What Happens When the Fed Waits Nine Months Between Rate Cuts?

Something potentially epic is brewing in the markets right now. Nearly everyone knows about it, but practically nobody knows what it’ll lead to. But those who do are getting extremely excited and getting their portfolios lined up for a major move…

Investors at a starting line waiting for the FOMC September rate cut to start the race after a nine-month pause.

You see, if the Federal Reserve gives markets a rate cut at its September 16–17 meeting, it will be the first cut since December 2024. That’s a nine-month pause — an eternity in market time.

And for investors, the question isn’t just whether the Fed finally cuts, but also what happens when it waits this long between moves…

Because history shows the pause itself creates as much market drama as the cut.

So today let’s explore what long Fed pauses mean for the big indexes, why gold and silver shine in these waiting games, and how hard commodities fit into the bigger picture.

And yes, we’ll pull in some history to show just how often markets rip higher after a delayed Fed move.

The Fed’s Long Pause: Suspense or Strategy?

When the Fed cut in December 2024, it lowered the federal funds rate into the 4.25 %–4.50% range, the first easing move after years of relentless hikes.

And markets breathed a sigh of relief.

But since then? Nothing.

Just a long pause while inflation data, job reports, and global trade worries piled up.

But the thing is pauses like this aren’t unusual…

The Fed prefers to act slowly and let data catch up to policy. But while that may be prudent for monetary planners, it’s maddening for investors.

And that’s why the length of the pause matters. Markets start trading every headline like it’s a Fed meeting in miniature, with volatility ratcheting higher and higher.

And then, when the cut finally comes, the move can be powerful — because months of waiting create a spring coiled tight, ready to release.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

How Do Stocks React to Fed Rate Cuts?

The big indexes — S&P 500, Nasdaq, and Dow Jones — are essentially barometers for Fed policy…

When rates rise, borrowing gets expensive and stocks sag. When rates fall, money gets cheaper and stocks pop.

But in between? That’s when anxiety builds.

During long pauses, stocks often stall, grinding higher in fits and starts as traders try to front-run the Fed.

The Nasdaq, with its army of tech stocks that depend on low financing costs, is hypersensitive.

The S&P 500 reflects broader sentiment — traders weighing the odds of a soft landing.

And the Dow, more cyclical by nature, shows whether Wall Street believes a cut will extend growth or warn of weakness.

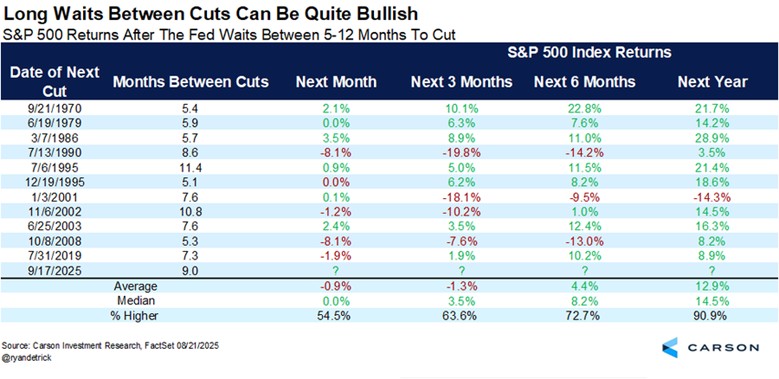

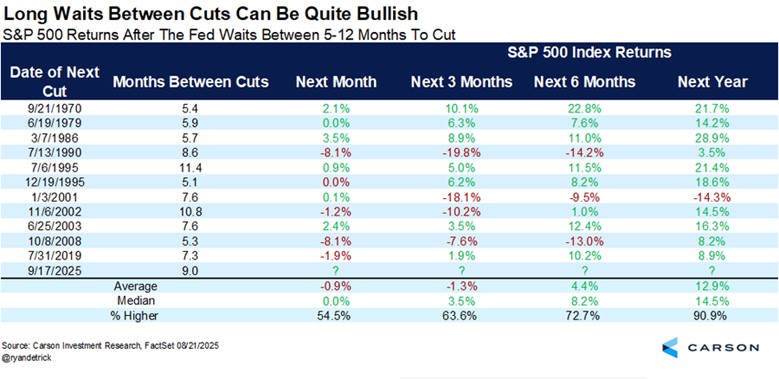

One big piece of evidence comes straight from history: In 10 of the last 11 times the Fed waited between five and nine months to cut rates, markets finished the following 12 months substantially higher.

In fact, the average gain 12 months after such a cut is a whopping 13%! And in 1995, a year this market is reminiscent of, markets ripped 21% higher over the following year…

Historical table showing 10 of last 11 times markets rallied after Fed waited 5–9 months between rate cuts.

That’s not opinion; it’s fact. Long pauses have consistently planted the seeds of rallies, and this nine-month stretch is right in the sweet spot.

The numbers don’t lie. The majority of the time the Fed waits this long between cuts, the next month, the next quarter, the next half, and the next full year are great for investors.

Precious Metals: Why Gold and Silver Love a Weaker Dollar

Now, while stocks fret during a Fed pause, gold and silver tend to thrive, something you’ve seen play out over the past year…

Both metals benefit from the uncertainty the Fed creates when it refuses to commit.

Gold, the world’s classic store of value, attracts capital when investors want protection from monetary waffling. Silver, half precious and half industrial, rides gold’s coattails in times of doubt — and then often leaps higher once growth optimism returns after a cut.

But here’s the real kicker: Interest rate cuts weaken the U.S. dollar.

And when the dollar falls, precious metals priced in dollars look even more attractive to global buyers.

That means with a weaker dollar, foreigners can buy more gold or silver for the same amount of their local currency, and that inflow of demand acts like rocket fuel.

It’s one of the reasons gold has historically surged during easing cycles — the Fed lowers rates, the dollar softens, and investors everywhere pile into bullion.

That’s why the nine-month pause is creating such a fertile setup…

Gold is already pressing near record highs thanks to central bank buying, and silver is holding ground waiting for a breakout.

If September brings a cut and a weaker dollar, which looks more and more likely with each passing day, the metals trade could ignite in a way we haven’t seen in years.

Commodities and the Dollar: The Fed’s Hidden Influence

Hard commodities like oil, copper, and agricultural goods respond differently, but they’re not immune to Fed policy, either…

High interest rates weigh heavily on producers and end users alike.

Financing big projects, hedging future production, and even trading commodity contracts becomes more expensive. That’s why long pauses can suppress demand and keep commodity markets sluggish.

But the moment the Fed cuts, two things happen at once: Borrowing costs ease and the dollar weakens. Both are bullish for commodities.

Oil producers find it cheaper to hedge and finance drilling. Copper demand rises as industrial growth expectations tick up.

And for foreign buyers, a weaker dollar makes everything from soybeans to steel cheaper to import.

This dual effect — lower financing costs and a softer dollar — is why commodities often stage strong comebacks after long Fed pauses.

They’re not just waiting for the cut; they’re waiting for the dollar tailwind that comes with it.

That’s the subtlety many investors miss…

When the Fed waits, commodities languish. When the Fed finally moves, the dollar drop amplifies the recovery, giving hard assets an extra layer of momentum.

Why Nine Months Matters So Much

To recap, nine months isn’t just a stretch of patience… It’s a setup.

- Investor psychology frays under the uncertainty, but rallies are bigger when the cut arrives.

- The dollar tends to weaken when rates fall, feeding demand for gold, silver, and hard assets.

- Stocks, especially the S&P 500, have historically rallied strongly in the 12 months following long pauses, with a 10-for-11 track record over the past 55 years.

In short, the pause builds suspense, the cut releases it, and the dollar shift adds fuel to the fire.

That’s why September’s Fed meeting may be one of the most important events of 2025 for investors.

The Bottom Line

The Fed’s nine-month pause has left markets restless, but history suggests this kind of waiting game often ends with a bang.

Stocks could surge, metals could break higher, and commodities could find new legs.

The dollar’s role is the hidden accelerator — each cut makes U.S. currency less attractive, and that makes real assets more desirable.

So, whether you’re stacking silver, watching the Dow, or playing copper, remember this: The pause is the setup, the cut is the catalyst, and the dollar is the turbocharger.

If Powell delivers in September with a dovish message, investors may look back at this long pause as one of the best opportunities of the cycle.

And if you’re a visual learner? Just look at the chart one more time…

Historical table showing 10 of last 11 times markets rallied after Fed waited 5–9 months between rate cuts.

Ten out of the last 11 times the Fed sat on its hands for 5–9 months, markets finished the next year substantially higher. Odds like that don’t come around often.

So stay ahead of the Fed. Position now, before September’s decision.

And keep coming back to Wealth Daily to stay on top of the biggest investment trends nobody else is talking about.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube