Have you ever looked at the IPO (initial public offering) market? I mean really looked at it? If you have, you already know where the real money is being made.

It’s not in a specific sector like technology, although some of those gains have been phenomenal. And although they’ve been great, the BIG gains aren’t coming from biotech stocks or cannabis plays, either.

No, the real money is being made BEFORE companies ever hit the open markets. Let me break it down for you…

The BIG profits are all taken home by private investors these days.

Don’t believe me? Let’s go through a few examples.

In the first year that eBay was a public company, its shares ran up an incredible 872%! Every $10,000 investment in the IPO grew to be worth nearly $100,000… in just a year! That’s an impressive gain, right?

Sure, until you see how much the folks made who got some skin in the game early while eBay was still private. They were able to turn every $10,000 into over $10 MILLION with their 105,000% win!

Makes that 872% seem like child’s play, right?

Or how about LinkedIn? From the day it went public until the day it was bought out by Microsoft, LinkedIn’s stock more than tripled in value.

Anyone who bought the IPO and held until the sale walked away with a respectable 336% gain. That would have turned every $10,000 investment into $43,555. And that would have probably made them pretty pleased with their investment acumen.

That is until they realized that the early investors, the ones who got in before the company went public, walked away with a 261,900% profit! That means their $10,000 investment grew to a massive fortune worth over $26 MILLION.

And if you think those differences in profits are stark, just wait until you see this one.

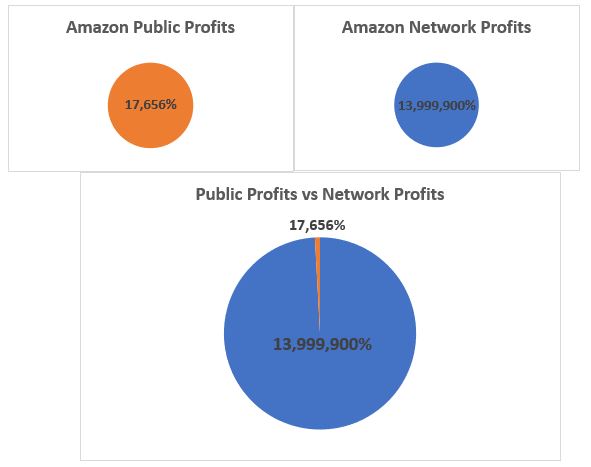

Amazon has been one of the most successful stock investments of all time. Since going public at a mere $18 a share back in 1997, the stock has gone on a rampage. The stock has undergone many splits over the years, the most recent being a 20:1 split in June ’22. Needless to say, Amazon’s Pre-IPO investors made life-changing gains. Those who bought the IPO and have held it? They’ve collected over 170,000%!

That’s even better than eBay’s private investors did! It would have turned every $10,000 invested in the IPO into over $17 MILLION! That’s a great trade right there, right?

Again, sure… until you see how much the early investors walked away with. Those folks are looking at nearly a 14,000,000% gain. That’s almost 14-million-percent profit! Fourteen MILLION!!

Think about that for a second. A 14-million-percent profit turns $10,000 into $1.4 BILLION!

Even a $1,000 private investment in Amazon would have netted you $140 MILLION in profits!

So if you still think the stock market is where the big money gets made, I’m sorry to tell you that you’re sorely mistaken.

The stock market isn’t the best place to make money — it’s just the best place available to most of us.

The Great Equalizer

Horace Mann famously called education “the great equalizer.” But I’ve also heard people call investing the same thing, and I see where they’re coming from.

In investing, everyone who buys and sells at the same time gets the same price and the same gain (or loss). The prices in the stock markets are set by supply and demand and aren’t (at least not usually) controlled by a small group.

But in order for investing to truly be an equalizer, we all need equal access to the same investments. And that hasn’t been the case for a long time.

You see, pre-IPO, or private investing, has always been off-limits to most people. You had to be super-wealthy (also knows as “accredited”) and you had to be extremely well-connected (to find the investments at all).

An accredited investor is someone who has a net worth (excluding their primary residence) of $1 million or more. Or if you made $200,000 a year for the past two years and expect to make that again this year, you can also call yourself accredited.

But even if you made the financial minimums to get in on the investments, you still had to find them. And if you ask any venture capitalist, they’ll tell you deal sourcing is the hardest part of their business.

That meant at least 99% of the investing public was cut out of these lucrative deals — probably even more, to be honest, because even those who were rich enough to make the grade had trouble with the second part: finding the investments.

But that’s all changed, and we can finally call investing a true equalizer.

Thanks to a landmark act of the U.S. Congress, the lucrative private markets are now open to anyone over the age of 18.

Taking Main Street Private

It goes by many names, but the most common one is crowdfunding. You’re probably familiar with campaigns on sites like Kickstarter, where people look for donations from their friends and family to support a project.

But there’s a profitable side to the industry as well. It’s called equity crowdfunding, and it’s giving average investors the ability to buy shares of private companies that could be the next Airbnb or Tesla.

But there’s a profitable side to the industry as well. It’s called equity crowdfunding, and it’s giving average investors the ability to buy shares of private companies that could be the next Airbnb or Tesla.

It’s opened the doors to the VIP section of the market by removing the income restrictions that used to keep so many people on the sidelines.

And it’s removed some of the opacity by requiring companies to file standardized forms with the SEC detailing each investment opportunity.

Additionally, thanks to technology, these investment opportunities are relatively easy for anyone with an internet connection to find and participate in.

Now everyday folks can be the venture capitalists walking away with 1,000,000% gains when their private company goes public. And they can get invested with as little as $100.

So you don’t even need $20,000 to put into a seed round to be the next person to cash out with a life-changing profit. A 1,000,000% gain on $100 is still a comfortable $1 MILLION.

Now we’ve all got access to the same kinds of investments that let Amazon insiders turn a grand into a veritable fortune, but with that new opportunity comes new risk.

Some Things Stay the Same

Because the one thing the law didn’t change was how difficult the terms of the investments can be to understand.

They detail the capital structure of the company. They include pre-money and post-money valuations and the modeling assumptions used to judge those values. They give the terms for the investment and let you know about any potential future dilution of shares and other risks to your investment.

They contain financial statements from the company along with projections of future operational growth. They’ll have the current ownership structure (who owns how much of the company) and if it’s a good company, it’ll tell you how much it paid for those shares.

That’s not even close to everything you’ll find on the forms detailing the investment, but it’s already a lot — enough to make most people’s eyes roll back and heads spin.

But that’s not the only risk that comes with this new market. You see, private investments aren’t the same as public ones.

Publicly traded companies are required by law to make quarterly financial reports and engage external auditors to confirm those numbers. Private ones don’t have to do that.

Public companies are easily comparable because all their information is public and they’ve got peers who are also public and transparent.

But private companies are difficult to assess because they don’t have to make any information public if they don’t want to.

And that opens up the doors to scammers looking to trick people out of their money.

Swimming With Sharks

Whenever a new market opens, there are always opportunists trying to take advantage of people who don’t have the experience to know better. And this market is no different.

They try to use esoteric language to hide their misdeeds. They use complicated share structures in the hopes that investors won’t take the time to see who really owns what. They tell an exciting story about potential markets despite having no product or service to sell.

And because of the opacity of the information in the private market, it’s tougher to spot the attacker.

They’re like bull sharks: They eat anything and prefer to hunt in murky waters.

But there are also incredible opportunities out there in the private markets, opportunities to make those earthshaking profits like the early investors in LinkedIn, eBay, and Amazon made.

So you can’t just sit on the beach because there are sharks in the water. You’ve got to go out and swim. But knowing there’s something that wants to eat you, you’ve also got to bring protection.

And that’s where I come in. You see, I’ve spent decades working with serial entrepreneurs, venture capitalists, and angel investors. I cut my teeth, so to speak, at the second-biggest investment bank in the world, and I’ve been investing in the private markets myself for years.

I put in the time and training to learn how to evaluate private companies (and how to spot a scam from a mile away), and I want to share that experience with you.

Think of my offer as a financial shark cage. You can get in the water and experience all the benefits, but you’ll have a sturdy barrier keeping you and the sharks just far enough apart.

Off to a Flying Start

Knowing there were a lot of sharks and scammers out there, I founded a new kind of investment advisory service this year. We’re entirely focused on the private markets that used to be off-limits to the majority of us.

And we’ve already hit the ground running with several impressive private opportunities.

We helped fund a cannabis delivery service that’s already expanding into other countries.

We helped get a life sciences company to scale and are now eagerly awaiting its IPO.

We funded the construction of environmentally friendly barns that will reduce the stress on the animals that live in them and reduce costs for the farmers who operate them.

And we got the opportunity to invest in an up-and-coming EV startup at the same terms Elon Musk got when he provided the seed money for Tesla.

And that’s just the start. I’ve got another investment opportunity coming down the pike in the next couple of weeks that’s one of the most exciting I’ve ever encountered.

This is a startup with multimillion-dollar revenues that’s also got positive cash flows. That’s unheard of in this market. And it’s going to fill up very fast once it’s open.

Thousands of investors are already using my analysis and advice to build their pre-IPO portfolios, but I want you along for the ride, too.

And I want you to have access to our next investment because I’m so sure this one has what it takes to grow our money 10, 20, maybe even 30 times over before all is said and done.

My Pain, Your Gain

You know the old saying, “No pain, no gain?” Well, it turns out it doesn’t always have to be the same person experiencing the pain and the gain.

In this case, I want to make my pain turn into your gain. You see, I’ve spent my career analyzing financial reports and SEC filings. I got my start in finance at one of the biggest investment banks in the world. I’ve advised startups looking for investors and multimillionaire investors looking for startups.

Most of it has been fun, but I’d be lying if I said there wasn’t a lot of growing pain involved, too.

But now, after years in the game, I’ve got a Rolodex and an understanding of the markets that makes my colleagues jealous.

And now that the private markets that helped me cement my own financial future are open to everyone, I want to help you the same way I helped those super-wealthy investors earlier in my career.

I want to be your guide. I want to help you find the best investments with the biggest shot of being wild success stories like Airbnb. And I want to help you avoid the ones destined to fail.

I don’t want you to go out into the private markets and get burned and decide they’re all a scam. I want you to have all the information and training of the professionals. And since I’ve been doing this a while for myself (and have stayed pretty well-fed so far), I think I’m the perfect guy to help you capitalize on these new opportunities.

I can comb through the financials and filings. I can break down the structure and the terms for you. I can do for you what I used to do for billionaires when I worked on Wall Street.

And since I figure you need the help more than they did, I’m not even going to charge a fraction of what they used to pay for my services. I really want to help everyone, and charging thousands of dollars a year for my advice isn’t doing that.

Get Your Main Street Venture Started

That’s why, today, I’m offering a special deal for everyone who joins me and the thousands of others already profiting from this lucrative market.

I spend weeks, sometimes months, analyzing each recommendation. And when I was at Morgan Stanley, my clients paid tens of thousands a year for access to that research.

They were already ludicrously wealthy and didn’t even blink an eye at a bill like that. But I don’t want to help people who already have more money than they know what to do with. I want to help Y-O-U.

And I’m not going to be very helpful if I charge you an arm and a leg and your firstborn for access to my research. So I’m not going to do that.

I made my money on Wall Street and I’ve made even more after. I don’t need to charge you huge fees to pay for the mortgage on a third house in the Hamptons like other advisers do.

But this research is very valuable. I spend a lot of time and money making sure we’re getting the best investments possible, so I can’t give it away either.

I could easily charge a few thousand dollars for a membership. As I said, my old money clients at Morgan would happily pay me $20,000 a year for this kind of access — probably more.

But I don’t want to help them. Again, I want to help you. So today, I’m offering the biggest discount ever for membership to our private investing community, Main Street Ventures.

But you have to act now to take advantage. I can’t offer this price very long. Even if I could, these investments fill up fast. So if you wait, you’re likely to miss out on some very lucrative opportunities.

Of the four companies we’ve funded in the past few months, only one is still accepting new investors. And I expect our next deal (coming very soon) to fill up even faster.

So if you’re ready to start investing in companies BEFORE they go public…

If you’re ready to see where the real money is made…

Then you need to join our community at Main Street Ventures.

Just click here to watch a brief presentation that explains how you can get started today.

I hope to see your name on my list when I send out my next private pre-IPO investment.

To your wealth, Jason Williams After graduating Cum Laude in finance

and economics, Jason designed and analyzed complex projects for the U.S. Army. He made the jump to the private

sector as an investment banking analyst at Morgan Stanley, where he eventually led his own team

responsible for billions of dollars in daily trading. Jason left Wall Street to found his own

investment office and now shares the strategies he used and the network he built with you. Jason

is the founder of Main Street

Ventures, a pre-IPO investment newsletter; the founder of

Future Giants, a nano cap investing service; and authors The Wealth Advisory income stock

newsletter. He is also the managing editor of Wealth

Daily. To learn more about Jason, click here. Want to hear more from Jason? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.

@TheReal_JayDubs

@TheReal_JayDubs Angel Research on Youtube

Angel Research on Youtube