This morning, I got a link to the new U.S. Solar Market Insight report.

This was me …

Yes, I'm such a renewable energy geek that I raced to download the executive summary, completely ignoring the delicious cup of Organic Bolivian coffee I had just brewed. And trust me, this coffee is hard to ignore. I bought the raw beans directly from Invalsa Coffee, roasted them over the weekend, and have since floated off into a cloud of happiness on three separate occasions.

But enough about my coffee obsession, let's turn to my renewable energy obsession.

Here are the highlights from the 2015 Year-in-Review …

- Solar PV deployments reached an all-time high of 7.26 gigawatts, representing a 16% gain over 2014 numbers.

- The U.S. is now approaching its millionth solar PV installation

- In 2015, solar accounted for 29.5% of new electric generating capacity in the U.S. This was more than natural gas!

- Six states have now surpassed one gigawatt of solar capacity. It wasn't that long ago when folks were getting all giddy about the entire nation hitting one gigawatt. These six states included California, Massachusetts, New Jersey, North Carolina, Arizona, and Nevada. Unfortunately, I suspect that in 2016 there may be less capacity added in Arizona and Nevada as both sun-soaked states seem determined to trivialize the gifts of their incredible solar resources by trying to slow solar's momentum. But that's another rant for another day. Getting back to the good stuff …

- Greentech Media and the Solar Energy Industries Association are now forecasting 16 gigawatts of solar PV installations for 2016. This would be an increase of 120% over 2015. Much of this is the result of clarity on the investment tax credit being extended through 2021.

- The residential PV market enjoyed its largest annual growth rate ever, marking the fifth consecutive year of annual growth in excess of 50%.

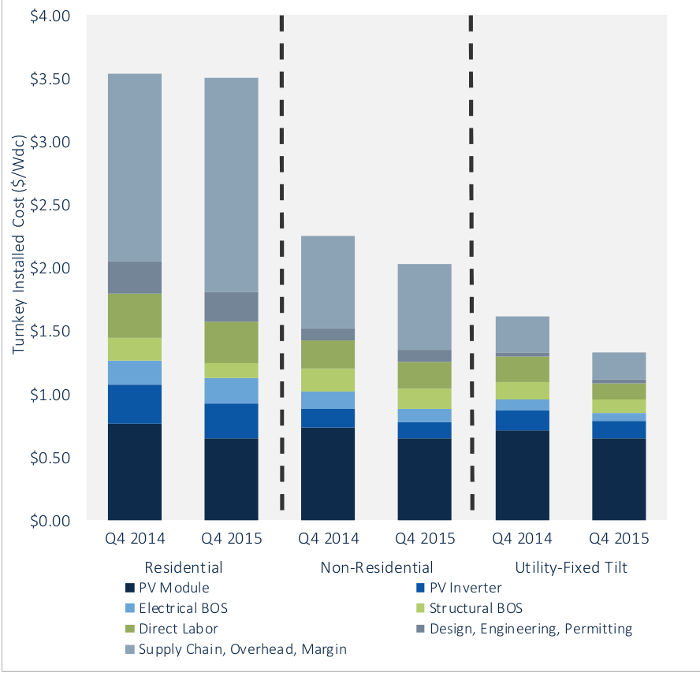

- Overall pricing fell up to 17% in 2015. Prices keep falling, consumers keep buying. It's just that simple.

And here are all the wonderful charts included in the executive summary that should give any renewable energy supporter a shot of enthusiasm. It's better than Internet porn!

Once again, the data analysis is quite clear: Solar is the future, and investors should be investing accordingly.

My favorite stocks in the solar space right now include: SunPower (NASDAQ: SPWR), First Solar (NASDAQ: FSLR), and SolarEdge (NASDAQ: SEDG).