How to Get Rich with Precious Metals: Why This Pullback Is a Golden Opportunity

If you’ve been paying attention to gold and silver prices over the past couple of years, you’ve probably noticed something pretty exciting. Precious metals have been on an absolute tear, putting in one of their strongest rallies in recent memory.

Gold surged to new highs, silver ripped higher, and suddenly, the world remembered what investors like us have known all along: These metals are the ultimate wealth protectors — and, if timed right, the ultimate wealth multipliers.

But then came the past few weeks…

Prices dipped. Headlines declared “the rally is over.” And some folks — always quick to panic — started unloading their positions.

The thing is, what we’re seeing isn’t the end of anything. It’s a pause, a breather, a healthy correction in a market that’s building strength for its next leg higher.

And if you play this right, it could be your ticket to real, generational wealth.

Why Gold and Silver Rallied So Hard

First, let’s rewind…

Why did gold and silver soar in the first place?

Simple: Investors were desperate for safety in a world that suddenly felt very unsafe.

- Central banks couldn’t print enough money fast enough.

- Inflation roared back, eating away at savings and salaries.

- Geopolitical conflicts created an environment of fear and uncertainty.

- AI-driven energy demand, trade tensions, and runaway government debt all poured fuel on the fire.

Gold, the eternal safe haven, responded as it always does — by climbing higher.

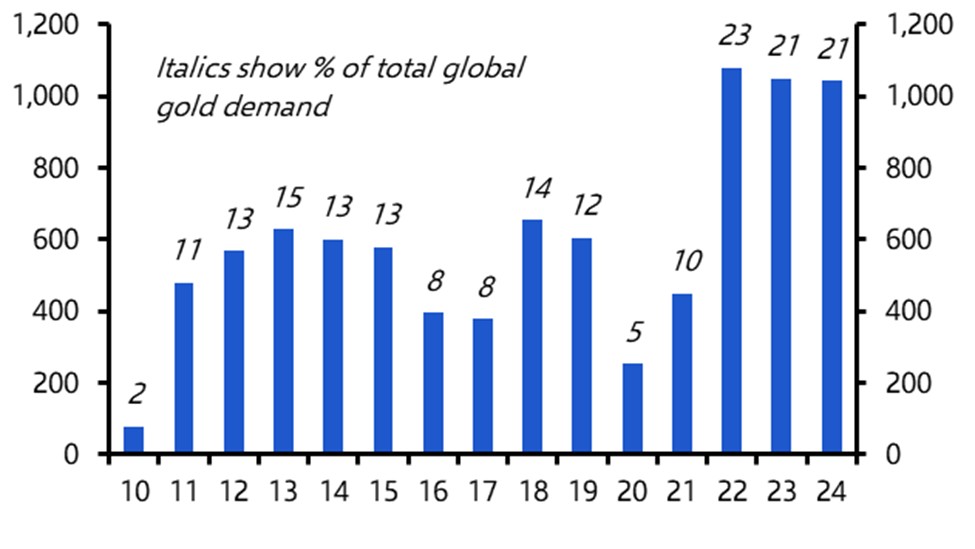

Central banks joined the party too, buying record amounts of gold, adding credibility and firepower to the rally.

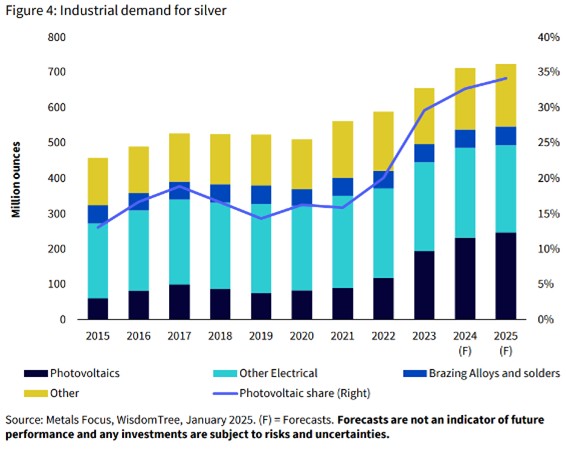

Silver, meanwhile, played its dual role as both a safe haven and an industrial metal, seeing huge demand from green energy projects, electric vehicles, and technology manufacturing.

In short, the rally was powered by the perfect storm of monetary, geopolitical, and industrial drivers.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Why Prices Just Pulled Back

So what’s with the recent weakness? Did the bull market really just fizzle out? Hardly.

Short-term pullbacks happen in every long-term rally…

After a strong two-year climb, traders took profits. Algorithms spotted overbought signals. Some retail investors, spooked by headlines, rushed to the exits. Prices cooled off.

But here’s the key: Every time gold or silver shows weakness, it’s getting met with buying.

Not just from mom-and-pop investors stacking coins, but from massive institutional players who are quietly scooping up metal.

That’s not the behavior of a market that’s topping out. That’s the footprint of accumulation — big money building positions before the next breakout.

This correction isn’t the end. It’s the setup.

The Healthy Bull Market Pattern

The pattern is crystal clear…

Precious metals rise, they cool off, they rise again — each leg higher drawing in more investors, more capital, and more attention.

And this particular cycle isn’t anywhere close to done.

The floor is rising thanks to demand from central banks, industrial users, and everyday savers.

The ceiling? Let’s just say it’s so high you can’t see it from here.

That’s what makes this moment so special: The downside risk is limited, but the upside potential is massive.

Smart investors don’t wait for the herd to wake up. They recognize the pattern, step in during the pause, and position themselves for the surge that comes next.

How to Get Rich With Precious Metals

So how do you play this? Well, there are two :

- The safe bet: Buy physical gold and silver. Coins, bars, rounds — whatever you like. It’s slow and steady, but it’s nearly guaranteed to pay off over time. If you just want to make sure you’re wealthier in five years than you are today, this is your move.

- The wealth multiplier: Buy mining stocks. This is where fortunes are made.

Why? Because miners are leveraged to the price of the metals they produce…

Here’s how it works: Let’s say a gold miner can produce gold for $1,200 an ounce. If gold is selling for $1,800, they’re making $600 in profit per ounce.

If the gold price rises just 10%, to $1,980, that profit margin doesn’t go up 10%…

It jumps from $600 to $780 — an increase of 30%.

That leverage explodes into the stock price, which can soar multiples higher than the metal itself.

Silver miners see even more extreme leverage because silver prices are more volatile…

A 20% move in silver can translate into a 100% move in some miners’ profits. And the market loves rewarding that kind of growth.

Two Gold Miners to Watch

If you’re looking to ride the gold wave, here are two companies worth your attention:

Seabridge Gold (NYSE: SA)

Seabridge isn’t your typical gold miner. It’s more like a treasure chest waiting to be unlocked…

The company controls some of the largest undeveloped gold projects in the world, with massive proven reserves.

The trick here is patience — these deposits are so big that it’s only a matter of time before a major mining company swoops in with a buyout offer.

When that happens, Seabridge shareholders could see windfall returns.

But even without mining a single ounce, Seabridge’s gold assets have value investors can see and they’ve driven the company to a near $2 billion valuation.

Shares are up 35% year to date and have pulled back some with gold prices. This could be the last dip before the real run starts.

NatBridge Resources (CSE: NATB / OTC: NATBF)

NatBridge is taking the Seabridge model of not mining gold into the 21st century as it pioneers something entirely new: digitizing in-ground gold assets.

That means it's not just mining gold — it's transforming how gold is owned, traded, and monetized.

By tokenizing verified reserves, NatBridge offers a bridge between the old world of physical metal and the new digital economy.

It’s a bold, disruptive approach that could make early investors very wealthy.

Shares are already up over 100% this year and have pulled back with the industry, potentially representing a very good time to buy.

Two Silver Miners to Watch

Silver is even more exciting right now, and two miners stand out:

Wheaton Precious Metals (NYSE: WPM)

Wheaton isn’t a traditional miner…

It’s a streaming company, which means it finances other miners in exchange for the right to buy their silver production at dirt-cheap prices.

This model gives Wheaton exposure to silver’s upside without the risks of running mines.

It’s a cash-flow machine, and as silver prices rise, Wheaton’s margins swell.

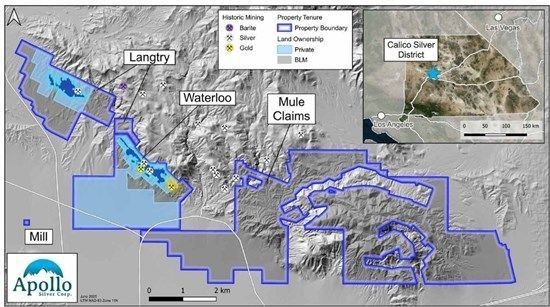

Apollo Silver Corp. (TSX-V: APGO / OTC: APGOF)

Apollo is a pure-play silver explorer with a high-potential project in one of the most mining-friendly jurisdictions in North America.

What makes Apollo so exciting is its leverage. It’s small, thinly traded, and virtually unknown outside of hardcore mining circles.

If silver rockets higher, Apollo has the kind of setup that can turn into a 5x or 10x gainer almost overnight.

The Bottom Line

The bottom line here is that the rally isn’t over. In fact, it’s far from it…

This correction isn’t a warning sign — it’s an invitation.

The long-term bull market in gold and silver is alive and well, supported by strong fundamentals and relentless accumulation from the biggest players in the game.

You don’t get rich chasing headlines. You get rich by recognizing patterns, stepping in when others are hesitating, and positioning yourself before the crowd arrives.

Buy some physical metal. Build a portfolio of miners. And most importantly, stay the course.

This precious metals supercycle is just getting started — and the biggest winners will be the ones who get in now and stick with it.

So get invested. Stay invested. And keep coming back to Wealth Daily to stay on top of the opportunities that could redefine your financial future.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube