When I was 19 or so, I got ditched by a woman I thought I was going to marry. I know he was just trying to be helpful, but I got kinda irritated at my dad when he told me, “There’s a lotta fish in the sea.”

How helpful is that observation, really?

Sure, when you’re hung up on one fish, the idea that there are plenty of fish just as good out there might sound like the right thing to say. But, the oceans are pretty big. Safe to say I’m not landing any 600-pound bigeye tuna off the coast of Peru…

Aside from the fact that I don’t get to Peru very often (ok, never), fishing for bigeye means shallow trolling in deep water. The big fish like to come up on their meals from deep below. Fishing for these big tuna means you’re not gonna catch yellowfin, which hang out in more shallow waters.

With apologies to my dad, I’ve learned that when I fish, I fish for a “type.” I’m not tall, and I don’t jog or kayak, so the Australian supermodel is pretty much out for me. The best thing I ever did was narrow my parameters, really get in touch with what I like and don’t like.

It’s the same way trading stocks.

I know traders who have five monitors that constantly troll the markets for high-volume breakouts from short-term moving averages or whatever. Trading systems like that might throw 10 or 20 stocks at them every day, some of which they may have never even heard of before.

And that’s fine. If fishing the entire ocean works for them, I am the last person to tell them that’s not going to work. But I will say that I’ve learned that approach doesn’t work for me.

Teaching a Man to Fish

I made my first option trade in 1999. It was Nokia, the biggest mobile phone company in the world. I think it was in the $70 range at the time. My memory is that I made 70% or so, but don’t quote me on that.

The point is: I’ve been actively trading the market for a long time. I know what works for me, and my success has a great deal to do with the fact that I have narrowed my field of trading candidates dramatically.

I watch about 40 stocks, I guess. Maybe only 10 are legitimate contenders for a trade. I’ve found that individual stocks have their personalities; they trade in different ways. Qualcomm likes to rally out of the hole. When Gilead gaps higher, it usually closes the gap after an hour or so before heading higher.

There was a time when I’d trade breakouts on stocks I didn’t really know — pretty much never worked. Seems like every time I tried, I lost. Expensive lessons, sure, but I took them to heart.

For one, I like stocks that I consider undervalued. As in, I think the market is underestimating their potential. A lot of traders like momentum names — Facebook, Apple, Netflix, etc. But I can’t tell you if these stocks are expensive or not. Are investors underestimating Apple’s potential or Facebook’s? It’s tough to say for sure.

But I have no problem telling you that investors are underestimating a stock like Chewy (NYSE: CHWY). And speaking of which, earlier today when I started this article, I saw that the stock was about ready for a move higher…

That last glyph is today. Earlier, it was sitting right on that lowest rising trendline. You can see that the stock has supported (which is a fancy way of saying “stopped going down”) on this trendline many times since November. A rally can take Chewy to $31 or higher (I say Chewy is fairly valued up around $38). So the time to buy for an upside trade is… right now.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “Options Made Easy”

It contains full details of tips on how options investing can be very simple.

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

135% Average for Every Trade

Now because I know my trade candidates very well, I don’t always recommend trades based on their charts.

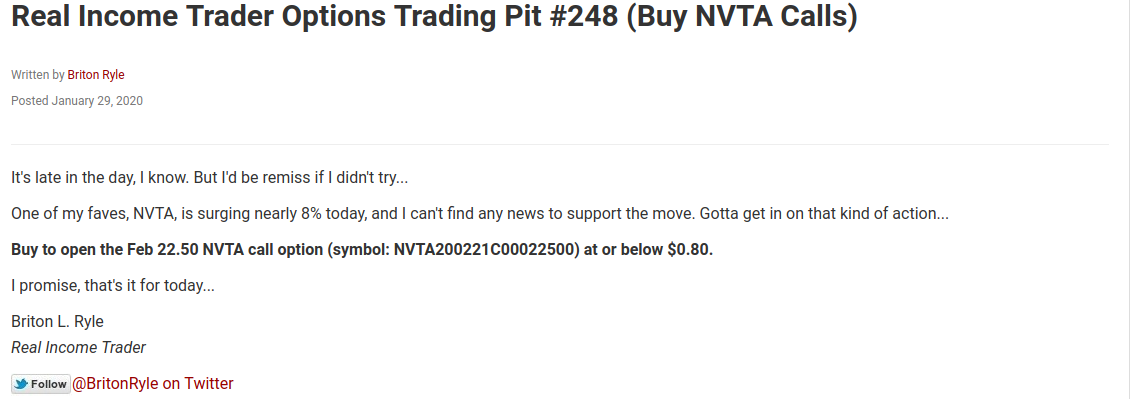

A couple weeks ago, one of my stocks spiked higher midday, and I sent this to my Real Income Trader subscribers:

The thing about knowing your stocks: It’s not easy to buy something that’s already spiking 8%. I didn’t hesitate. My subscribers actually got those call options at $0.65. We sold them on Monday at $2.40 for a 269% gain.

Here’s another example (from a Gilead Sciences trade) of the value of knowing your stocks:

That was from January 29. As it happens, over that weekend, we learned that one of Gilead’s drugs might be useful against coronavirus. You could say we got lucky regarding that news because the shares did spike higher. But as Louis Pasteur said, “Fortune favors the prepared mind.” We took 225% gains on February 4…

So, I would put the value of knowing your stocks at 135%; that’s what Real Income Trader subscribers are averaging on each and every trade we’ve made this year.

Sadly, however, that average is about to go down. We’re about to take profits on some Maxar Technologies (NYSE: MAXR) calls that are *only* up 100%…

Until next time,

Briton Ryle

The Wealth Advisory on Youtube

The Wealth Advisory on Youtube

The Wealth Advisory on Facebook

The Wealth Advisory on Facebook

A 21-year veteran of the newsletter business, Briton Ryle is the editor of The Wealth Advisory income stock newsletter, with a focus on top-quality dividend growth stocks and REITs. Briton also manages the Real Income Trader advisory service, where his readers take regular cash payouts using a low-risk covered call option strategy. He is also the managing editor of the Wealth Daily e-letter. To learn more about Briton, click here.

@BritonRyle on Twitter

@BritonRyle on Twitter