A couple of years ago, a survey came out that showed most Americans don’t have any money invested in the stock market.

That’s changed a little since then, but the most recent numbers are still dismaying.

According to Gallup’s most recent Economy and Personal Finance survey, only 54% of adults report having any money invested in stocks.

That’s better than the 52% from last year’s survey, but still not good.

The stock market is the greatest wealth-generating tool ever invented. And since the 2008 financial crisis, the market has recovered all its losses and soared to new highs.

But people still aren’t positioned to take advantage of those gains.

The worst part of the matter is that those who need those gains the most are the ones least likely to be invested.

Only 21% of people with an annual income of $30,000 or less have money in the market. 13% fewer Americans with a middle-income range ($30,000–$75,000) are investing than before the financial crisis. And 10% fewer folks in the upper-middle-income range ($75,000–$100,000) have money in stocks than they did back in 2008.

These are the people who are really going to need the profits offered by the stock market to have a healthy retirement. Heck, many of them need those gains just to have a retirement at all.

Where’s the Money?

Many folks are putting any extra cash they have into bank accounts. But that’s not going to grow savings enough to get them a worry-free retirement.

Returns on even the highest-paying savings accounts have been near record lows for nearly a decade. They’re starting to rise, but they’re still nothing compared to the gains you could see by investing in stocks.

According to Bankrate.com, the highest 10-year CD (where your money is locked up for a decade) only pays 2.35% interest. And that’s if you invest $100,000. Drop that down to $10,000, and you’re looking at a 10 basis-point drop in growth.

So bank accounts are out if you’re hoping to grow your money and not just save it.

Then there’s real estate. Before the financial crisis, many people thought real estate prices could only go up. But they found out the hard way that’s not the case.

And while prices are on their way back up, they still just barely keep pace with inflation.

Plus, if you sell a property for a profit, you’ve got to pay some serious taxes, and you’ve got to pay the commissions to both realtors involved in the transaction.

Say you’re renting the property. That’s not a bad idea… if you can find good tenants and keep the property filled. But, as a landlord, I can tell you it’s not as easy as it sounds.

People who look good on paper can still be terrible tenants. They might trash your place. Then you’ve got to make the repairs. They might even stop paying rent entirely. Then you’ve got to evict them. That’s a messy process, and it takes months, even years to get everything settled.

When you need to replace your tenants, you’ve got to spend a lot of time looking for new ones. You’ve got to do background checks. You’ve got to do credit checks. You’ve got to be around to show the place. You’ve got to clean and repaint the property. Sure, if you use a property management company, you can avoid some of these headaches. But they’re not going to do it for free. And you need to make a profit on top of whatever loan you’ve taken to buy the property in the first place.

So, while you can make a little more in real estate than you can with a bank account, you’re not going to come close to matching the returns you could have gotten in the stock market.

Getting Help

Nobody should have to go it alone. If you’re reading this, then you’re already on your way to getting the help you need to build your nest egg with the stock market.

I and the other editors here at Wealth Daily take pride in helping retail investors learn the ropes. And we take even more pride in helping them find the best investments to get their money working for them.

Combined, we’ve got over a century of experience combing the exchanges for stocks set to grow exponentially. And we don’t keep those to ourselves like most analysts. We’re all about sharing them with our readers.

Take my investing service, The Wealth Advisory, for example. As the name suggests, it’s about building wealth. And it’s done a great job for our readers. No matter what the market is doing, my strategy keeps portfolios growing.

In fact, during the depths of the financial crisis, we were still bringing in huge profits — some in just a couple of months. There was W.R. Grace. We sold that after a few months for a 72% gain. There was VMware. It netted us ~45% in two months while the rest of the market was tanking.

Working for You

Part of my strategy is to find solid companies that are going to grow their dividend payments year after year.

Think of it this way…

Say you put $5,000 into a $50 stock that pays 8% a year. Then you hold it for 20 years. Your investment would be worth $24,377.

That’s a 487% gain.

Not bad. But it could be a lot better. That same $5K in a stock that pays just 3% — but grows that payment at 20% a year — would be worth $4,055,388 after 20 years.

That’s a phenomenal 81,327% gain.

And it works. Every time.

My readers are sitting on massive gains in multiple investments as I write this article.

Gains like:

- The Best American Bank — up ~160% in less than five years

- The Best American Restaurant Chain — up ~180% in a few short years

- The Technology Superstar — up ~85% in less than two years

- The Top American Health Care Provider — up ~240% and still growing

- The Best American Retail Investment — up over 300%

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth.On your own terms. No fees, no comission.

Beating the Market

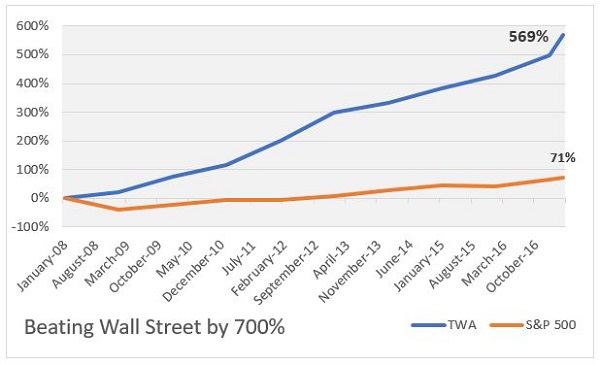

We’ve been beating the market since the service was founded. We’re up 700% more than the S&P 500 even after it hit new all-time highs!

You could’ve started with just $10,000 and invested an equal amount in each of our recommendations the first year.

Then if you’d just reinvested the past year’s profits in each recommendation the following year, you’d be up a whopping 569% today!

All without investing another dime of your paycheck. Just think how much that cash would’ve grown if you’d been adding more to it each month!

The S&P 500 is only up about 70% in the same amount of time.

And most mutual funds can’t even claim to have beaten the S&P over that period — heck, over any period.

That means you’d have started investing right at the peak of the markets before the biggest financial disaster since the Great Depression, and you’d still have cumulative gains of more than 2,400%!

You simply can’t get those kinds of reliable and low-risk profits anywhere else.

Not from mutual funds.

Not from hedge funds.

Not from index funds.

And certainly not from bank accounts and real estate.

The Latest Opportunity

Most recently, we’ve uncovered a profit loophole that’s already made investors millions of dollars.

I can’t give you all the details here, as it’s still an active investment for our paid subscribers.

But you can click this link to learn more and find out how you, too, can get your share of the multimillion-dollar payouts this strategy is generating.

Bottom Line

I implore you to get involved in the stock market.

Everyone needs to be investing. It’s the only way we’re going to be able to stop working one day. It’s the only way we’re going to be able to leave something behind to help our children and grandchildren. It’s the only way we’re going to build real, lasting wealth.

It’s how legacies are made. The Rockefellers, Rothschilds, and Buffetts of the world weren’t made from savings accounts and mattresses stuffed with cash. They were made in the stock market.

And there’s still a fortune just waiting for someone like you to step up and take it.

So keep reading Wealth Daily. Keep learning more and more. And keep building your wealth in the market. If you’re not doing it yet, get started today. I’m here to help.

To investing with integrity (and an eye on the future),

Jason Williams

Wealth Daily

Follow me on Twitter @AllBeingsEqual