A Seed Awakens: The Germination of the MoneyQuake

“In a world of infinite debt, gold is the only finite truth.”

— Brian Hicks, Founder and President of Wealth Daily

Imagine a pebble-shaped object dropped into calm earth.

At first, the world above barely notes the disturbance — but beneath the surface, a seed cracks. Outward calm conceals an immense transformation beginning to unfold.

A coming birth.

In the language of the MoneyQuake thesis, we are at that hushed moment of germination.

The conditions — fertile in ambiguity, rich with latent power — are now aligning. And the first green sprout piercing the soil?

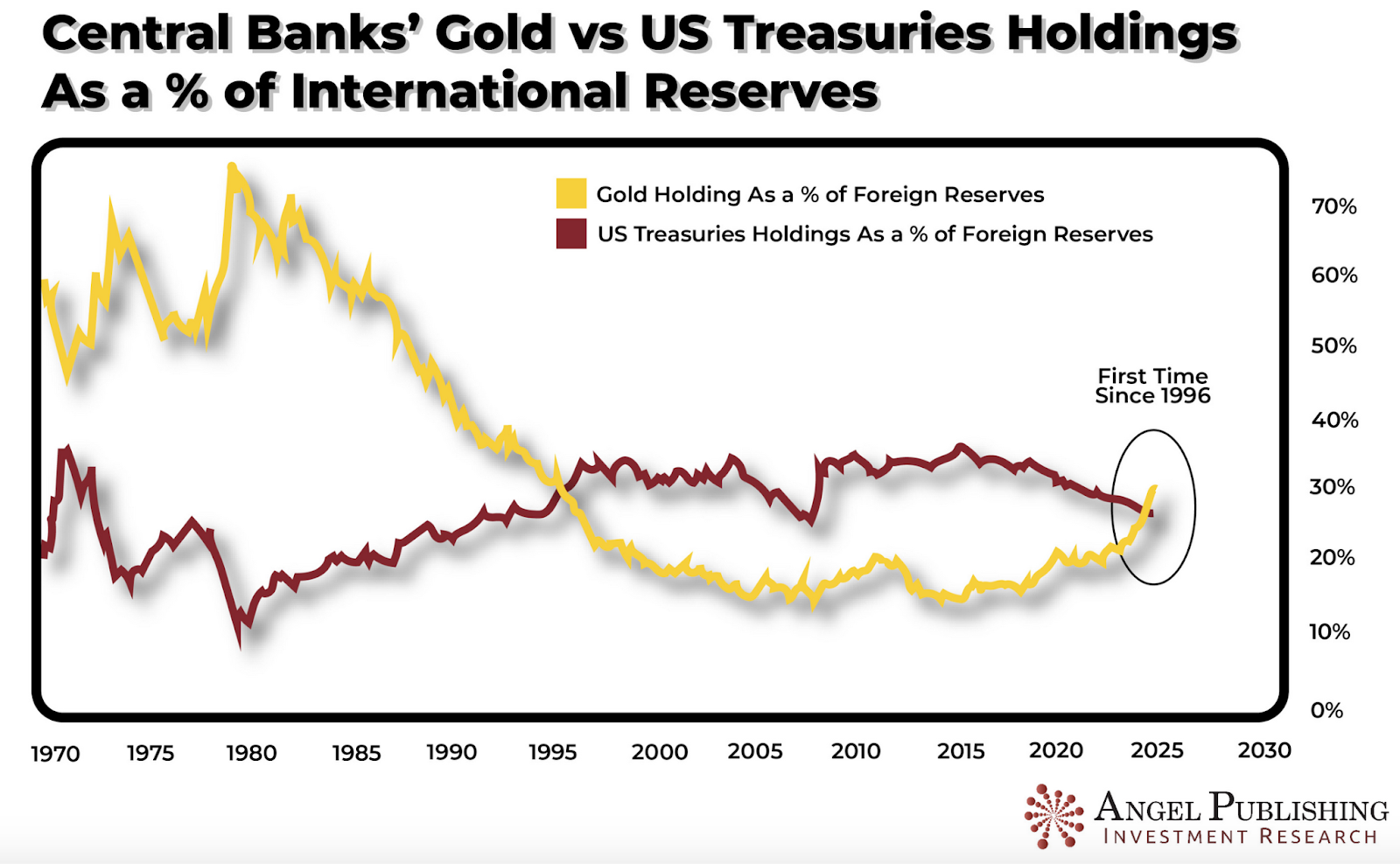

It is gold’s audacious ascent, reaching record highs and overtaking U.S. Treasuries in central bank reserves for the first time since 1996.

Let that sink in for a minute.

Gold Reaches New Heights: The First Sprout

Last week, gold surged to record territory — topping over $3,600 intraday.

Investors, buffeted by never-ending government debt, geopolitical turbulence, and a weaker dollar, rushed to the timeless safe haven of bullion.

Simultaneously, global central banks shifted their stance dramatically: For the first time in nearly three decades, official gold holdings have surpassed U.S. Treasuries. This is no footnote — it’s a tectonic shift in global finance.

Motivated by sanction-proof assets, de-dollarisation impulses, growing U.S. debt anxieties, and a quest for stability, central banks — notably those of India, China, Russia, Turkey, Poland, and others — have swelled their bullion reserves.

And yet, in the grand narrative, these are but the tiny green shoots, barely visible above soil. But those tiny shoots are unlocking a process — a MoneyQuake that has barely begun.

Seed Through Soil: MoneyQuake’s Early Phase Unfolds

1. Seed Planted: Structural Fragility Meets Catalyst

The MoneyQuake seed lies in structural vulnerabilities: unstable geopolitics, swelling national debts, rising inflation, and global monetary realignments. Fed rate decisions, sanction risks, and teetering confidence in U.S. fiscal steadiness act as catalysts watering that seed.

Gold’s leap to fresh all-time highs — and the central bank pivot — are the first signs that the seed is responding to nurturance from beneath.

2. Germination Begins: Central Banks Lead the Way

Germination starts beneath the surface, invisible until the sprout breaks through. Central banks are now the hydrators of gold’s resurgence:

- In 2024 alone, they purchased a record 1,180 metric tons, up from about 400–500 metric tons per year earlier in the decade.

- The World Gold Council notes 43% of central banks plan to raise gold holdings, and 95% expect further increases in coming years.

- Tavi Costa of Crescat Capital called this “likely the beginning of one of the most significant global rebalancings we've experienced in modern history.”

These early adopters — the rising sprout — are Earth’s intelligence detecting what’s to come.

3. Visible Shoot: Gold’s Price Surge

At record prices — over 90% gain since 2023, approaching $3,600 — gold’s green shoot is now visible to all. But recall: Even a modest shoot can brace for a towering tree.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We”ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “A Maverick’s Guide to Gold: 3 Gold Stocks Set to Disrupt the Market”

It contains full details on something incredibly important that’s unfolding and affecting how gold is classified as an investment..

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.

Gold: The King of Assets (Even Outpacing Bitcoin)

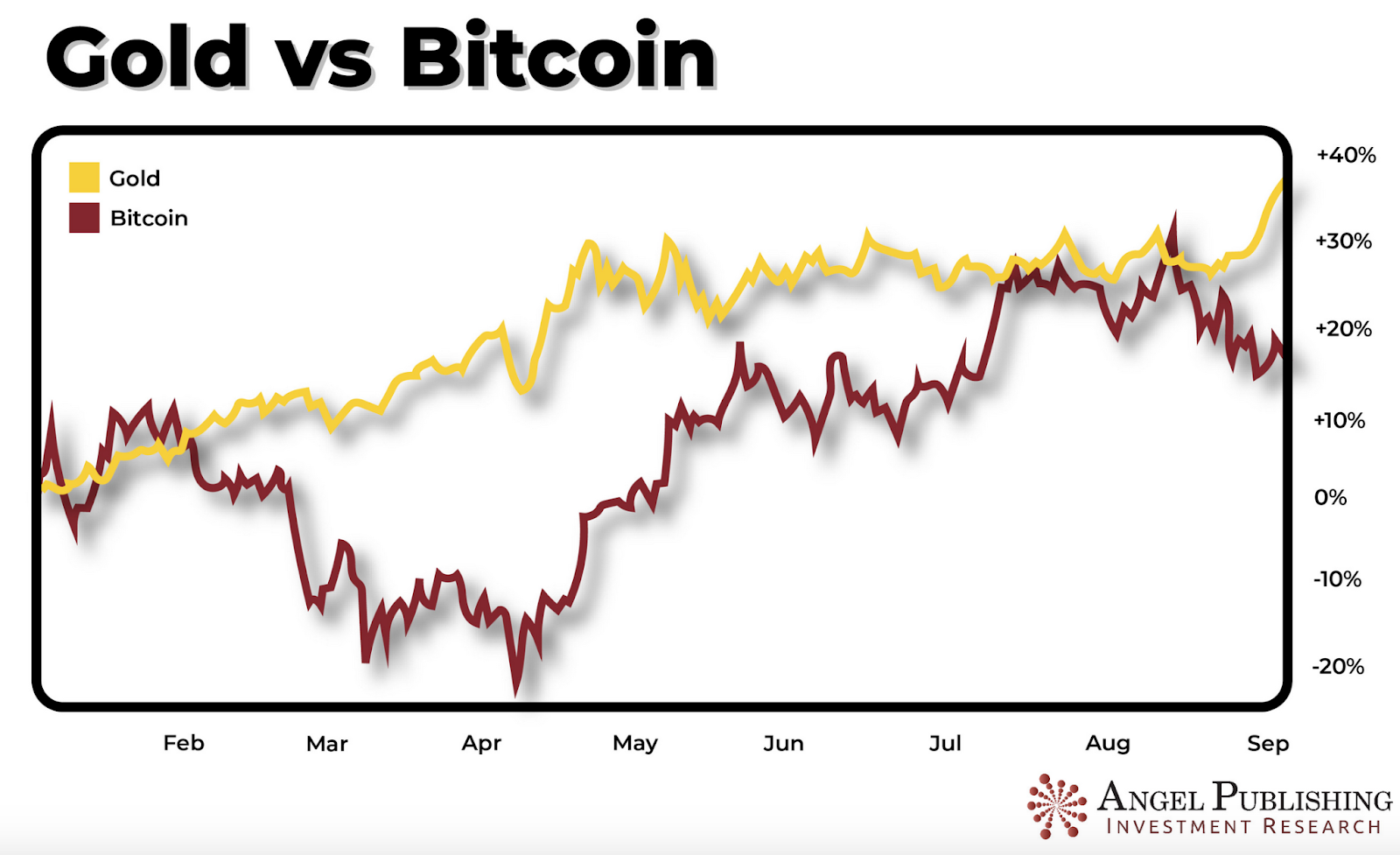

For years, skeptics dismissed gold as the “old man’s asset,” the shiny relic of a bygone era, while Bitcoin was hailed as “digital gold” — the modern hedge against inflation and currency debasement.

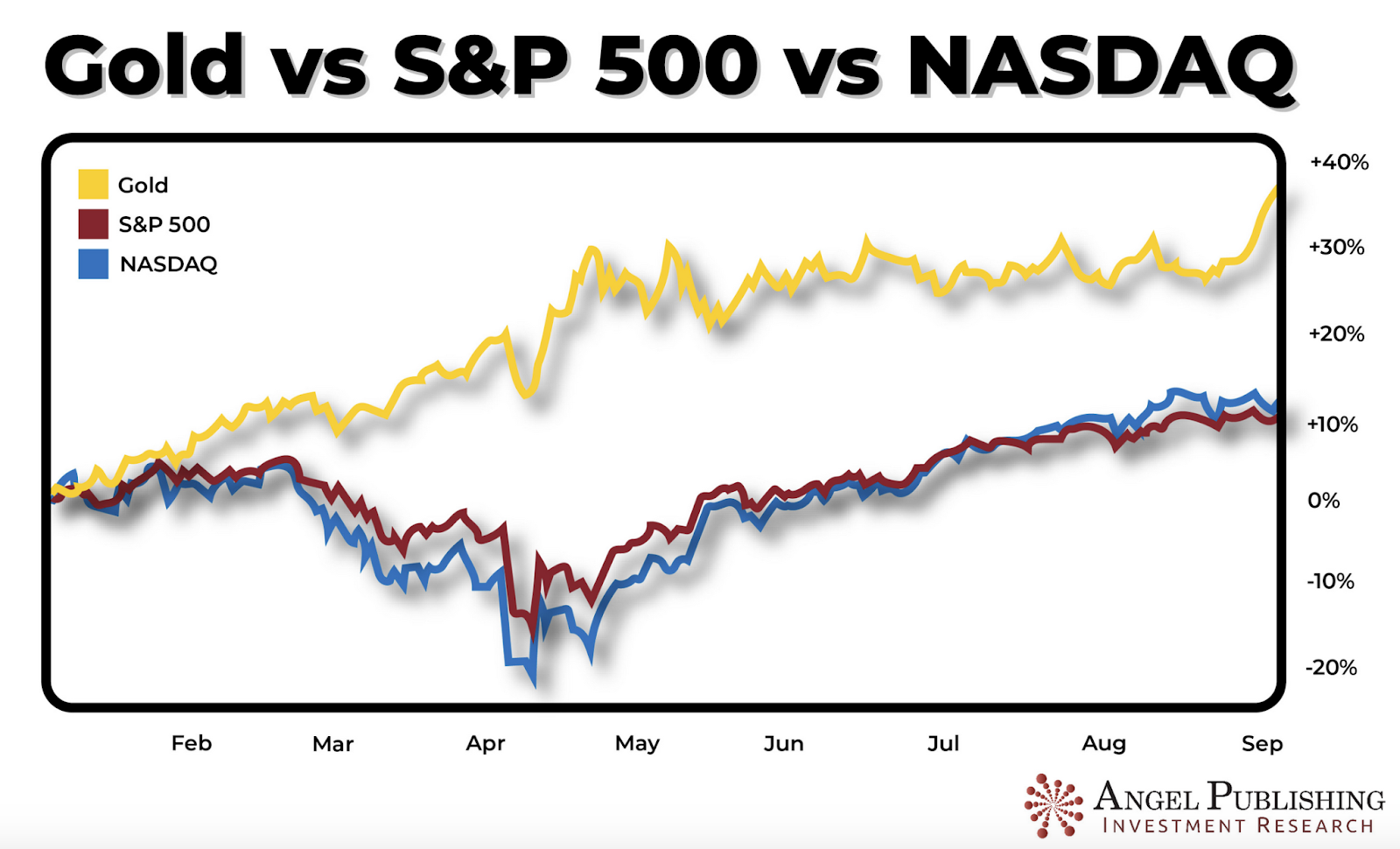

But here’s the reality in 2025: Gold isn’t just keeping up; it’s beating everything.

- Gold has doubled the return of Bitcoin this year — a 2-to-1 outperformance.

- Against equities? Gold is crushing the S&P 500, Dow, and even the once-untouchable “Magnificent 7.”

- Against bonds? No contest — U.S. Treasuries are being dumped in favor of bullion for the first time since 1996.

- Against real estate? With rates still volatile, property markets have stalled, while gold keeps climbing.

When gold beats Bitcoin, Treasuries, and stocks all at once — that’s not just a rally, that’s MoneyQuake… and everything changes from here.

Think about that: The supposedly stodgy, immovable metal is leaving behind the world’s flashiest crypto. That alone is proof that we’re at the dawn of something massive. Investors aren’t chasing hype anymore — they’re chasing survival, sovereignty, and certainty.

Gold has outlasted every empire, every currency, every lie.

This is the MoneyQuake at work. When conditions are right, seeds don’t just sprout — they surge.

Growing Toward a 10-Year Bull Market: The MoneyQuake Unfolds

You don’t harvest trees the day they sprout. This is the start of a decade-long unfolding — MoneyQuake’s bull market — in which gold asserts itself as a generational asset.

Why It’s Just the Beginning

- Reserve Rebalancing Is Early-Stage

Gold's share of global reserves has surged (20%) but still trails far behind the dollar’s share of about 46%. Central bank buying remains elevated, and much more rebalancing lies ahead. - Macro Conditions Remain Supportive

Inflation, fiscal stress, massive debt, geopolitical tension, and cracks in confidence in traditional reserve assets are unlikely to vanish soon. Should they grow, they will stoke further demand for gold. - Immutability and Sovereignty of Bullion

Gold is immune to freezing, default, or sanction — its permanence offers sovereigns and investors a bulwark unseen in Treasuries. From pharaohs to presidents, Caesar to the Fed — the one truth they could never erase has been gold. - Momentum Begets Momentum

As prices appreciate and central banks pour more into gold, it can feed further appetite from institutions and retail alike. Projections of gold hitting $4,000 (UBS) or beyond may be conservative. - No Viable Alternative for Diversification

The euro, yen, digital currencies, and other assets lack Treasuries' liquidity or the dollar’s ubiquity. Gold enters as the default diversifier.

10-Year Roadmap: The MoneyQuake Bull Market Stages

Let this germination evolve before you:

- Years 1–2: Continued gold accumulation by central banks, price breakthroughs, growing institutional acceptance.

- Years 3–5: Adoption expands: ETFs, private wealth, and sovereign wealth funds increase gold exposure; public narratives reframe gold as strategic.

- Years 5–7: Gold becomes entrenched — not just for crisis protection, but expectation of its bull paradigm. Dollar-centric fears accelerate demand for gold.

- Years 8–10: The MoneyQuake bull market matures. Gold consolidates its role as one of the top reserve and investment assets. Price levels that today seem elevated become benchmarks for a new era.

Closing Thoughts: From Seed to Forest

The MoneyQuake analogy finds its first vital expression in gold’s march to record highs and central banks’ newfound preeminence in gold reserves. We are witnessing the germination phase: the earliest, most hopeful, and most momentous.

This is not a fleeting rally. The sprout is fragile, yet it carries the structural strength to burgeon into a forest — a decade-long bull market where gold's rise reshapes reserve strategies, investor psychology, and monetary realities.

So step quietly and watch the light: MoneyQuake has begun, subtle as a seed, powerful as time.

And the proof is in plain sight: Gold is the new king of assets — it’s outpacing stocks, bonds, real estate, and even Bitcoin. The world’s wealth is shifting beneath our feet, and those who plant themselves early will harvest a forest of opportunity.

Get to the good, green grass first…

The Prophet of Profit,

Brian Hicks

Brian is a founding member and President of Angel Publishing. He writes about general investment strategies for Wealth Daily and Energy and Capital. Brian is the managing editor and investment director of R.I.C.H Report (Retired Independent Carefree Healthy), New World Assets and Extreme Opportunities. For more on Brian, take a look at his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.