Editor’s Note: Before you begin your free report, “Guardians of Growth: 3 Defense Contractors for Savvy Investors,” I wanted to share this special note with you from Angel Investment Research Founder and President, Brian Hicks.

The Timing on This is CRITICAL

Big institutions are loading up the truck…

With nearly 17 MILLION SHARES snatched up on the cheap in just a single day.

So why are big funds like Blackrock going crazy over this AI PURE PLAY?

It’s simple: odds are this small firm could DOUBLE by the end of the year and 10X your money if you hold it longer.

And for good reason.

It’s creating a vast AI MONOPOLY.

The same way Microsoft did with Windows. And Google did with Search.

Which sounds like a lot of hype, until you realize they are 4-5 years ahead of everybody else.

Now, according to a billionaire insider, their plan is “take the whole market”…

It all adds up to one thing: BIG MONEY.

Bottom line: If you get out in front of this AI play the way we have, you could collect some of the biggest gains in history.

Everything is revealed right here.

Guardians of Growth: 3 Defense Contractors for Savvy Investors

Defense contractors are on a hot streak the likes of which we haven’t seen since Donald Trump first took office.

Back then, the president’s pledge to go on the offensive with the military sent defense stocks soaring as soon as November 9, 2016 — the day after he was elected.

Since then, the SPDR S&P Aerospace & Defense ETF (NYSE: XAR) has more than doubled. Almost every company in the industry is posting amazing returns.

And is that any surprise? In the past eight years, violence has broken out all over the world. Most recently, all eyes are on Gaza as Hamas and Israel continue a heated exchange of destruction. As you’ll see in the charts above and below, October 7th ignited more than a feud that dates back hundreds of years. It reignited defense stocks.

While it may be a bit morbid of an idea, the fact of the matter is these companies exist and are publicly traded. If they can turn your $1,000 invested into $5,000, why not take advantage of the opportunity?

No doubt, global tensions have been on the rise for some time now. And in response, so are defense budgets…

Global defense spending recently rose to a staggering record height of $2.24 trillion.

We haven’t seen levels like that since the end of the Cold War.

And as always, the U.S. is leading the charge.

Last year, the Senate approved a record defense budget of $858 billion for 2022–2023. That’s $45 billion more than the Biden administration requested and 10% higher than last year.

In December 2023, the U.S. Senate passed the National Defense Authorization Act for Fiscal Year 2024. It passed with a vote of 87 yeses to 13 nos. The NDAA allows for a total spend of $886 billion in 2024 for national defense — a cool $28 billion increase from 2022-2023.

To put this into perspective, Congress only authorized $711 billion for defense back in 2018 during Trump’s administration. A year before that, former President Barack Obama was only granted $580 billion.

Defense spending in the U.S. is on the run with no end in sight.

And as we all know, a huge portion of that money goes directly into the pockets of defense contractors.

They’ve outpaced the market for years now, and that’s not going to stop anytime soon.

Here are our top three picks for the sector:

- Lockheed Martin Corporation (NYSE: LMT)

- General Dynamics Corporation (NYSE: GD)

- Northrop Grumman Corporation (NYSE: NOC)

1. Lockheed Martin Corporation

Lockheed Martin Corporation (NYSE: LMT) is the world’s largest defense contractor, although it didn’t have the best year in 2023.

Perhaps that presents investors with a prime buying opportunity for LMT stock. Most recently, on January 16, 2024, the Space Development Agency (SDA) awarded Lockheed a contract to build 18 space vehicles for its Tranche 2 Tracking Layer Constellation. The deal is worth a potential value of $890 million.

Lockheed’s Aeronautics division reported in September 2023 that they were going to fall short of their F-35 deliveries for the year. However, that didn’t stop Belgium from rolling out their first F-35s. Or Canada from selecting Lockheed and their F-35 as their future fighter jet.

F-35 sales have netted Lockheed hundreds of billions so far, but the company is far from a one-trick pony. One of its newest ventures could put the entire defense industry out of business. Introducing hypersonic missiles…

Hypersonic missiles are weapons that travel at speeds of Mach 5 (five times the speed of sound) or higher.

Such weapons can include unmanned jets or more traditional cruise missiles. But the real threat comes from “glide vehicles.”

A glide vehicle is launched into space (low-earth orbit) by rockets almost identical to ones that carry satellites and astronauts, except it carries a glide vehicle/maneuverable warhead instead. That glide vehicle deploys from the rocket, re-enters the earth’s atmosphere, leaves again, coasts for a while, and then re-enters once more, screaming down at its intended target.

This is called “boost-glide” or “skip-glide.”

It looks something like this…

This is much different than a traditional ICBM which launches up and comes down in a pretty standard arc. And this unpredictable nature, along with uncanny speed, makes it almost impossible to intercept.

Still, this technology has been around for a while.

Russia’s is called Avangard. First introduced in 2018, it launches from an ICBM and is capable of hitting Mach 20.

Meanwhile, China’s hypersonic glide vehicle is known as DF-ZF, and it officially became operational in 2019. It can also reach speeds between Mach 5 and Mach 10 and can be outfitted with various ICBMs.

This is why government-wide hypersonic research funding grew 740% between 2015 and 2020.

All told, the government is working on about 70 hypersonic programs projected to cost $15 billion through 2024.

Where’s the lion’s share of that money going? You guessed it. Lockheed Martin.

2. General Dynamics Corporation

General Dynamics Corporation’s (NYSE: GD) business can be broken into four main segments:

- Aerospace — jets and other aircraft

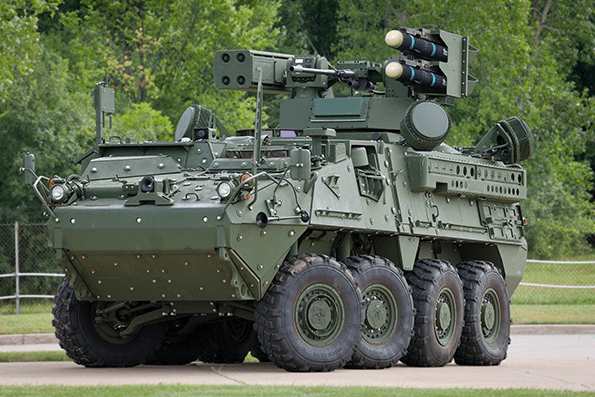

- Combat systems — tanks, combat vehicles, and light armored vehicles

- Information systems and technology (IS&T) — secure communications, command, and control systems, imagery sensors, and cyber tools

- Marine systems — complex ships like nuclear submarines

There’s no shortage of lethal machinery at General Dynamics. But the company’s true goal is to become the government’s leading IT provider — with a few armored vehicle sales on the side.

And where there’s no shortage of lethal machinery, there’s no shortage of government spending.

The Pentagon’s original goal was to build 85,000 155 mm artillery rounds a month by FY2028. However, it’s currently on pace to reach 100,000 per month by FY25 and at least 57,000 a month by spring 2024.

That’s thanks in large part to efforts made by companies like General Dynamics (NYSE: GD) and Lockheed Martin (NYSE: LMT), which are also benefiting from the Pentagon’s renewed commitment.

See, the military-industrial base shrank in the decades after the Cold War as demand fell. However, the United States and its Western allies have since come to realize that it was a mistake to let their defense manufacturing atrophy.

So they’re reversing course.

Indeed, the FY24 defense budget (which totals $858 billion) includes $1.5 billion to increase the Army’s production capacity for the 155 mm shell. It also allocates another $18 billion to growing the industrial base over the next 15 years to get to that 100,000-per-month production target.

Again, General Dynamics makes 155 mm artillery shells, as well as key propellant and propulsion chemicals like ball powder propellants and artillery propelling charges.

It makes shells at its Ordnance and Tactical Systems facility in Wilkes-Barre, Pennsylvania, and it fills them at a government facility in Iowa.

Beyond that, the Army is collaborating with GD on another manufacturing facility in Garland, Texas.

Since the defense budget has recently ballooned to unprecedented levels and the world only recently realized how terrible our cybersecurity is, much of that money will be spent modernizing federal IT systems.

These are some big fish that could secure not just the one-time contract to build the cloud but also years of recurring support and development revenue. It’s a major opportunity. And it’s bringing in big tech names, such as Amazon and Oracle, as well as rival defense contractors.

But by establishing itself as the go-to IT maven for the Pentagon, General Dynamics has carved out a firm foothold for itself to contend with those massive projects.

According to company financials, General Dynamics recently reported a massive $129 billion contract backlog. The government just keeps sending the company more and more lucrative deals — how can management say no?

So while GD makes missiles, armored vehicles, and submarines, it’s also looking to cyberspace for added growth.

3. Northrop Grumman Corporation

Northrop Grumman Corporation (NYSE: NOC) is another defense behemoth.

Its core capabilities include:

- Logistics solutions

- Autonomous systems — drones, satellites, and space systems

- Strike — such as the B-2 Spirit stealth bomber

- Cyber

- C4ISR (command, control, communications, computers, intelligence, surveillance, and reconnaissance)

Northrop Grumman saw Lockheed Martin reinvent military technology with its hypersonic missile and felt left out. The only logical response was to raise the bar even higher.

Northrop Grumman recently announced the completion of the preliminary design review for its high-energy laser prototype under the Department of Defense’s High Energy Laser Scaling Initiative (HELSI).

According to reports, the architecture of the system is scalable up to a megawatt — enough juice to power a small town for a year. The picture above is an artist’s rendition, but it might not be science fiction for long.

Last year, the U.S. Air Force selected Northrop Grumman to watch over its intercontinental ballistic missile defense shield. The company will continue its role as the Minuteman III intercontinental ballistic missile (ICBM) Ground Subsystems Support Contractor (GSSC).

The award has a potential ceiling of $3.86 billion over 18 years.

On top of that, Northrop Grumman has seen a steady stream of revenue from aviation products like the MQ-4C Triton and the E-2D Advanced Hawkeye.

The Triton is a drone that provides real-time intelligence, surveillance, and reconnaissance (ISR) over vast ocean and coastal regions. The units have been flying successfully since November 2017.

The Navy has ordered 68 Triton aircraft in total.

The Hawkeye, meanwhile, is often called the “digital quarterback” of the battlefield. It monitors the surrounding area and communicates to battle groups to keep them out of harm’s way.

NOC has set itself up very, very well, no doubt. While the stock has recently taken a bit of a hit due to headlines regarding inflation, supply chain and budget uncertainties, investors have nothing to fear. While these concerns are nothing to scoff at, they’re most likely just small road bumps. In addition to these not-so-great headlines, Northrop reported a 7% revenue increase in the last quarter of 2023. It has also just been announced that their orbital fueling port has been selected by the U.S. military for refueling satellites.

A Rare Opportunity Just Opened Up For “Top Secret” Defense Stock

When’s the last time regular investors had the chance to invest in technology that would power a multitrillion-dollar industry?

Well, it wasn’t that long ago.

You see, all of our computers, phones, smart devices, televisions, cars…

Even our refrigerators and microwaves…

Pretty much every single piece of technology we use every day relies on semiconductors to function.

And the companies that produce those semiconductors have made lucky investors wealthier beyond their wildest dreams.

Like Taiwan Semiconductor Manufacturing Company, which has returned 13,173% to people who got in on the ground floor.

Or Advanced Micro Devices, Inc., which has handed out gains of as much as 4,851% since 2015.

And Nvidia, which has delivered as much as a 26,221% windfall to well-timed investors.

$500 in Nvidia would have turned into $131,600!

But the pick-and-shovel play of the future won’t be semiconductors.

It will be this.

You see, as we speak, a brand-new type of technology is about to go mainstream.

A technology that’s expected to release $7 trillion in new wealth over the next five years!

And just like Advanced Micro Devices, Taiwan Semiconductor Manufacturing, and Nvidia powered the internet and mobile revolution…

One tiny company will power this new $7 trillion industry.

And if early investors place their stake in this company now, they could have a shot at 26,221% gains.

Sincereley,

Jason Simpkins

P.S.: There is a lot more FREE actionable investment analysis and commentary on our YouTube channel. If you want a leg up in 2024, then you should definitely subscribe and take advantage of the free content we’ve laid out for you. Just click here.

Jason Simpkins is Assistant Managing Editor of the Outsider Club and Investment Director of Secret Stock Files, a financial advisory focused on security companies and defense contractors. For more on Jason, check out his editor’s page.