What if it IS Different for Oil This Time?

It’s time we prepare ourselves. It may actually be different for oil this time…

Yeah, I know. It’s an article of faith for investors. Anytime you hear someone say, “It’s different this time,” you can chuckle to yourself with an air of superiority, because you know, you KNOW, that person is just wrong. And not only that, but when you hear things might actually be different, there’s probably an investment bubble somewhere…

Like when investors hailed the economic miracle of the internet and wondered if productivity had made a permanent move higher. Productivity growth in the nonfarm business sector had averaged about 1.3% between 1973 and 1990. Then it jumped to 2.2% from 1990 to 2000 and to 2.6% from 2000 to 2007. Nope. For the last decade, U.S. productivity has gone back to 1.2%.

Or like when before the housing bubble collapsed, former Fed Chief Greenspan wondered aloud if the use of derivatives had spread risk around to the point that a full-on meltdown was unlikely. Nope. Just the opposite: Derivatives made sure everything melted down.

The conventional wisdom knows full well that it’s never really different. Situations and players may change, but the plot remains the same, right?

Well, yes and no. There is such a thing as reversion to the mean. Spikes in productivity growth or unemployment or interest rates tend to drop back to historical averages. But that’s not really what I want to talk about today. I want to talk about times when things actually are different…

Big shifts do happen. One of the most popular analogies about this is the makers of buggy whips. In 1890, there were 13,000 businesses in the U.S. that made buggy whips and other products for the horse-drawn carriage. Of course, within two decades, automobiles made them all obsolete.

I’m not going to run this tired simile any further lest it fail altogether. But you get the point: If you don’t see the big changes coming, if you just figure things will go on as they have, well, you can get steamrolled.

It’s Different This Time

I’ve made this observation before regarding China. China began to emerge as a true global power around 2000. It built out like crazy. In just the three years between 2011 and 2013, China poured more cement than the U.S. did in the entire 20th century. Those years, however, marked a crescendo.

For over a decade, China was a voracious consumer of copper, steel, iron ore, coal, etc. Resource-based economies expanded production to meet the need. Caterpillar shares soared as the world dug. After the financial crisis, starting about 2010, China dumped $1 trillion in stimulus into its economy. That marked the crescendo. And now it’s over…

Commodity prices have trended lower ever since. China’s economy is awash in debt. It’s not a huge leap to think China will never purchase commodities like it did in the past. I find it easy to imagine that massive build-out was a one-off event. It happened, and now it’s over. And that leaves the world with a huge oversupply of commodities.

We can see the same sort of dynamic with coal. Coal use has done nothing but fall over the last eight years or so. You can blame regulations if you want, but that’s not it. Cheap natural gas has helped the transition away from coal. But so has cheap renewable energy. Look, utility companies are playing the long game. Why burn coal when you can invest in virtually perpetual electricity generation via wind and solar power?

The Trump administration likes to say it can reinvigorate coal use. But it can’t. That era is over.

Which brings us to oil.

I find it easy to imagine oil’s best days are behind it. I don’t think it’s a reach to look at that run to $147 a barrel in 2008 as the blow-off top for oil prices. At that time, Peak Oil was the big catalyst. The world just wasn’t making massive discoveries anymore. But that was before technology unlocked U.S. shale oil. And that was before electric cars started hitting the road. And it was before fuel economy standards took a big jump higher…

Now, perhaps we should be talking Peak Demand for oil…

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth. On your own terms. No fees, no comission.

Oil Is Dead, Long Live Oil

When oil prices collapsed in late 2014, we may have witnessed the end of the oil age. That’s not to say the world won’t use oil anymore. Of course we will. But oil’s time as a dominant resource may be over. And it would be especially ironic if it was Saudi Arabia that tipped the balance.

When Saudi Arabia boosted supply to crush U.S. shale, it made a huge mistake. It failed to understand a basic tenet of capitalism: that adversity makes you stronger. In the U.S., companies don’t fold up the tent when times get tough. They adapt. They get better, more efficient. U.S. shale oil companies cut their costs roughly in half. That barrel that cost over $60 in 2008 now costs around $30 to bring online.

The Saudis lost control of the oil market. And I don’t think they can get it back. Sure, maybe if they cut production more, we could see $60 a barrel for a little while. But any surge in price will just bring more crude online and pressure prices again.

The real question is, how do you get stronger demand?

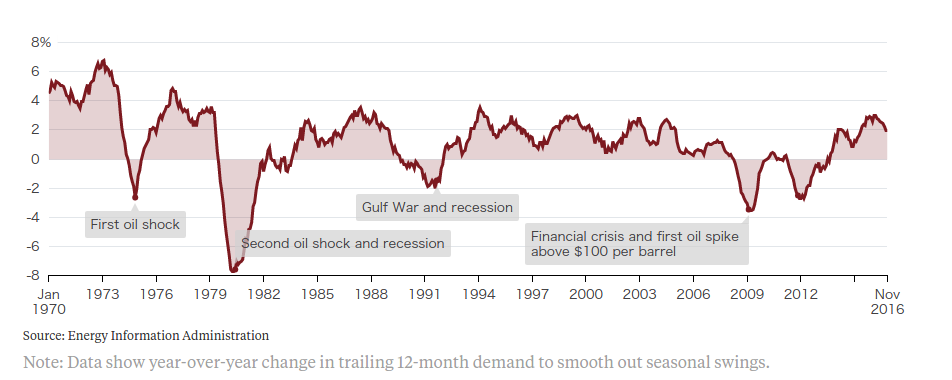

For the foreseeable future, I don’t think you can. U.S. economic growth is very weak. Demand for gasoline here in the U.S., the biggest market, is basically static. We’ve already seen a small spike in demand that coincides with better employment numbers and cheaper gas prices, as this Bloomberg chart shows:

But that spike didn’t push prices higher. Demand has been weakening so far this year in Russia, India, and Brazil. It’s not rising here in the U.S.

So again, if oil is ever to make a sustainable run higher in price, we need more than just production cuts from Saudi Arabia. We will need to see demand numbers improve. And I don’t see a compelling case for a solid jump in demand. In fact, it seems more likely that demand for oil will fall.

Urban density is rising, electric cars may account for 20% of miles driven within the next decade, populations are falling in Japan, Europe, and China. For oil, it may be different this time.

Until next time,

Briton Ryle

The Wealth Advisory on Youtube

The Wealth Advisory on Youtube

The Wealth Advisory on Facebook

The Wealth Advisory on Facebook

A 21-year veteran of the newsletter business, Briton Ryle is the editor of The Wealth Advisory income stock newsletter, with a focus on top-quality dividend growth stocks and REITs. Briton also manages the Real Income Trader advisory service, where his readers take regular cash payouts using a low-risk covered call option strategy. He is also the managing editor of the Wealth Daily e-letter. To learn more about Briton, click here.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

@BritonRyle on Twitter

@BritonRyle on Twitter