Bitcoin Broke, Gold Held — and a New Digital Safe Haven Just Emerged

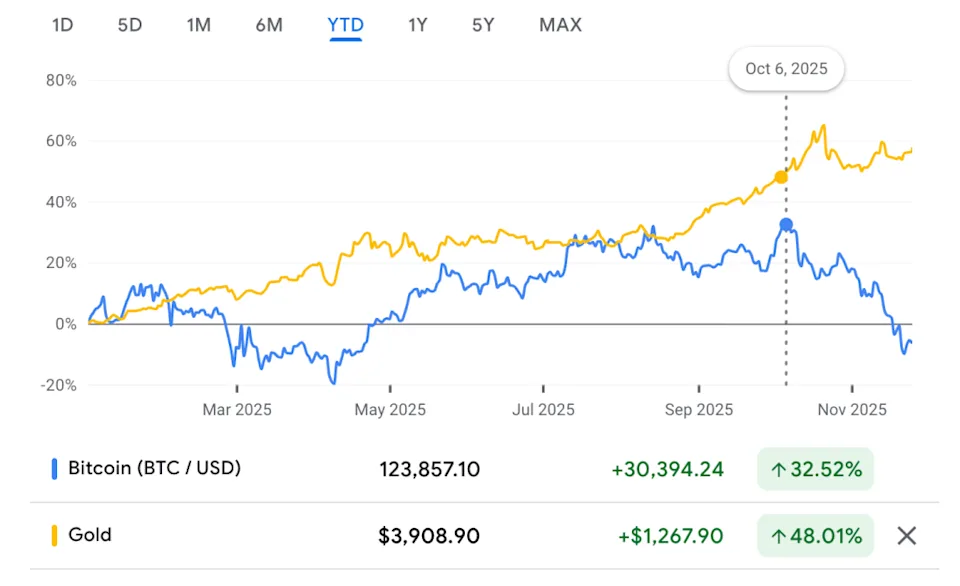

Publisher’s Preface: Bitcoin crashed 36% after hitting a high on October 6. Stocks went haywire. Bonds buckled.

But gold didn’t flinch — it hit a brand new all-time high.

And now, a breakthrough technology is quietly reinventing gold for the modern age… and a tiny public company sits at the center of it.

It’s NatGold. Bloomberg recently featured the NatGold ecosystem. In an article titled "Leave the Gold in the Ground" published on November 24, Bloomberg says…

There is a lot of gold in vaults underground, but there is also a lot of gold in gold mines underground. There are places on Earth with a lot of rocks that have gold in them, and with modern science you can make reasonably confident estimates of how much gold there is under your particular parcel. If gold is valuable, why is this gold still underground? Sometimes the answer is that no one knows it’s there; sometimes the answer is that it is under an active gold mine and they’re getting to it. But often the answer is that mining it is uneconomical: The gold is mixed with a lot of rock, and the cost of digging up all the rock and refining out the gold would be more than you’d get from selling the gold.

Bloomberg continues…

NatBridge Resources is a gold mining company… [It] has a better idea:

[That idea is] you get a technical report saying that your parcel contains gold — “Parcels 45 and 46 comprise approximately 12,290,139 tonnes containing an aggregate of 122,211 ounces of indicated gold resources, and 6,650 ounces of inferred gold resources at a 0.005 oz/ton cutoff grade” — and then you mint digital tokens representing that amount of gold.

And then you sell those tokens to, uh, to people who want digital tokens representing a certain amount of gold.

Well, those tokens are NatGold tokens.

My investment firm, Angel, has been allowing our readers to pre-reserve tokens before NatGold goes live. As of right now, over 91,000 tokens have been reserved.

You still have a chance to reserve your tokens before they start trading. You don’t have to exchange any money to reserve your token right now. That will happen next year at the tokenization event.

This is your chance to jump in the front of the line to reserve NatGold tokens before Wall Street.

You can follow this link to reserve your tokens and set yourself up for generational wealth.

And here’s why NatGold is about to become a game-changer in the crypto world…

The Tale of 2 Charts

Bitcoin didn’t “pull back.” It broke.

In just a few weeks, Bitcoin fell from its $126,000 October peak into the low $80,000s — a 36% plunge.

But the price drop isn’t the problem.

1. What the drop exposed is.

- Big money is quietly heading for the exits.

Bitcoin ETFs — the supposed "Wall Street gateway” to crypto — saw $3.5 billion in outflows in November.

Markus Thielen of 10X Research didn't sugar-coat it:

These ETFs have turned into sellers.

When the products meant to prop up Bitcoin become forced sellers… the foundation is cracking.

2. Liquidity is drying up.

Stablecoins — the lifeblood of crypto liquidity — are shrinking instead of growing.

- $800 million left crypto and moved back into cash

- Stablecoin market caps dropped $4.6 billion

This is like seeing the fuel gauge drop while the car is still racing downhill.

3. Bitcoin's true believers are cashing out.

“OG” Bitcoin holders — the hardened veterans who held through every crash — are finally selling.

A Nansen analyst revealed that OG holders have sold every single cycle — and they’re doing it again.

When the people who swore they’d never sell… sell — that’s the loudest alarm you can get.

4. The fallout spread everywhere.

- Total crypto market cap collapsed from $4.28 trillion to $2.99 trillion

- Ethereum fell 38%

- Solana plunged 40%

This wasn’t ordinary volatility. It was mass liquidation.

5. Bitcoin’s “safe haven” pitch didn’t just crack — it imploded.

For years, Bitcoin was marketed as:

- Digital gold

- Chaos insurance"

- A stable store of value

But when the real-world fear hit — inflation, geopolitics, bond chaos — Bitcoin acted exactly like a leveraged tech trade.

One single liquidation event erased $19 billion in a day.

Safe havens don't do that.

Fire hazards do.

While Bitcoin Crashed, Gold Didn’t Blink

Gold didn’t spike.

Gold didn’t panic.

Gold didn’t follow the crowd.

It simply held firm, like it has for thousands of years.

Gold hit $4,360… pulled back… and then refused to fall.

Gold steadied above $4,000 and started climbing again.

Every time something broke:

- Crypto collapsed.

- Liquidity vanished.

- Tech stumbled.

- Bonds blew out.

Gold held.

One trader put it best: "Safe havens don’t need to spike. They just need to refuse to fall."

Gold anchored itself — while everything else lost its bearings.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Gold Isn’t Just Stable — It’s Surging

2025 has been historic.

Gold has delivered its most extraordinary year in more than four decades — its best performance since 1979.

Up over 50% this year alone.

That’s not a rally.

That’s a revaluation.

And now, 2026 is shaping into a gold supercycle.

Gold enters the new year with:

- Heavy institutional buying

- A reinforced price floor

- Rising global uncertainty

- Broken correlation with risk assets

- Demand exploding worldwide

At the exact moment Bitcoin’s weaknesses are unavoidable… gold’s strength is undeniable.

The Real Force Driving Gold’s Surge

Cable news says retail investors caused the rally.

They’re wrong.

The real buyers driving this?

The deepest, smartest, most powerful money in the world.

Central banks are buying at record levels — even at record prices.

They’re not buying dips.

They’re not selling strength.

They’re accumulating — because gold:

- Can’t be frozen

- Can’t be sanctioned

- Can’t be printed

- Can’t be hacked

- Can’t be controlled

Gold is the only asset every nation trusts… even nations that don’t trust each other.

Sovereign wealth funds and institutions are joining in.

These investors think in decades — even generations.

They’re watching:

- Weakening currencies

- Unstable bonds

- Geopolitical fractures

- Collapsing trust in global systems

And they’re doing what they’ve always done in moments like this…

They’re going back to gold.

Not as a trade.

As a foundation.

Gold Still Has One Fatal Flaw

Gold is the ultimate safe-haven asset.

But gold has one last problem…

It’s stuck in the Stone Age.

Physical gold was built for:

- Vaults

- Governments

- Armored trucks

- Paper certificates

Not the digital world.

To move gold, you deal with:

- Delays

- Fees

- Storage

- Middlemen

- Endless paperwork

ETFs help, but:

- You don’t actually own the gold.

- You can’t verify it yourself.

- You rely on layers of custodians.

Gold is timeless — but the way we own it is outdated.

The Breakthrough: NatGold

The world needed:

- Gold’s stability

- Crypto’s speed

- Blockchain’s transparency

And now it exists.

NatGold is digitally mined gold — verified in-ground gold placed directly on-chain.

No vaults.

No middlemen.

No friction.

Each NatGold token is backed by gold validated under NI 43-101/JORC — the same standards used by the world’s top miners.

This isn’t “digital gold” in name only.

This is actual gold, secured by blockchain instead of paperwork.

And the gold never leaves the earth.

No digging.

No blasting.

No environmental damage.

The gold stays underground — the value is what moves.

NatGold moves like cash, not metal.

With NatGold, you can:

- Send gold instantly.

- Hold it privately.

- Verify it publicly.

- Trade it globally.

- Own fractions of it.

- Skip vaults and custodians entirely.

It’s everything Bitcoin tried to be — except it’s backed by the oldest, safest asset on Earth.

And early buyers get a guaranteed discount.

Only the first 10,000 NatGold tokens come with a 10% guaranteed discount to gold’s baseline intrinsic value on Tokenization Day.

Over 91,168 tokens have already been reserved across 160 countries.

This early window is closing fast.

The Future of Safe Havens

Bitcoin blinked.

Stocks blinked.

Bonds blinked.

Gold didn’t — and NatGold won’t.

NatGold fuses:

- Gold’s permanence

- Blockchain’s precision

- Bitcoin's speed

- Real, verifiable value

This is gold built for a world that demands safety and portability.

It’s not a trend.

It isn’t a meme.

It isn’t a speculative gamble.

It’s the next step in monetary evolution.

The Public Company Powering the Digital Gold Rush

If NatGold is the breakthrough…

NatBridge Resources is the tollbooth.

Most investors won’t hear about NatBridge until it’s too late.

You’re hearing about it now.

NatBridge is the first public company feeding gold into the NatGold mint.

It is:

- The first approved NatGold deposit

- The first source of digitally mined gold

- The first company whose gold becomes NatGold Tokens

- The only public equity gateway to the NatGold ecosystem

When institutions ask, “Who gets paid every time NatGold mints a token?”

The answer is NatBridge.

NatBridge isn't a miner — it's a gold-to-token engine.

NatBridge doesn't dig.

It digitally mints.

This means:

- Faster revenue

- Higher margins

- No environmental footprint

- No extraction risk

- Massive global scalability

It's the digital infrastructure — like owning the data centers before the cloud boom.

This is how generational wealth plays begin.

Think of:

- The first copper supplier before the electrification boom

- The first silicon producer before semiconductors

- The first data center REIT before cloud computing

NatBridge is positioned the same way — at the front of a brand-new monetary revolution.

If Bitcoin’s collapse was the warning…

And gold’s rise was the confirmation…

NatGold and NatBridge are the opportunity.

👉 Click here to access the full investor briefing while Wall Street is still asleep.

Once NatGold mints its first tokens in Q1 2026…

Once institutions move in…

Once central banks realize what this unlocks…

The early window will slam shut.

This is your chance to be early.

Get to the good, green grass first…

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.