I spent the past weekend working on my deck garden. You see, I live in the city here in Baltimore. So, instead of a backyard, I’ve got a parking pad. And instead of grass out front, I’ve got a sidewalk.

But I need nature. I grew up in a somewhat rural part of the state of Maryland. I spent my summers camping and “drowning worms” with my dad and hanging out and working on my grandparents’ farm. In the fall, we’d rake leaves and cut firewood. In the winter, we’d go skiing. In the spring, we’d plant a garden and take care of the lawns. All year, we’d go hiking or bike-riding wherever we could.

This city living is tough for a country boy. So, every spring, I spend the first few weekends getting my deck all set. I grow whatever veggies and fruits I can — this year, it’ll be lots of cooking herbs, strawberries, tomatoes, peppers, and I’m going to try a dwarf lemon tree, too. And lots of flowers — I’ll get you pictures once it’s in and the plants are growing.

My neighbors call me “Farmer Jason.” They like to poke a little fun, but they like sharing the fresh produce even more.

This weekend, I was building a raised platform for my Japanese maple tree and a vertical garden for the herbs and strawberries, and I looked at my filthy hands and saw my dad’s. They’re not quite as browned from the sun or as scarred. But they’re pretty darned close.

And it got me thinking about all the other things about me that I got from my father…

I still have an iPhone 6. It still works. Why get rid of it? My dad says the same thing about his flip phone.

I shut the door immediately in the summer and winter. Because I’m not trying to heat up/cool off the whole neighborhood…

I follow guests around my house shutting off lights and reminding them that electricity isn’t free and wasting it is bad for the planet. I can’t tell you how many times I got grief from my dad for leaving a trail of lights on behind me…

And all the time, I catch myself saying things like, “Offense wins games but defense wins championships,” and “Hard work beats talent when talent doesn’t work hard.”

It’s like my dad’s brain has somehow occupied my body.

But I kind of don’t mind. I mean, there’s not really anything wrong with any of those things I just mentioned.

And the last two — the statements I catch myself making — they’re two of the most accurate statements ever made.

And they’re not just about sports, although that’s always the context I heard them in as a kid. They’re true for all aspects of life.

Today, I’d like to talk about how to implement a strong defense in your portfolio so you can win the championship that is a comfortable retirement and lasting wealth.

Defensive Stocks Win Recessions

Yep. I want to talk about defensive investments. In case you’re unsure what I mean, defensive investments are ones that tend to either move opposite the market or have little to no correlation to it at all. They’re also known as noncyclical stocks because they don’t react to economic cycles of recession and growth.

They don’t fall as far as other stocks in a bear market or crash. And because of that, they’re a weapon you need to introduce to your investing arsenal immediately.

My newsfeed is rife with articles about the potential for a crash in the near future. The bears are forecasting death and destruction, and even the bulls are starting to get a little worried.

I’m not here to say there is or isn’t a crash coming. Historically, there will be another. I can’t tell you exactly when. But I can tell you that preparing for it now is something you should do. You won’t regret it even if it takes another decade for that crash to come.

So, let’s get back to those defensive stocks. There are four sectors that fall into the defensive category:

Defensive Sector #1: Consumer Staples

Consumer staples, also known as consumer noncyclical stocks, are considered defensive because they tend to maintain more price stability in a down market than other stocks, such as growth or cyclical stocks.

During a recession, people still need things like cereal and milk, and they may even increase consumption of so-called “sin stock” products, like cigarettes and alcohol. These companies tend to buck the downtrend in the market and provide a cushion of profit during tough times.

I’ve got two top picks for the staples sector, one that provides things people need and one that provides things they want.

For supplying your needs and protecting your profits, AutoZone (NYSE: AZO) is my top pick. Not only does the company provide staples, but in tough economic times, people are more likely to do their own auto maintenance than take their car to a mechanic. That makes AZO twice as strong during a recession. It won’t drop as far, and it’ll come back a ton faster.

For supplying your wants and boosting your recovery, I recommend Constellation Brands (NYSE: STZ). It makes beer. And people drink beer no matter what the economy is like. In fact, studies show they drink more beer in bad times than in good. So adding some STZ to your portfolio is a smart move if you’re concerned we’re about to hit a crash.

Defensive Sector #2: Health Care

Health care is a massive defensive sector. You’ve got hospital conglomerates, institutional services, insurance companies, drug manufacturers, biomedical companies, medical instrument makers, and even real estate trusts that own nursing homes and skilled care facilities. Some of them are even household names: Cigna, Pfizer, UnitedHealthcare.

These are companies that offer products or services that consumers will continue to buy during recessions because health is a high priority and people still need to go to the doctor and buy medications in hard times. Just because the economy is down in the dumps doesn’t mean people will stop caring about not dying.

And when it comes to health care, my number one recommendation is without a doubt Johnson and Johnson (NYSE: JNJ). The company is actually a double-defense. Not only does it provide tons of health care products and supplies, but it’s also a big deal in the consumer staples sector. With JNJ, you get a bump from the staples and another from the health care. What could be better?

Defensive Sector #3: Utilities

Now, I’m not a huge fan of utility companies. They’re the closest thing to a government-approved monopoly we’ve got in the U.S. And they’re running up against some really big competition thanks to renewable energy options that cut the utility out of the picture.

But during a recession, they’re some of the best stocks you can own. They pay a steady dividend, so you get income to add to your profits (or cushion your losses). And, like toothpaste and soap, people don’t stop using energy when the economy stumbles.

So, if you’re looking for another protective position, an investment in a utility like Dominion Energy (NYSE: D) should be something you’re considering. Dominion pays a 4.9% dividend yield. It’s also got a beta of 0.23. Beta is a measurement of correlation to the market. A beta of 1 means the stock moves in lockstep with the market. A beta of 0 means the company has absolutely no correlation to the market’s moves. And a beta of -1 means the stock moves exactly opposite the market.

So, at 0.23, Dominion follows the market, but just barely. So, it’ll drop some in a crash, but nowhere near as far as everything else.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no comission.

Defensive Sector #4: Commodities

Commodities are really assets and not industrial sectors, but they’re defensive as heck, so I’m lumping them in here, too.

Commodity goods are things like crude oil, coal, corn, tea, rice, gold, and silver. Not all these goods are defensive, but they can still maintain stability during recessionary environments. You might hear them called safe-haven investments. That’s because they’re a place to put your money when stocks aren’t profitable and cash is losing its power.

Think about it: During a recession, we usually see currencies weakening in relation to goods and services. The currencies might be just as strong next to each other, but they can’t buy the same amount of stuff.

So, having some commodities in your portfolio before a recession hits gives you the opportunity to sell your assets for far more currency than you paid. Then, when markets recover, you can buy back those assets with your newly re-strengthened money.

Gold is my favorite investment for recession protection. When stocks go down, typically gold goes up. When money weakens, you need more of it to buy the same ounce of gold. It’s a double benefit.

You’re holding gold that’s going up in value because of rising demand. And you’ve got gold that’s going up in price because dollars just don’t buy as much as they used to.

You can sell your gold for a tidy profit and buy it back once the economy recovers and people aren’t so excited about owning precious metals.

For ease of entry and exit, I recommend investing in a gold-backed ETF such as the SPDR Gold Shares (NYSE: GLD). You’ll pay an expense ratio of 0.40% of your total investment. That pays the folks managing the fund’s investments. But it’s a small price to pay for the comfort of knowing your savings will survive.

All Your Recession Resources

That’s it. It’s just that easy. Knowing what sectors and investments defend against crashes is 99% of the battle when it comes to protecting your savings during a crash.

The other 1% is picking the right investments in those defensive areas. And lucky for you, you’ve got help for that last little bit.

My fellow analysts and editors and I are here every day — seven days a week, 365 days a year — searching out the best investments for every market. And you get first access to all those amazing strategies and exceptional stocks.

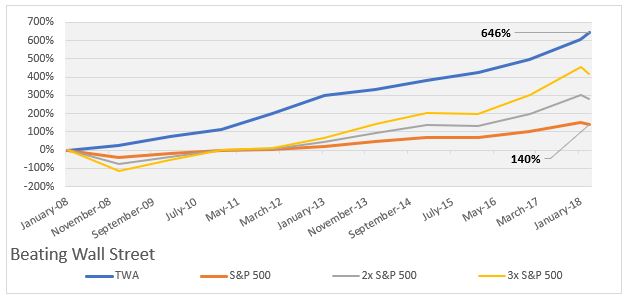

And, if you want even more assistance, my colleague Briton Ryle and I run an investment advisory service called The Wealth Advisory that’s already provided massive profits in one recession.

And we’re busy right now putting together a portfolio of investments that should give the absolute best protection during the next one and help you bounce back even faster than the market.

Obviously, our current subscribers are going to get first access to the recommendations and the strategy. But you’ll be next in line.

And if you want to join The Wealth Advisory nation now so you’re assured you’ll have the most time to act, just click here and you’ll be taken to a special offer.

To your wealth,

To your wealth,

Jason Williams

After graduating Cum Laude in finance and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team responsible for billions of dollars in daily trading. Jason left Wall Street to found his own investment office and now shares the strategies he used and the network he built with you. Jason is the founder of Main Street Ventures, a pre-IPO investment newsletter; the founder of Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock newsletter. He is also the managing editor of Wealth Daily. To learn more about Jason, click here.

Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube