Gold, Silver, and the Untold Critical Minerals Story

The phrase “critical minerals” has gone from niche policy-speak to a buzzword echoing across Washington, Wall Street, and every corner of the energy and defense industries.

These are the building blocks of our digital and industrial future — think gallium for semiconductors, antimony for military alloys, and rare earths for magnets that power everything from fighter jets to wind turbines.

They’ve been called “critical” not just because of their importance, but also because of how vulnerable the supply chains are…

China processes over 80% of the world’s rare earths. Russia holds sway over palladium and specialty metals. And the U.S.? For too long, it’s been reliant on foreign producers for the very materials needed to build resilient infrastructure and defend national security.

Now the government is scrambling to establish domestic supply, offering funding, partnerships, and policy tailwinds to anyone who can help.

And here’s the part most people don’t realize: Some of the best potential sources of these critical minerals aren’t stand-alone mines…

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

How Gold and Silver Mines Unlock More Than Just Ounces

Gold and silver mining has always been marketed as a straightforward business…

Dig, blast, process, sell. But geology doesn’t follow business plans.

Minerals don’t travel solo underground — they arrive in clusters, deposited together when hot mineral-rich fluids cooled in fractures and faults millions of years ago.

That’s why you’ll often find silver veins laced with antimony, gold systems rich in tellurium, and polymetallic deposits carrying gallium, germanium, and indium right alongside lead and zinc.

For decades, those extras were shrugged off as impurities or processed quietly in the background. Today, with the government eager to subsidize critical mineral development, they’re being recast as potential jackpots.

The byproducts of precious metal mining are suddenly taking center stage. The gold and silver mines of today could very well be the backbone of tomorrow’s critical mineral supply chain.

The Rocks Don’t Lie: Where These Minerals Hide

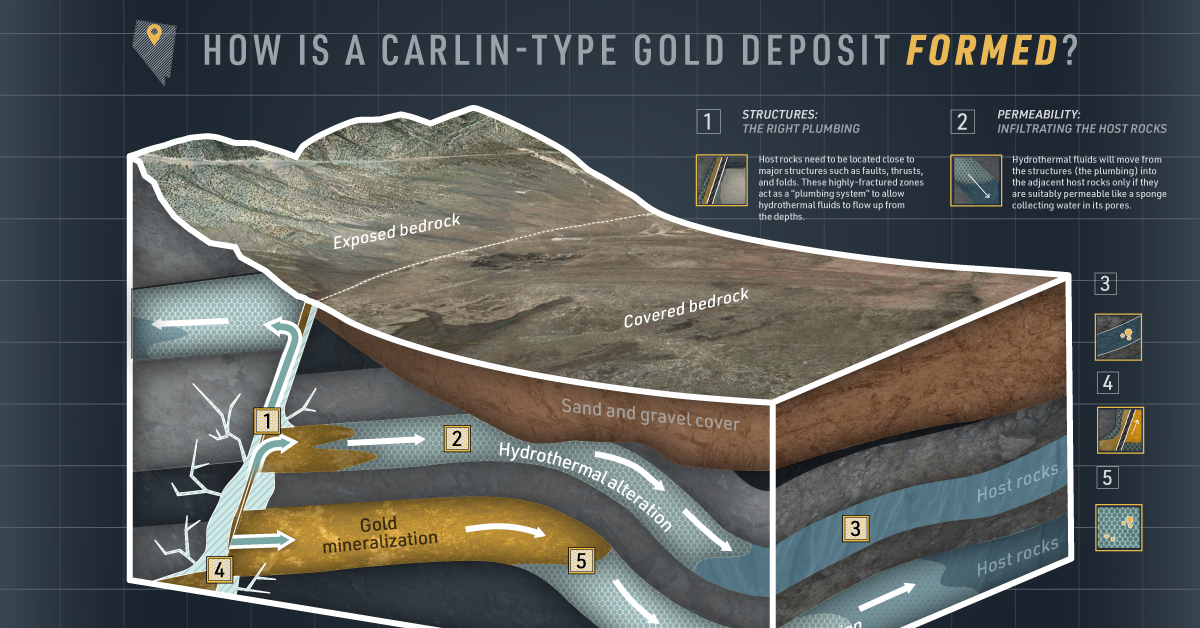

The specific associations between precious metals and critical minerals come down to deposit type…

Epithermal deposits, formed by shallow hydrothermal activity, are rich in gold and silver but often contain antimony, arsenic, and tellurium.

Carlin-type deposits, the kind that put Nevada on the mining map, host microscopic gold particles and have been known to yield antimony and mercury.

Polymetallic systems — particularly those focused on lead and zinc — often carry silver as a byproduct, and in those ores you’ll find gallium, indium, and germanium, three minerals that are absolutely indispensable for the semiconductor industry.

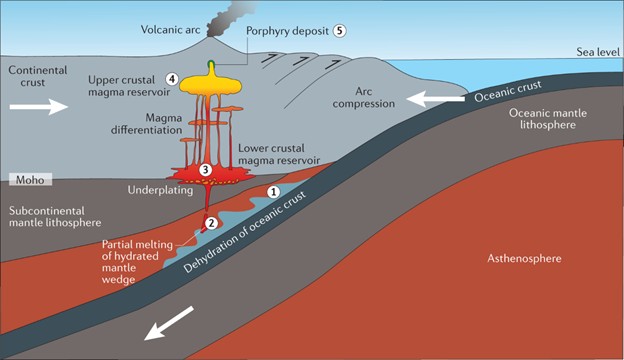

Then there are porphyry systems, massive copper-gold formations that often include molybdenum and rhenium. Those two may not grab headlines, but they’re vital for strengthening steel and building jet engines.

In short, a gold or silver deposit is rarely “just” about gold or silver. Each type of deposit carries with it a suite of critical minerals waiting to be tapped.

Lessons From the Past

History has already shown us what happens when these “extras” get their moment in the spotlight…

Idaho’s Coeur d'Alene district produced silver for over a century — but along the way, it also yielded germanium and gallium, two elements that would later become essential for electronics and aerospace.

And Nevada’s legendary Carlin Trend wasn’t just a gold mine…

Its antimony byproducts became strategic as flame retardants and military alloys gained importance.

Then you have Mexico’s silver belts, long dismissed as single-commodity plays, proved to be rich in tellurium — a once-ignored element now essential for high-efficiency solar panels.

Time and again, what was once considered waste rock has turned into a source of national advantage. Today’s overlooked byproducts are tomorrow’s lifelines.

Four Precious Metals Miners Positioned for the Future

That brings us to the modern players…

There are several companies whose gold and silver projects are perfectly positioned to deliver not just ounces of bullion, but pounds and tons of critical minerals that America desperately needs.

And each of these companies demonstrates that mining isn’t a one-dimensional game.

Ounces of gold and silver may grab the headlines, but the byproducts could be the real prize.

Coeur Mining: More Than Silver and Gold

Coeur Mining isn’t just another silver-and-gold producer. With operations across the U.S. and Mexico, including its flagship Rochester mine in Nevada, Coeur is building a reputation as a polymetallic powerhouse.

Rochester alone has one of the largest heap leach pads in the world, and while silver and gold are the headliners, the geology points to byproduct lead and zinc.

That opens the door to gallium and germanium — two critical minerals that are essential for semiconductors, fiber optics, and infrared optics.

For Coeur, what was once background noise is quickly becoming a second line of business that positions the company as a potential key player in America’s critical mineral strategy.

I-80 Gold: Nevada’s Critical Advantage

I-80 Gold is carving out a reputation as one of the most exciting emerging gold companies in Nevada…

Its portfolio includes Granite Creek, Lone Tree, Ruby Hill, and McCoy-Cove — projects that sit squarely in the Carlin and Battle Mountain trends, some of the richest gold belts on Earth.

But Ruby Hill in particular tells a bigger story…

This deposit isn’t just about gold — it’s polymetallic, with zinc, silver, and indications of antimony, making it a candidate for critical mineral development.

With Nevada already recognized as the beating heart of America’s gold industry, I-80 could become a central node in building the nation’s secure mineral supply chain.

West Point Gold: Small Name, Big Potential

West Point Gold may not have the scale of Coeur or I-80, but its projects are located in regions where gold and copper mineralization overlap.

That matters because copper-gold systems are often fertile ground for molybdenum and rhenium — two minerals with outsized importance in aerospace and defense…

Molybdenum strengthens steel for pipelines and power plants, while rhenium is indispensable for jet engines.

For a company like West Point, critical mineral byproducts could dramatically increase its strategic value, turning a small-cap gold play into something much bigger than the market currently recognizes.

Apollo Silver: A Sleeping Giant in California

Apollo Silver is rapidly emerging as one of the most compelling silver developers in North America…

Its Calico Project in California is one of the largest undeveloped silver deposits in the United States, with billions of dollars of potential in the ground.

Add to that its Cinco de Mayo Project in Mexico and Apollo has serious leverage to the silver price.

But what makes Apollo particularly intriguing is the potential for barite and zinc in these deposits.

If Apollo can show economic recoveries of barite or zinc, it won’t just be a silver developer — it’ll be a critical mineral story too.

When Gold and Silver Join the Critical List

There’s also the possibility that gold and silver themselves join the official critical minerals list. Silver is already halfway there…

The U.S. Department of the Interior has openly suggested adding it, recognizing its role in solar panels, advanced electronics, and defense applications.

A formal designation would instantly elevate silver mines to critical status, unlocking faster permitting and potential federal support.

Gold hasn’t been given that designation yet, but the case is strong…

Central banks are buying it hand over fist as the ultimate reserve asset. Its industrial uses in aerospace, electronics, and medicine only strengthen the argument.

If gold ever makes the list, every gold mine in the U.S. will instantly become a strategic operation.

Imagine what that does for companies like Coeur, I-80, West Point, and Apollo…

Their projects wouldn’t just be about precious metals, which are already in a long-term bull market…

They’d be redefined as pillars of America’s critical mineral strategy, too.

The Bottom Line: Get in Before the Big Moves

The conversation around critical minerals is no longer limited to rare earths or lithium.

Gold and silver miners are stepping onto the stage, not just as providers of wealth and safe-haven assets, but as hidden sources of minerals critical to the future of technology, energy, and defense.

We’ve seen this story before — ignored byproducts suddenly become strategic, reshaping entire industries.

The companies best positioned to ride this wave are the ones already in production or development, with projects rich in both precious metals and the minerals Washington wants so badly.

This is the kind of market shift that turns small-cap miners into household names.

Coeur Mining, I-80 Gold, West Point Gold, and Apollo Silver are four companies already in the right place at the right time.

Investors who get in now are buying not just exposure to gold and silver, but leverage to a critical minerals boom that could redefine the mining industry.

The time to act isn’t after the government stamps these mines with “critical” status. By then, the easy gains will be gone. The time to act is now — before the big moves really start.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube