Deep-Sea Mining Stocks Poised for MAJOR Support

Today, let's dive into the world of deep-sea mining stocks! This industry is starting to make waves, and there's a lot of buzz about its potential. So here's a look at what's happening beneath the surface and some of the companies involved.

Deep-Sea Mining Stocks: A New Frontier for Investors?

Imagine a place on Earth largely untouched, holding vast reserves of minerals essential for our modern world. That's the deep sea.

And as the demand for critical materials needed for electric vehicles, renewable energy, electronics, and military technology grows, the focus is turning toward the ocean floor, particularly for resources like polymetallic nodules rich in nickel, cobalt, copper, and manganese, as well as cobalt-rich crusts and seabed massive sulphide deposits.

This growing interest in underwater mineral wealth is shining a spotlight on deep-sea mining stocks…

While deep-sea mining has been explored for decades, recent technological advancements are making commercial extraction seem far more feasible.

This, combined with geopolitical factors and a global race for critical minerals, is fueling a boom of investor interest.

It kind of feels like a new gold rush, but instead of digging in the ground, companies are looking thousands of feet beneath the ocean's surface.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Why the Excitement Around Deep-Sea Mining Stocks?

So what's behind the sudden surge in attention for deep-sea mining stocks?

Well, a major driver is the increasing global demand for key metals like nickel, cobalt, and copper. These are the building blocks for batteries, electric motors, and other green technologies.

And while land-based sources face challenges like declining ore grades, increasing extraction costs, and significant environmental and social impacts…

The deep sea offers potentially large, concentrated deposits.

Regulatory developments are also playing a role…

While the International Seabed Authority (ISA), an entity established by the U.N. Convention on the Law of the Sea (UNCLOS), governs resources in international waters, some countries are pushing forward with exploration and potential exploitation licenses within their own exclusive economic zones (EEZs).

There's even talk of renewed government support for domestic mineral exploration and production, potentially including subsea resources. For instance, a recent U.S. executive order aimed at securing critical mineral supply chains and countering China's dominance directs agencies to pursue exploration and exploitation both within the U.S. EEZ and beyond.

This shift in focus is certainly catching the eye of investors looking for the next big growth area, potentially boosting deep sea mining stocks.

However, it's not all smooth sailing. The industry faces significant environmental scrutiny and regulatory hurdles…

Environmental groups and some scientists raise concerns about the potential impact on delicate deep-sea ecosystems. There is ongoing debate about whether the environmental risks outweigh the benefits, and robust regulations from bodies like the ISA are still under development.

This creates both opportunities and risks for deep-sea mining stocks.

A Look at Some Key Players in Deep-Sea Mining Stocks

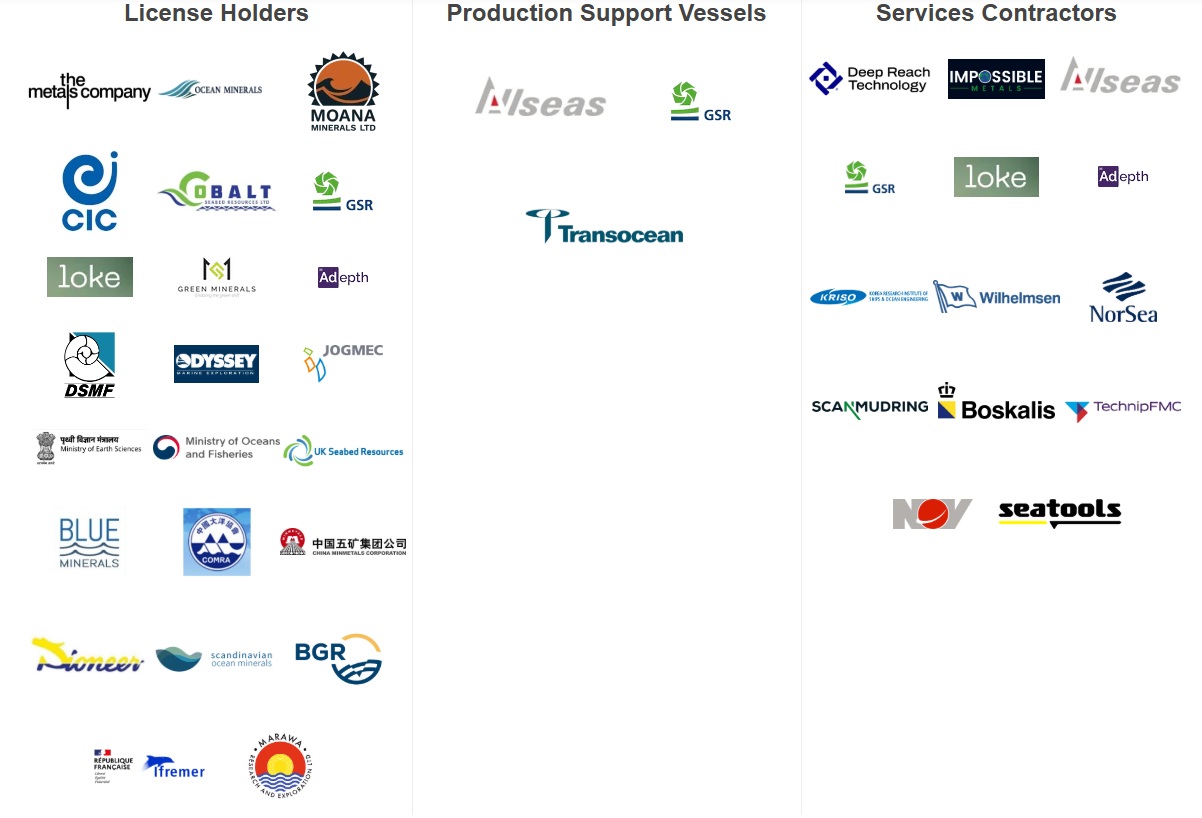

Several companies and organizations are involved in the deep-sea mining sector, ranging from those holding licenses for exploration to those providing specialized services.

Here's a high-level overview of some of the top deep-sea mining stocks available to investors…

Leading the charge, particularly in the public markets, is The Metals Company.

Based in Vancouver, Canada, TMC holds licenses in the Clarion-Clipperton Zone (CCZ) of the Pacific Ocean for mining polymetallic nodules. These nodules contain nickel, cobalt, copper, and manganese.

The Metals Company is publicly traded on the NASDAQ under the ticker symbol TMC. They are widely considered one of the most advanced deep-sea mining companies and are working towards developing a nodule collection system.

Another significant player is Global Sea Mineral Resources (GSR).

As a subsidiary of the Belgian dredging group DEME, GSR is both a license holder and a services provider, operating in the Clarion-Clipperton Zone. It's focused on polymetallic nodules and are involved in developing collection technology.

GSR has also partnered with drilling contractor Transocean.

Transocean is a major offshore drilling contractor with a long history, founded in 1973 and publicly traded on the NYSE under the ticker symbol RIG. While primarily serving the oil and gas industries, the company has partnered with GSR to potentially convert a deep-water drillship into a production support vessel for polymetallic nodule mining.

In the Norwegian sector and the CCZ, Loke is a notable entity. Founded in 2019, Loke holds licenses in the Norwegian EEZ and the CCZ. It is developing subsea technology for collecting polymetallic nodules, as well as UAVs for surveying and drilling.

Another Norwegian company, Green Minerals, founded in 2020, is also focused on marine minerals. It holds licenses in the Norwegian EEZ and is working on securing licenses in the CCZ, and its stock trades on the Euronext growth exchange.

Adepth is another Norwegian company positioned to acquire mineral licenses and developing surveying solutions.

Several government-backed entities also hold significant exploration licenses…

The German agency Bundesanstalt für Geowissenschaften und Rohstoffe (BGR) holds licenses in the CCZ and the Mid-Indian Ocean Ridge for polymetallic nodules and seabed massive sulphides.

France's oceanographic institution, Ifremer, has licenses for similar minerals in the CCZ and the Mid-Atlantic Ridge.

Japan's JOGMEC focuses on cobalt-rich crusts and seabed massive sulphides in the Japanese EEZ and Prime Crust Zone.

The Ministry of Earth Sciences in India holds licenses for polymetallic nodules and seabed massive sulphides in the Central Indian Ocean Basin and Indian Ocean Ridge.

South Korea's Ministry of Oceans and Fisheries holds licenses for various mineral types across the CCZ, Mid-Indian Ocean Ridge, and Prime Crust Zone.

State-owned enterprises like Marawa Research and Exploration Ltd. from Kiribati, China Ocean Mineral Resources Research and Development Association (COMRA), China Minmetals Corporation, and Beijing Pioneer Hi-tech Development Corporation Limited (BPHDC) also hold extensive licenses in key areas like the CCZ and the Prime Crust Zone, targeting polymetallic nodules, seabed massive sulphides, and cobalt-rich crusts.

U.K. Seabed Resources (UKSR), a subsidiary of Lockheed Martin, holds licenses for polymetallic nodules in the CCZ. A Jamaican company, Blue Minerals Jamaica, also holds licenses for polymetallic nodules in the CCZ.

The Cook Islands EEZ is another area of focus, with companies like CIC Limited, Ocean Minerals LLC, Moana Minerals (a subsidiary of Ocean Minerals LLC), and Cobalt Seabed Resources Ltd. holding licenses for polymetallic nodules in different basins like the Penrhyn Basin.

Beyond license holders, a range of service providers are crucial to the industry…

These include companies like Scanmudring, specializing in offshore services and conversion of equipment for subsea mineral extraction, and engineering consultancies like Deep Reach Technology.

Companies developing collector technology include Impossible Metals, which uses image recognition; Blue Nodules, a European project; and KRISO from Korea, which has tested a nodule harvester.

Other service contractors include Wilhelmsen, NorSea, Boskalis, TechnipFMC, and NOV, indicating a diverse range of support needed for operations.

Finally, Odyssey Marine Exploration Inc., publicly traded as OMEX, is an experienced deep-sea exploration company.

While known for shipwreck recovery, it is engaged in exploring and developing subsea mineral resources, holding various licenses and stakes in other mineral companies.

Navigating the Waters of Deep-Sea Mining Stocks

The deep-sea mining industry is complex and still in its early stages, particularly regarding commercial-scale operations.

Investor interest is certainly piqued by the massive potential for critical minerals and the potential for favorable regulatory environments. However, significant challenges remain, including environmental concerns, the need for robust and agreed-upon international regulations, and the sheer technical and financial demands of operating in the deep ocean.

Investing in deep-sea mining stocks means betting on the successful navigation of these hurdles and the eventual realization of the ocean floor's mineral wealth.

The companies involved represent different parts of the ecosystem, from explorers and license holders to technology developers and service providers.

Understanding their specific roles and the regulatory landscape is going to be key to evaluating the potential of each of the deep-sea mining stocks we’ve discussed.

The Bottom Line and Your Next Investment Move

The bottom line here is that the world of deep-sea mining stocks is gaining traction due to the critical need for metals used in modern technologies, potential government support, and ongoing technological advancements.

Companies like The Metals Company, GSR, Loke, and numerous state-backed entities hold key licenses, while others provide essential services and technology. However, significant environmental and regulatory challenges lie ahead.

So it’s safe to say that this industry represents a potentially high-reward, high-risk investment area.

But deep-sea mining stocks aren't the only place where significant profits might be found.

There are other exciting sectors with huge potential and fewer risks just waiting to be discovered. To uncover another industry with even more profit potential, make sure you check out our special report.

And let me know what you think about all this deep-sea mining talk… Is it another big government boondoggle? Is it way too costly to Mother Earth to be valuable to humanity? Is it the next logical step in technological progress? Or is it somewhere in the middle?

Just reply to this email, draft a new one to customerservice@angelpub.com, or send in a note here and my team will make sure I get your message.

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

P.S. Trump just signed an executive order that could end the IRS as we know it — replacing taxes with direct payouts from a brand-new $1 trillion national investment fund. Everyday Americans could soon collect checks worth up to $21,307… but only if they act BEFORE the first round goes out. Here’s how to get in line now.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube