Investors and business owners don’t want to get involved with the Securities and Exchange Commission (SEC).

They’ll do anything to avoid confrontation with the bureaucracy.

That’s because if the SEC comes knocking on your door, you’ve probably done something wrong.

And it'll most likely negatively impact your business.

I'll explain more below…

But we tend to admire those who fly in the face of authority.

Especially when that person is the CEO of one of the most influential companies on the planet.

Elon Musk is just such a person.

From the moment he founded Tesla, Musk’s been under the scrutiny of the SEC.

Admittedly, for good reason.

At the end of the day, the SEC has to keep people honest.

Elon Musk and his brother, Kimbal, are currently under investigation by the SEC for insider trading violations.

If you’ll remember, last November, Kimbal sold 15% of his shares of the company.

This didn’t raise any alarms because he's known to trade in and out of Tesla stock frequently.

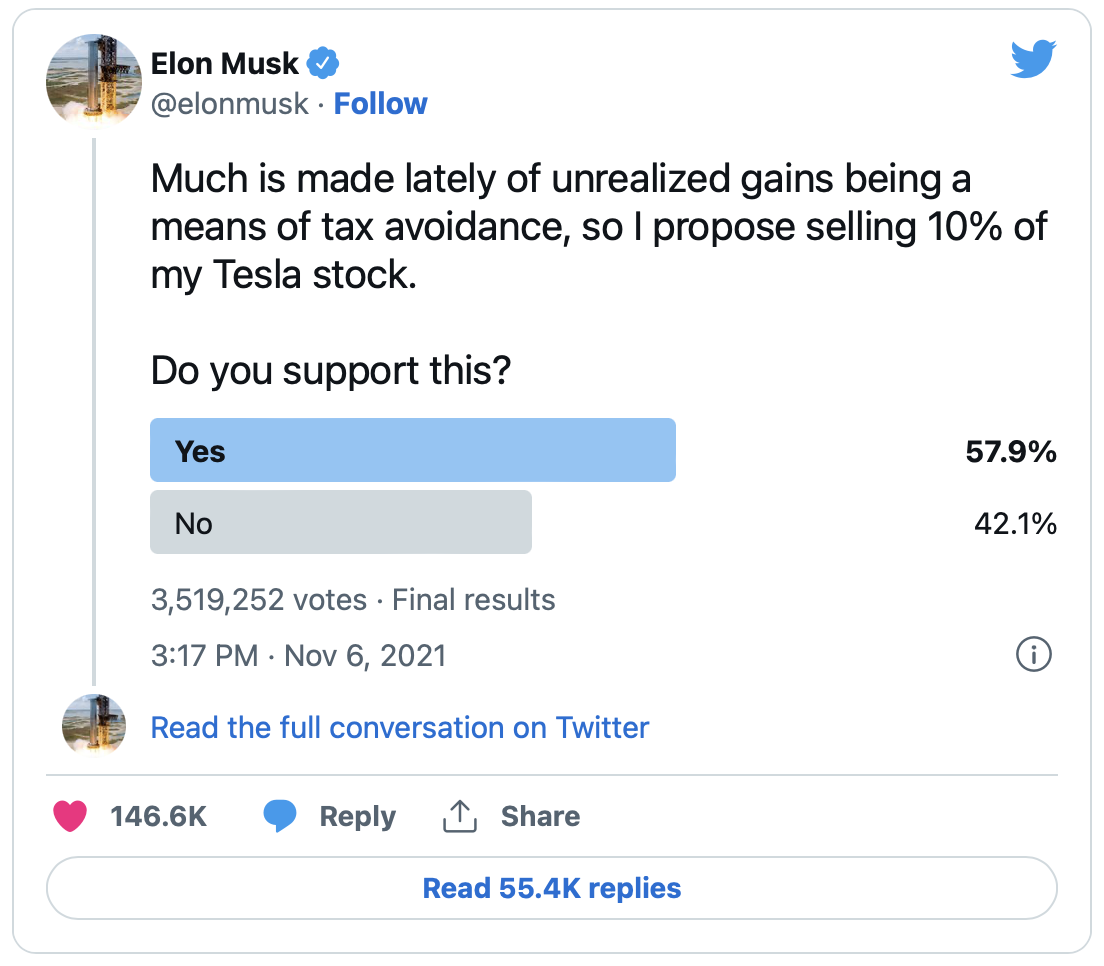

However, the day after Kimbal’s sale, Elon held a Twitter poll asking users if he should sell some Tesla shares.

After the poll closed and the majority of voters supported the stock sale, Tesla stock fell 5%.

It’s this kind of stock price manipulation that raises eyebrows, especially from the paper pushers at the SEC.

This isn’t the first time Musk has had a run-in with the SEC, though.

Back in 2018, he tweeted, “Am considering taking Tesla private… Funding secured” and said that “shareholders could either sell at $420 or hold & go private.”

The stock dropped on the news, and the SEC promptly filed a complaint. Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Musk had to step down as chairman and pay $40 million in penalties.

Additionally, Tesla’s lawyers must now preapprove Musk’s tweets if they contain material, nonpublic information.

Musk has openly criticized the SEC for hindering his freedom of speech, so it makes sense that he’d want to purchase Twitter.

Now he's at it again with this recent Twitter exchange:

In a time of great stock market volatility, Musk openly admitted he doesn't care about the stock.

And why should he?

He's only the richest man in the world.

According to TheStreet, "Very few CEOs would dare to make such a statement for fear of reprisals from their board of directors and a sanction from the markets."

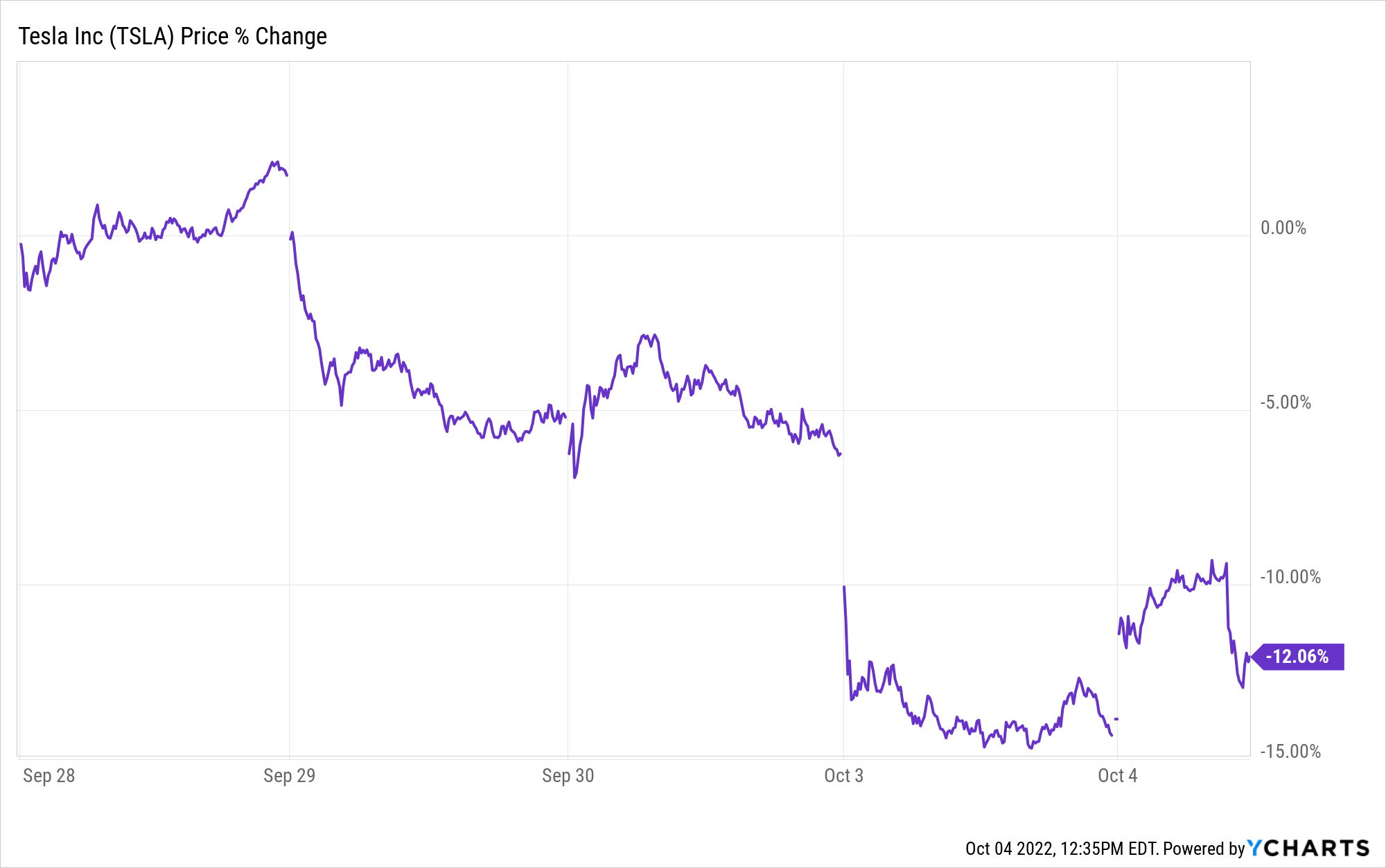

And that's exactly what happened over at the EV-maker.

Yesterday, the Dow shot up 1,000 points.

Tesla remained flat and has actually dropped more than 12% the last five trading days.

Musk's management team is starting to take notice, and members are leaving in droves.

Tesla's director of AI, vice president of legal, and heavy trucking lead… the list goes on.

They're sick of Musk's antics.

Just yesterday, he held a poll where he described how he thinks the war in Ukraine could end.

The outgoing Ukrainian ambassador to Germany, Andrij Melnyk, promptly replied, "'F— off is' my very diplomatic response to you. The only outcome [is] that now no Ukrainian will EVER buy your f—ing Tesla crap. So good luck to you."

Tesla could be in serious trouble.

My colleague Jeff Siegel told his subscribers this week that a group of Tesla execs left the company to build their own EV business, one that's not caught up in the limelight.

And they've created something really special.

The company just announced that its EV set a world record for the longest distance traveled on a single charge.

A whopping 1,102 miles!

I had never heard of the company myself until Jeff pitched it to me.

And as it's only trading for around $5 today, it could be a solid bet, especially now that Elon Musk is so focused on space and robots that he's neglected his bread and butter EV business.

Jeff says this company could give Tesla a run for its money, and he even predicts it'll soon be bigger than Tesla.

Once the EV market explodes even higher and this company is at the center of it, you won't regret getting into this one early.

Stay frosty, Alexander Boulden After Alexander’s passion for economics and investing drew him to one of the largest financial publishers in the world, where he rubbed elbows with former Chicago Board Options Exchange floor traders, Wall Street hedge fund managers, and International Monetary Fund analysts, he decided to take up the pen and guide others through this new age of investing. Alexander is the investment director of Insider Stakeout — a weekly investment advisory service dedicated to tracking the smartest money on the planet so that his readers can achieve life-altering, market-beating returns. He also serves at the managing editor for R.I.C.H. Report, a comprehensive service that uses the highest-quality investment research and strategies that guides its members in growing their wealth on top of preserving it.

Check out his editor’s page here. Want to hear more from Alexander? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

Editor, Wealth Daily

Check us out on YouTube!

Check us out on YouTube!