Will Euro Slosh Drown Gold

I am nominating Slosh for “Economic Input of the Year.”

I’m talking about the huge tides of wealth that have flowed back and forth between the U.S. dollar and euro over the past few months.

Here’s how I put it in a recent issue of Blue Chip Trader:

Picture your kid in the bath. What happens when they scoot wildly from one end to the other looking to escape the dreaded soapy washcloth? The restricted space creates a miniature tidal wave that ends up sending water up their nose and soaking your shirt.

One moment, it looks like the Euro is going to vanish right here and now, forcing anyone doing biz on the continent desperately seeking dollars. It’s not that they love the dollar. They just need practical liquidity.

The next day, the sun rises on Paris and Berlin, and lo and behold: the Eurozone is still in business, the Euro is still coin of the realm, and traders and business men of all stripes have to go out and get some if they want to biz that day.

Nailing the Lid on the Coffin

It kinda sucks to be a generic “European” right now.

Over the past few days, we have seen reports of:

- The European Central Bank has cut its 2012 euro-area growth forecast this month to 0.3%.

- European industrial production declined 0.1% in October.

- British unemployment is hitting a 17-year high.

- The next EC Composite PMI Output index of euro-area manufacturing and services activity is slated to fall to from November’s 47 to 46.5 in December.

- The Kiel-based IfW institute forecast growth will slow from 2011’s 2.9% to 0.5% in 2012.

- Essen’s RWI predicts that European expansion will decelerate from 3% to 0.6%.

- And Sweden’s central bank has cut its main interest rate for the first time since 2009, signaling it may keep the benchmark unchanged over the next year.

I could go on ad nauseam, but I think you get the picture.

Strangely enough, German confidence is actually up.

Or Just Maybe, Steps on a Ladder?

The Ifo institute’s business climate index survey of 7,000 German executives beat guesstimates of a drop to 106, climbing instead from 106.6 in November to a current reading of 107.2.

And market researcher GfK SE claims consumer confidence will hold its gains in January as German unemployment hits a two-decade low.

The gestalt here?

I guess it’s that old Nietzschean “What doesn’t kill us makes us stronger” ethic.

German players are talking about “weathering the storm” with industry-friendly wage agreements and full order books.

The Best Free Investment You’ll Ever Make

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they

hit Wall Street. Become a member today, and get our latest free report: “Why You Need to Fire Your Money

Manager.”

It contains full details on why money managers are overpaid and provides you with

tools for growing your wealth. On your own terms. No fees, no comission.

Feeding the Short-term Need

If there is to be biz come the morning, the Germans will need an ample supply of currency to feed the need.

And since there is still no Neu-Mark yet, that means that we are sloshing once again from dollars to euros.

As I sit to write to you, the dollar is plummeting compared to the usual basket of global currencies.

Now, let’s be honest with ourselves…

So far, this is just a cyclic downturn within the context of a rising trend — in other words, slosh — rather than a genuine dollar downturn.

Eventually, we will have to see if this thing has real legs or not.

But for now, this is a broad rising trend — and this particular cyclic downturn could very well see the dollar lose some 5%, much as it did back in October.

Following the Golden Thread

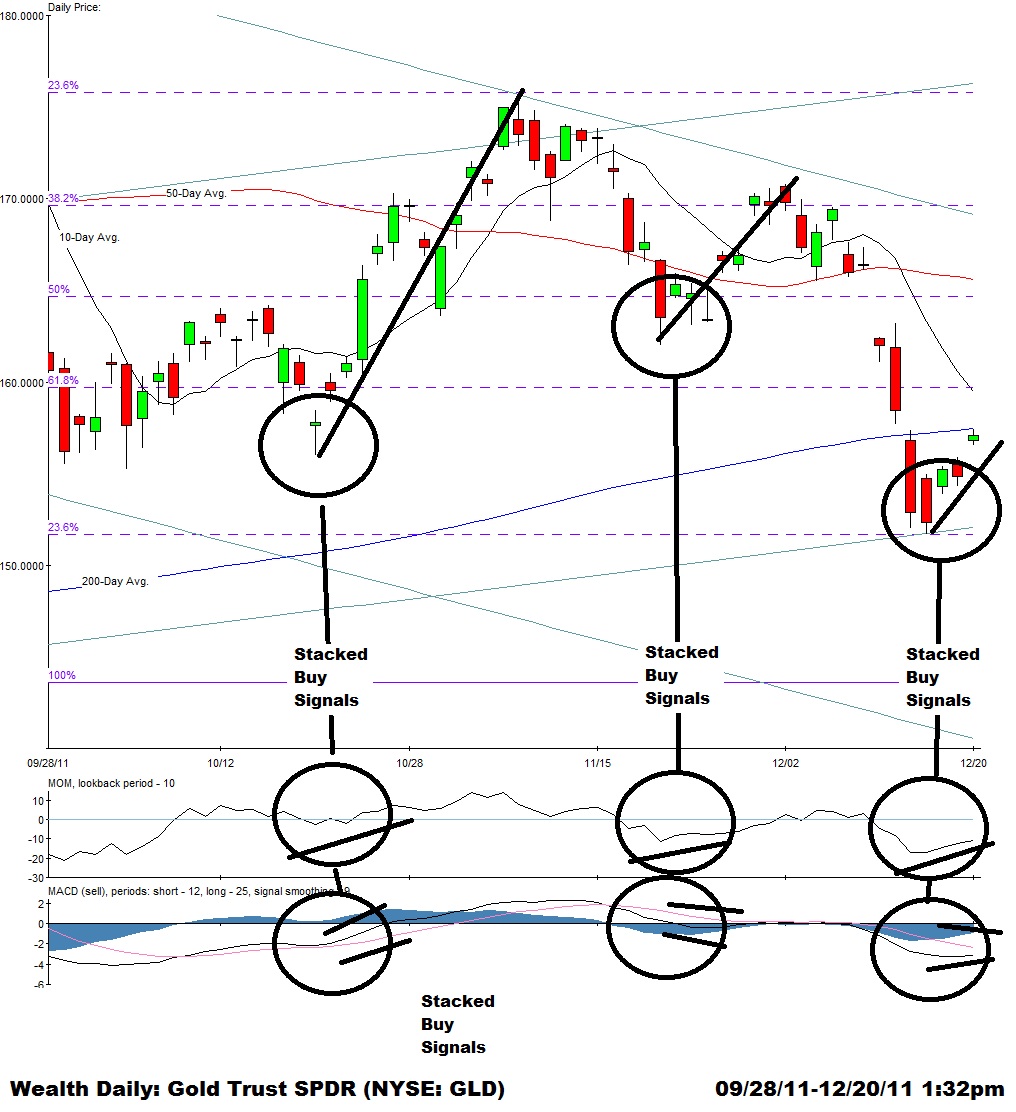

Now let’s take things another step: quite a few assets are doled out in dollars (stuff like oil and gold in particular). When we look to the charts for the Gold Trust SPDR (NYSE: GLD), the ETF that follows gold, we see the same slosh — with the GLD rising and falling contrapuntally to the dollar’s stumbles and spikes.

When we look to the charts for the Gold Trust SPDR (NYSE: GLD), the ETF that follows gold, we see the same slosh — with the GLD rising and falling contrapuntally to the dollar’s stumbles and spikes.

This not the value argument you might think…

Simply put, gold and the GLD are measured in dollars.

So when the dollar sinks, it requires more dollars to buy the same gold.

Okay, maybe there IS a value argument in here somewhere. I could easily claim gold is rising long term.

If this is indeed a true reversal in gold’s resent slide, you would see GLD return to its September high of $185, which would make for gains of 17% just for the STOCK.

280% Bucket of Slosh

But I don’t care about value philosophy right now.

I’m making a chart argument today, and the chart for GLD is showing matching short-term cyclic buy signals to the dollar’s sell signals.

Right now, I think I can promise you a rise in GLD anywhere from 5% to 12%.

That first target ought to push mid-dated at-the-money GLD calls up some 78%.

Considering the ever-changing state of “slosh” these days, you probably ought to settle for that…

But for those of you who like play in rough seas for fun and sport, a 12% rise in GLD would push that gain to 180%.

And that genuine breakout I mentioned? It would push call gains to 280%.

Take care,

Adam English

Editor, Outsider Club

Adam’s editorial talents and analysis drew the attention of senior editors at Outsider Club, which he joined in mid-2012. While he has acquired years of hands-on experience in the editorial room by working side by side with ex-brokers, options floor traders, and financial advisors, he is acutely aware of the challenges faced by retail investors after starting at the ground floor in the financial publishing field. For more on Adam, check out his editor’s page.

The Best Free Investment You'll Ever Make

We never spam! View our Privacy Policy

After getting your report, you’ll begin receiving the Wealth Daily e-Letter, delivered to your inbox daily.