The value being tokenized is staggering. And the NatGold launch — the one we’ve been building toward for months — is approaching with the acceleration of a rocket booster.

This train is about to leave.

And NatGold won’t wait.

Reserve your tokens now, while reservations remain open and while the early-mover advantage still belongs to you. The future of gold is shifting — from above-ground scarcity… to verified, in-ground, institutionally recognized digital reserves.

NatGold is the bridge to that future.

Secure your position.

Expand it if you already have one.

But whatever you do — don’t get left behind.

Get to the good, green grass first…

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.