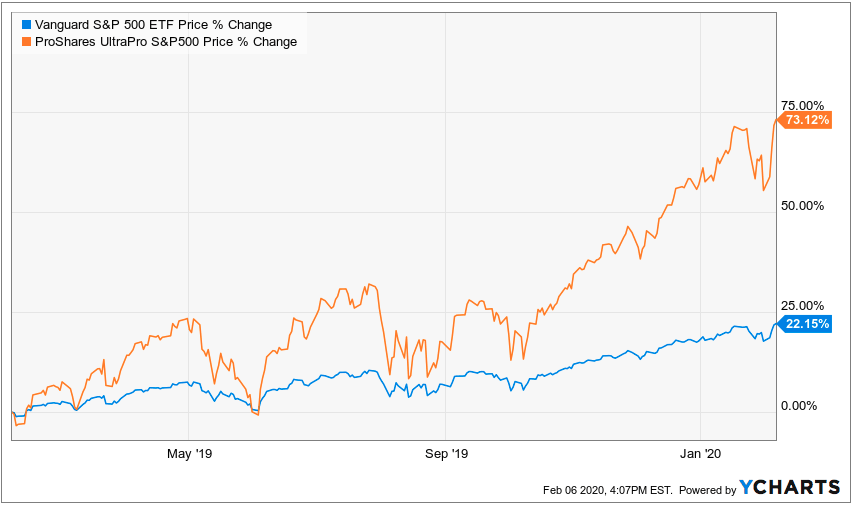

Investors who passively held an S&P 500 exchange-traded fund (ETF) for the last year are currently sitting on a handsome 22.15% gain.

But as you can see in the graph below, another cohort of single-fund investors earned 73.12% returns in the same time period!

The ProShares UltraPro S&P 500 ETF (NYSE: UPRO) is one example of a leveraged ETF — a controversial class of funds that uses derivatives and debt to track a multiple or inverse of an underlying index. UPRO in particular is designed to deliver three times the daily performance of the S&P 500.

These funds can be great tools for short-term traders and medium-term investors who know what they’re doing. But they come with significant pitfalls, particularly for investors who try to hold them long term.

Today, we’re looking at the right and wrong ways to use leveraged ETFs, but first, let’s look at what’s inside of those “2x,” “3x,” and “inverse” funds.

How Do Leveraged ETFs Work?

As the name implies, leveraged ETFs use leverage instruments like short-term debt and options contracts to make big bets on (or against) the stocks and bonds in an index, thereby earning returns that are equal to some multiple (positive or negative) of the index’s returns.

For instance, suppose that the S&P 500 gains 1% in a day. A fund manager at a leveraged ETF tracking twice the return of the S&P 500 might buy a set of call options on the index that gain an average of 2% that day. A manager at a leveraged ETF tracking the inverse of the S&P 500 might buy a set of put options that lose an average of 1% that day.

As a result of their tendency to take bold, high-risk positions, leveraged ETFs win big when their underlying index goes the right way and lose big when it goes the wrong way.

But there’s something else to consider about the way leveraged ETFs work; when their underlying index trades sideways, they still tend to lose some money.

That’s because the options and margin trading strategies employed by leveraged ETF managers all cost money to use. After all, options have premiums, and borrowed money comes with interest. Fund managers need to earn some sort of positive return in order to pay these costs. A flat trading day means losses.

With all this in mind, let’s learn about what leveraged ETFs are good for — and what they’re not good for.

The Wrong Way to Use Leveraged ETFs

Leveraged ETFs aren’t built for buy-and-hold investors for a variety of reasons.

For one, they have higher annual expense ratios (0.9% on average) than most ETFs (0.44% on average), making them impractical long-holds from a cost perspective.

Also, the rapid sale of securities within leveraged ETFs generates a lot of taxable events for shareholders throughout the year, making it especially annoying to hold leveraged ETFs for a long time outside of a tax-advantaged account.

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, “Seven Techincal Analysis Tools for Investors.“

Finally, it’s worth noting that leveraged ETFs track some multiple of their underlying index’s daily performance, not its long-term performance.

Over a time period of years, a leveraged ETF’s returns may not even correlate strictly to its index’s returns.

As you can see above, UPRO and the Direxion Daily S&P 500 Bull 3x ETF (NYSE: SPXL), both of which are supposed to be leveraged ETFs returning three times the performance of the S&P 500, have significantly divergent returns over the last 10 years.

So if you shouldn’t use leveraged ETFs for long-term investing, how should you use them?

The Right Way to Use Leveraged ETFs

Investors who have a solid short-term investment thesis in a strongly trending market can get a lot of use out of leveraged ETFs.

One relatively recent example could be found in European markets around the time of the 2015 Greek bailout deal.

Investors who held a generic Europe ETF like the Vanguard FTSE Europe ETF (NYSE: VGK) earned a respectable 7.48% return in the first six months of 2015. But investors who held a leveraged Europe ETF like the Direxion Daily FTSE Europe Bull 3x ETF (NYSE: EURL) earned a return of more than 21%.

Leveraged ETFs can also be used to hedge short-term options trades. For instance, if you’re buying a large number of put options on the S&P 500, picking up a few shares of UPRO could provide some peace of mind in the event that the S&P 500 rises and the trade goes against you.

As you can see, leveraged ETFs are powerful but risky investment vehicles that should be used carefully. Just make sure that you have a strong short-term thesis for buying and selling them (and that you’re not buying and holding) and you’ll be well on your way to earning “2x” and “3x” returns like a pro.

Until next time,

![]()

Samuel Taube

Samuel Taube brings years of experience researching ETFs, cryptocurrencies, muni bonds, value stocks, and more to Wealth Daily. He has been writing for investment newsletters since 2013 and has penned articles accurately predicting financial market reactions to Brexit, the election of Donald Trump, and more. Samuel holds a degree in economics from the University of Maryland, and his investment approach focuses on finding undervalued assets at every point in the business cycle and then reaping big returns when they recover. To learn more about Samuel, click here.