Where Are the Best Value Stocks After the Market Sell-Off?

The sell-off of the last three months has caught many investors off guard. Too many, if you ask us. This has been one of the most predictable market turnovers in recent memory.

Interest rates have been rising for years, the labor market is as tight as it can get, and the world is facing trade tensions that could take big bites out of corporate profits and GDP growth. With all this in mind, it’s easy to understand why the S&P 500 looks like this:

Source: YCharts.com

Source: YCharts.com

But the news isn’t all bad. In fact, hundreds of quality stocks have sold off despite having minimal sensitivity to trade risks, interest rates, and the other bogeymen in the market today.

After all the investor freak-outs of the last few months, these stocks are much cheaper than their metrics suggest they should be. And they’re clustered in a few oversold areas of the market, making them accessible to ETF and mutual fund investors as well as stock pickers.

Below, we’re investigating where to find the best value stocks after the sell-off.

Industrials

Why is the world so worried about the prospect of a trade war? Because of Trump’s tariff threats. And who’s pushing for tariffs? Steelworkers, factory machinists, and other industrial workers.

These workers know what’s good for them. The industrials sector is one small part of the U.S. stock market that could actually benefit from a trade war. After all, for companies like U.S. Steel (NYSE: X) and Alcoa (NYSE: AA), tariffs are effectively taxes on their competition.

Look how much these two stocks shot up in the months after Trump’s 2016 election victory:

Source: YCharts.com

Source: YCharts.com

For ETF investors, there’s an easy way to play the entire sector. The Vanguard Industrial ETF (NYSE: VIS) offers a well-diversified position.

Regional Banks

No sector benefits from higher interest rates quite as much as financials. After all, banks make money by… well, lending money with interest.

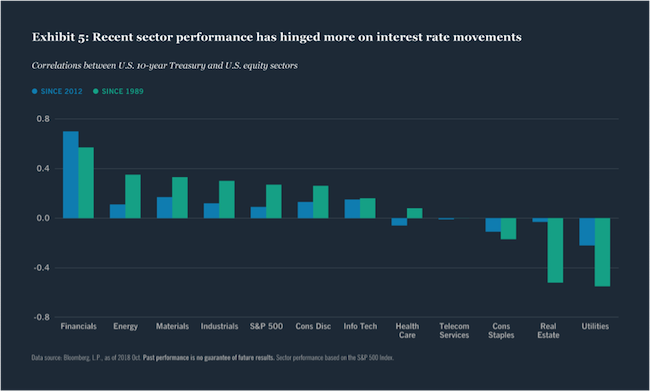

In fact, financial sector returns have the strongest correlation with interest rates of any stock market sector.

Source: Nuveen.com

Source: Nuveen.com

But of course, interest rates are only part of the story of the recent sell-off. How do banks hold up during trade wars?

For big banks like Goldman Sachs or Deutsche Bank, the answer is “not very well.” These larger companies do a lot of their business overseas, meaning their revenues are very vulnerable to trade conflict.

But regional banks — which do most of their business here in the States — are in a unique position to profit from a trade war. The top holdings of the SPDR S&P Regional Bank ETF (NYSE: KRE) include Ohio-based KeyCorp (NYSE: KEY), Tennessee’s First Horizon (NYSE: FHN), and M&T Bank (NYSE: MTB).

All of these smaller banks have solid lending-based revenue sources and little to no overseas exposure. That makes them ideal buys during an interest rate- and trade tension-fueled sell-off like this one.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no comission.

Junior Gold Miners

People have been using the yellow metal as a hedge against instability since the dawn of civilization. And it’s a particularly good hedge for a trade war.

After all, tariffs could lead to widespread price increases for consumers. Those, in turn, could bring inflationary pressure and a loss of confidence in the U.S. dollar.

Our economy went through similar problems during the oil trade wars of the 1970s. That was a bad time for most of the stock market. But it was a fantastic time for gold. Check out this graph of gold prices throughout the decade:

Source: TradingEconomics.com

Source: TradingEconomics.com

Given that gold is trade war-proof and isn’t particularly correlated with interest rates, you might be tempted to go out and grab some bullion. But we think junior miners like Yamana Gold (NYSE: AUY) and Kirkland Lake Gold (NYSE: KL) are more sensible plays. Small caps tend to do well in rising rate environments, and thus small gold miners are great choices for current market conditions.

The VanEck Vectors Junior Gold Miners ETF (NYSE: GDXJ) is a good choice for fund-focused investors.

The Fed’s recent actions generally haven’t been good for the stock market — and neither have the White House’s last few moves.

But whether you love Trump or hate him, and whether you trust the Fed or see it as an evil cabal, we can all agree that market conditions like this are not uniformly good or bad for everyone.

The recent changes in monetary policy and trade policy have winners and losers. By picking up the winners on the cheap, you can turn the recent sell-off into an opportunity to juice your returns.

Until next time,

Samuel Taube

Wealth Daily

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.