Black Monday: October 19, 1987, the Dow Industrials fell 22%.

Black Tuesday: October 29, 1929, the Dow Industrials fell 12%.

Am I the only one who thinks it’s ironic for brick and mortar retail to adopt a nickname for their best day of the year that most of us associate with disaster?

I get that in retail’s case, “Black Friday” refers to the day that stores start showing a profit, after running in the red (at a loss) all year. But the irony is that the distinction isn’t going to matter much anymore…

Store visits on Black Friday were down 4.2% over last year. And sales fell 6% last week. Truly a disaster for brick and mortar retailers and their shareholders.

Or so these headline “sales miss” numbers would have you believe.

But the fact is, traditional retailers like Best Buy, Target, and Walmart have done an amazing job of developing their online muscles. They aren’t a bunch of 98-pound weaklings anymore. Yep, the line between brick and mortar and online sales is getting pretty blurry.

Retail Evolution

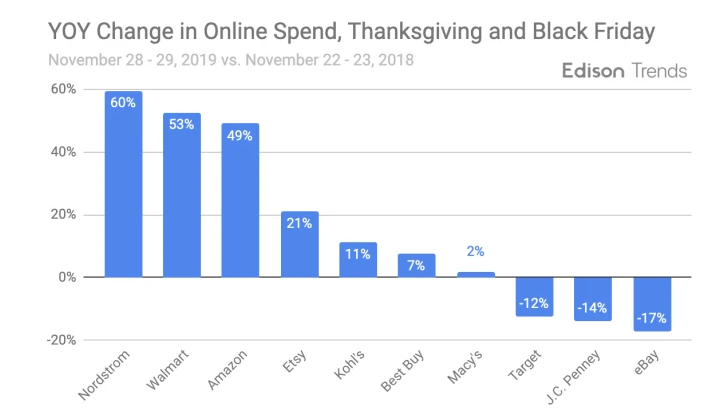

To show you what I mean, check out this chart of what companies had the best percentage gains in online retail…

Number one and number two were Nordstrom and Walmart — not really what you think of as online retailers. Also, I gotta say, 49% growth in Amazon’s Black Friday revenue is freaking amazing.

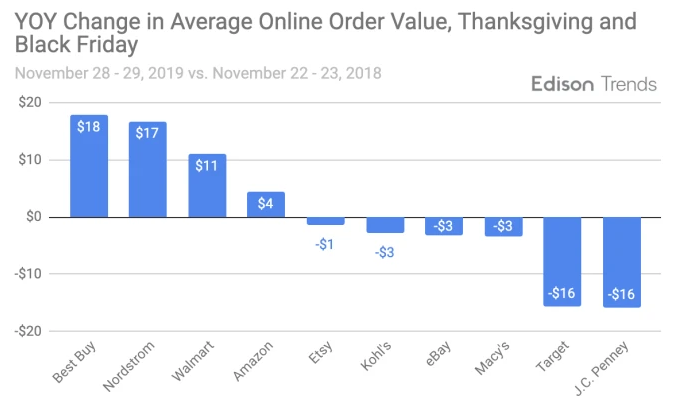

Now, I know you see poor little Best Buy down there with its barely growing percentage, so check this out…

Yeah, don’t feel so sorry for Best Buy now, do ya? If an $18 change in the average order represents just a 7% gain in revenue, it tells you that people spent a lot at Best Buy last year, too.

Another interesting tidbit: The average order at Amazon doesn’t change much, but the number of people placing orders sure does.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

Then there’s dead-store-walking J.C. Penney. The jig is up; don’t be surprised if it enters bankruptcy in the spring of 2020.

Finally, Nordstrom seems to be killing it when it’s Target that has had like three amazing quarters in a row. I suspect the performance for both was a bit of an outlier because neither stock reacted much. Especially with Target, reports are that foot traffic was strong.

It’s All About… Groceries?

Clearly, the rise in online sales means traditional retail has been in flux for a while. Some malls have been reinvigorated, while others have been abandoned to squirrels and birds.

I’ve long believed that people will never fully give up shopping. I am strangely comforted by seeing stuff in stores, trying on clothes, and choosing my own produce. So it seems reasonable to me that both Target and Walmart have rejuvenated themselves with groceries and the whole “buy online, pick up in store” thing.

In a version of the “time is money” rule, what if we look at the value of great companies in terms of the time we gain by using their services? Spend $12 on Netflix a month, and you’ll have a few extra hours to live your life that might’ve been spent watching commercials. Buy from Amazon, and you’ll save a few hours that might’ve been spent driving to the mall, parking, and wandering aimlessly.

This is where the seemingly small addition of groceries to the mix is kind of genius, if you assume that many people want to see the food they are buying. Order the clothes or whatever you need from Target online, pick it up at the store, and grab some groceries while you’re at it.

It might well be groceries that explain why Walmart was a $65 stock less than four years ago and it’s pushing $120 now. Groceries are a big reason why Target shares have doubled in the last year.

Groceries aside, retail space is quickly becoming what’s called a “fulfillment center” — basically centrally located warehouses from which goods can be delivered or picked up quickly and easily.

Clearly, Amazon is a leader when it comes to fulfillment centers. What many investors don’t know is that Amazon has a few companies that actually build its fulfillment centers. And they are technological and logistical marvels. They are so good at tracking orders that sometimes stuff comes off one truck right on to another.

I think we are just seeing the beginning of the spread of these fulfillment centers. And the companies that build them are at the start of a long run higher. These are the picks and shovels plays for the evolution of retail. You can learn more about these companies in this special presentation.

Until next time,

Briton Ryle

The Wealth Advisory on Youtube

The Wealth Advisory on Youtube

The Wealth Advisory on Facebook

The Wealth Advisory on Facebook

A 21-year veteran of the newsletter business, Briton Ryle is the editor of The Wealth Advisory income stock newsletter, with a focus on top-quality dividend growth stocks and REITs. Briton also manages the Real Income Trader advisory service, where his readers take regular cash payouts using a low-risk covered call option strategy. He is also the managing editor of the Wealth Daily e-letter. To learn more about Briton, click here.

@BritonRyle on Twitter

@BritonRyle on Twitter