On April 23, the magazine Fast Company published an article titled “American Billionaires have gotten $280 Billion Richer since the start of the COVID-19 Pandemic.”

The article was less of an explanation of how these billionaires increased their wealth and more of a shaming — how dare they accumulate so much wealth when so many people are experiencing so much misery?

Fair enough.

The super liberal think tank the Institute for Policy Studies called these billionaires “pandemic profiteers” in a recently released report.

Again, no mention of how many of these billionaires increased their wealth.

So I will.

Amazon founder Jeff Bezos’ wealth has increased a whopping $25 billion during the COVID-19 pandemic. Not coincidentally, Amazon’s stock has made all-time record highs this month.

Another billionaire who has increased their wealth during Amazon’s record-breaking stock rise is Jeff Bezos’ ex-wife MacKenzie Bezos.

She got 19.5 million Amazon shares in her divorce settlement last year.

At a current price of $2,320 a share, MacKenzie is worth over $45 billion.

Two things the anti-wealth crowd won’t mention are:

1. This is all paper wealth. Jeff’s and MacKenzie’s increased wealth is tied up in the stocks of Amazon. They won’t realize a capital gain or have a tax obligation until they sell. More importantly, that wealth could disappear as quickly as it appeared. A market crash or an even greater depression (something many Debbie Downers are cheerleading for) could erase all the wealth.

2. Instead of demonizing Jeff Bezos, congratulate him for starting and developing a company as vital and successful as Amazon. It was recently reported that Amazon is doing $10,000 in sales every single second of this global lockdown. Almost every other day, the Hicks household receives a delivery from Amazon. With most of the nation on house arrest, online orders have skyrocketed.

But Amazon isn’t the only stock hitting all-time highs during this pandemic.

Here’s a short list of some of the high-fliers that made record highs in April…

Dollar General (NYSE: DG):

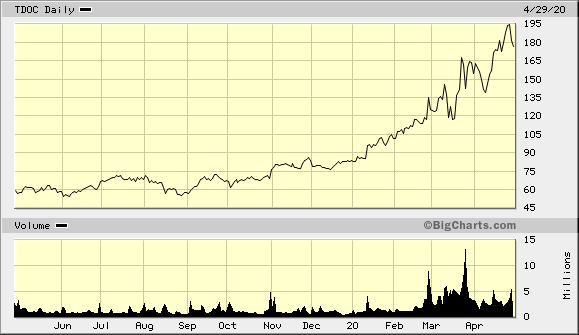

Teladoc Health (NYSE: TDOC):

Netflix (NASDAQ: NFLX):

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”The Best Free Investment You’ll Ever Make

It contains full details on why dividends are an amazing tool for growing your wealth.

Eli Lilly (NYSE: LLY):

Newmont (NYSE: NEM) (not technically a record high):

These are just some of the stocks that have padded the wealth of many of America’s richest investors.

Not included in this list of all-time highs are a bunch more biotechnology and health care stocks.

In other words, many investors and traders are making a fortune in these uncertain times. In fact, many describe it as shooting fish in a barrel. It’s been that easy.

Stocks are going up. Don’t fight it; participate in it.

Now, unlike many of my super liberal friends, I don’t bemoan the success of these investors. Putting capital back into the markets and back into the economy is the right thing to do. It’s the moral thing to do.

And you can, too.

That’s why I’m inviting you to a very special event that takes place tomorrow. I urge you to attend it. It could make you quite a bit of money.

You see, my friend and colleague, Briton Ryle, is hosting a free webinar on April 30 at 2 p.m. EDT, where he’ll show you exactly what the smart insiders are doing…

And how you can copy these insiders and earn serious returns for yourself.

This is a chance to not just survive but thrive in these difficult times.

However, slots are limited, so you need to register right away.

Click here to sign up for the webinar now.

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.