There’s a shockingly common misconception about insider trading out there, and it’s keeping investors from taking advantage of a powerful moneymaking tool.

Contrary to popular belief, it is perfectly legal for corporate insiders to trade shares of their own companies. In fact, it happens all the time. The insiders just have to publicly disclose their transactions to keep everything aboveboard.

In this report, we’re going to teach you how to find these public disclosures online and how to use them to enhance your due diligence and trading capabilities.

But first, let’s clear up the root of this misconception…

Legal Versus Illegal Insider Trading

People can be forgiven for getting confused about this issue. Insider trading is a crime, but it’s not quite what it says on the label. Here’s the short explanation: It is illegal to trade on nonpublic insider information without disclosing it. (You’ll see why I italicized “without disclosing it” in a moment.)

If you’re a corporate executive (or you’re friends with one) and you get your hands on, say, a not-yet-released earnings report, you could use it to make a bunch of money by secretly buying (or short selling) shares of that corporation before the report is released.

That would mean you’d unfairly profit from a piece of insider information that is totally inaccessible to the rest of the market. And that’s the crime we call “insider trading.”

Corporate insiders can legally trade shares of their own companies — and they can even get away with using insider information — as long as they report the transaction to the Securities and Exchange Commission (SEC) with a Form 4 within two days.

The SEC then uploads that Form 4 to its Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system, a public and searchable online database. Thanks to EDGAR, all investors have equal access to trading information from corporate insiders, and no one has an unfair advantage.

Well, that’s the idea, anyway. In practice, EDGAR is typical of many government websites. It’s poorly designed, archaic-looking, and seems almost intentionally difficult to use. That’s why we’ve written a tutorial on using it.

Before we get to the tutorial, we want to make sure you understand how to use the valuable information you can find in EDGAR…

How Legal Insider Trading Can Help You as an Investor

As I explained in the section above, the difference between legal and illegal insider trading really comes down to disclosure. Corporate executives inevitably do incorporate sensitive insider information into their personal trading decisions.

The government knows it would be impossible to ban this practice outright. Prosecutors would have an extremely hard time proving that a specific transaction was motivated by a specific piece of insider information.

So instead, they just require executives to make their insider transactions publicly visible on the internet no more than 48 hours after closing. This levels the playing field a bit by tipping off other investors (at least those who can navigate EDGAR) and reducing the executives’ first-mover advantages.

But here’s the thing: EDGAR is so user-unfriendly that most investors don’t bother learning how to use it. If you do learn how to use it, you’ll be part of a select group of investors who can track the insider trades of a company’s executives in (almost) real time. You’ll effectively have that first-mover advantage that EDGAR was supposed to eliminate.

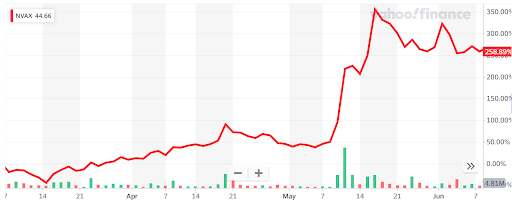

And this can be an incredibly powerful due diligence tool. Suppose you were researching Novavax (NASDAQ: NVAX) back in the spring of 2020 — at the beginning of the race for a COVID-19 vaccine. If you had looked at CEO Stanley Erck’s Form 4 filings, you could have spotted a powerful buy signal on March 10, which foreshadowed a 250%+ gain over the next three months.

On May 11, 2020, Novavax reported that it had received a $384 million investment in its COVID-19 vaccine candidate from a coalition of European investors, and its share price more than tripled in the following days.

Weeks earlier, however, CEO Erck had filed a Form 4 with the SEC for a trade, which implied that he had advance knowledge of the deal that sent his company’s shares soaring.

Curious about what was in Erck’s Form 4 filings? To find out, you’ll have to read my EDGAR tutorial below…

How to Use EDGAR

First, go to this page. You can also get there by googling “EDGAR full text search” (it should be the first thing to pop up that isn’t an ad) or by clicking on “EDGAR full text search” from the EDGAR main page. It should look something like the image below.

Next, type the company name or ticker symbol into the search field (it should autocomplete). Click the “SEARCH” button, and you’ll be taken to another search page with more parameters.

Under “Filing category,” select “Insider equity awards, transactions, and ownership (Section 16 reports).” Then select your desired date range.

When using EDGAR as a due diligence tool for future stock purchases, it’s usually good to select “Last Year.” For the purposes of this Novavax example, however, we’re pretending it’s spring 2020, so I’ve entered 4/10/2019 to 4/10/2020 as a custom date range.

Once you’ve entered your parameters, click “SEARCH” and scroll down.

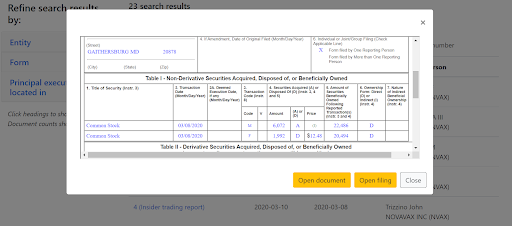

At this point, you’d want to Google the company in question’s CEO if you don’t already know their name, and click on their most recent insider trading report (Form 4). In this case, we’re going to click on the Form 4 from “Erck Stanley C” — the fourth item from the top.

A copy of the form will appear in a sort of pop-up window, which is often laggy — don’t be surprised if it’s blank for 10–20 seconds before the form appears. (Again, the SEC is not going to win any web design awards for this website.)

In the pop-up window, scroll down to “Table I — Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned.” An “A” in Column 4 indicates buying (“acquisition”), while a “D” indicates selling (“disposal”).

As you can see, Erck made a net purchase of 4,080 Novavax shares — worth more than $50,000 at the time. There’s a good chance he already knew about the $384 million investment at this point — and knew that his shares would suddenly become much more valuable when news of the investment broke.

Sure enough, the $50,000 worth of shares purchased in this reported transaction would be worth more than $175,000 by mid-June.

This isn’t a perfect example, nor is it an exhaustive tutorial of everything EDGAR can do. But I hope this report has demystified the strange world of legal insider trading for you.

The Limits of Do-It-Yourself Due Diligence With EDGAR

Of course, as we’ve discussed, EDGAR research isn’t exactly convenient, and it can be downright labor-intensive if you’re tracking multiple insiders at multiple companies. Retail investors, who often have day jobs, families, and other obligations to worry about, don’t necessarily have time to read dozens of pages of filings just to make a decision on a single trade.

What’s more, out-of-context insider data isn’t necessarily a good trading signal on its own. Our Novavax example is somewhat unusually straightforward, in part because we picked it with the benefit of hindsight. In practice, EDGAR analysis should be complemented with other kinds of due diligence, like balance sheet and income statement analysis. That adds even more time to the research process.

Fortunately, Wealth Daily has a premium trading service that does all of this tedious work for you. Editor Alexander Boulden pores over EDGAR insider trade filings and combines his findings with deep technical and fundamental analysis of select stocks for his portfolio. All you have to do is read his alerts and make trades.