Three months ago, many of us were finishing up some last-minute holiday shopping. On cable and on Twitter, financial pundits were debating whether or not Black Friday sales would hit a record $1 trillion.

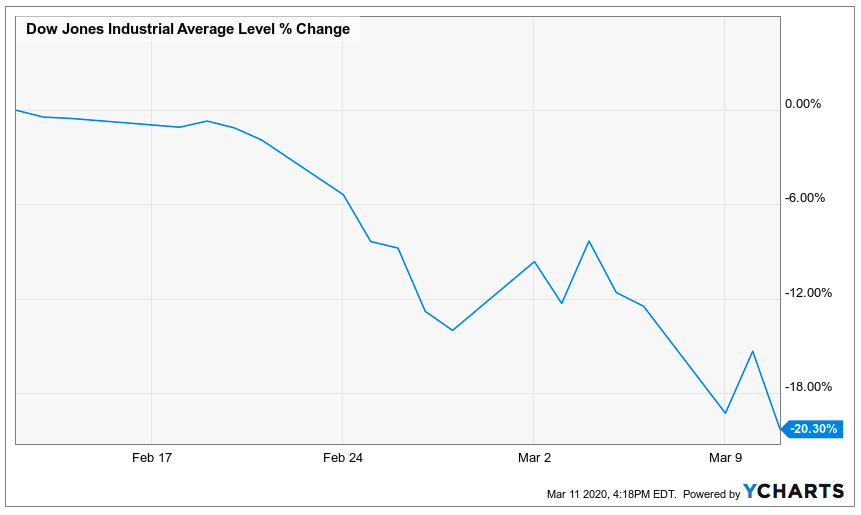

Fast forward to this week, when we watched the Dow sink into a bear market after several sessions of brutal, coronavirus-inspired panic selling. Crazy how fast life can change, huh?

On Tuesday afternoon, the index closed a little more than 20% down from its early-February highs, officially ending the 11-year-long bull market.

It’s scary to be staring down the first bear market in more than a decade, but every downturn eventually ends, and life goes on.

Besides, stock market crashes have some silver linings. Below, we’re looking at four substantial upsides to this massive selloff.

Lower Interest Rates

For one thing, the government’s emergency response to this crisis could make it cheaper to borrow money. Ultra-low interest rates are back, baby!

The Federal Reserve already cut the benchmark rate by 50 basis points on March 3, setting the current range between 1% and 1.25%. That’s down almost 50% from the pre-coronavirus peak rate of 2.25%–2.5%.

And there’s reason to believe that the Fed is going to pump even more cheap money into the economy. On Thursday, the central bank announced that it would resume large-scale quantitative easing (QE) operations by expanding its bond purchases, which will further lower rates.

So if you’re looking to refinance student loans, buy a house, or open up a new credit card, the next few months are a good time to do it.

Lower Gas Prices

The energy sector has been one of the hardest hit in this crash, as Saudi Arabia has opportunistically used the occasion to cut oil prices in an attempt to gain market share.

Brent crude is down 15% this month, and it briefly crashed by more than 90%!

That’s very bad for workers and investors in the oil industry… but it’s actually quite good for consumers.

If these low oil prices persist (which they likely will), they could substantially bring down the prices of plane tickets (via jet fuel), heating oil, gasoline, and other petroleum products.

It remains to be seen how much travel will be restricted by the government’s emergency response to the coronavirus pandemic. But once quarantines are lifted, Americans may find that many modes of transportation have become dirt cheap.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks.”

It contains the best dividend growers to add to your portfolio and full details on why dividends are an amazing tool for growing your wealth.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Higher Dividend Yields

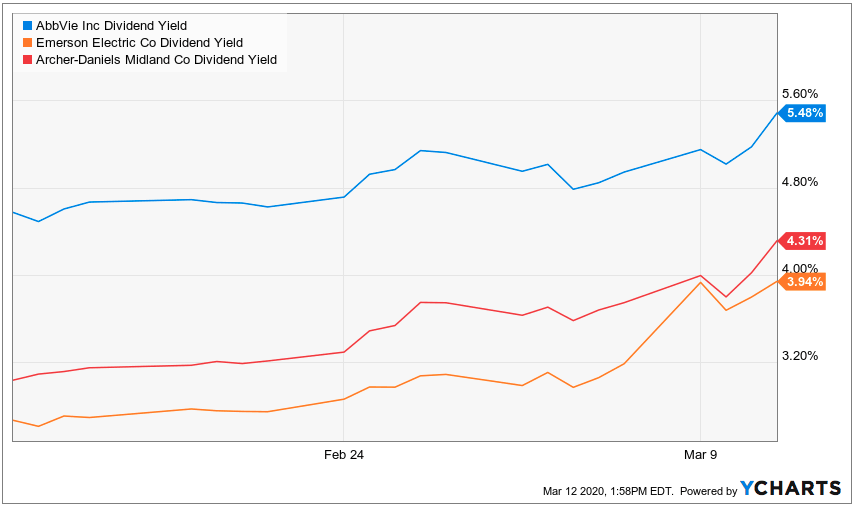

The current crisis is very bad for bond yields, but it could boost the yields of another kind of income investment: dividend stocks.

The selling action in the stock market is depressing the prices of many reliable dividend-payers, thus driving up their respective yields. The payouts offered to investors in AbbVie (NYSE: ABBV), Emerson Electric (NYSE: EMR), and Archer-Daniels Midland (NYSE: ADM) are all on the up and up.

But dividend stocks are just one aspect of the biggest upside to this bear market…

The Mother of All Buying Opportunities

Simply put, stocks haven’t been this cheap since the Great Recession.

The S&P 500’s price-to-earnings (P/E) ratio is below 20 for the first time in years. Many index-tracking exchange-traded funds (ETFs) are at late-2018 price levels.

Of course, it’s scary to buy during a bear market like this one. It’s unclear how far we are from the bottom and which stocks are good value buys.

Getting guidance from a team of value investing experts can help — and that’s exactly what The Wealth Advisory offers. Its subscribers have already gained almost 10% on a recommendation made a few weeks ago just as the market was starting to turn over.

Until next time,

![]()

Samuel Taube

Samuel Taube brings years of experience researching ETFs, cryptocurrencies, muni bonds, value stocks, and more to Wealth Daily. He has been writing for investment newsletters since 2013 and has penned articles accurately predicting financial market reactions to Brexit, the election of Donald Trump, and more. Samuel holds a degree in economics from the University of Maryland, and his investment approach focuses on finding undervalued assets at every point in the business cycle and then reaping big returns when they recover. To learn more about Samuel, click here.