Southern food is not alien to me.

Having spent many summers visiting my family in Richmond, VA, I have a decent amount of experience diving face-first into plates of fried chicken, mustard greens, okra, butter beans, and pecan pie. All homemade, of course.

I can still remember the smell of the chicken frying in my grandmother’s cast iron frying pan. It’s making my mouth water just thinking about it. To this day, I’ve never been able to find chicken the way she made it.

Super crispy on the outside, juicy on the inside, and full of flavor. The latter probably had a lot to do with the fact that she raised and butchered her own chickens. You can’t get fresher than that!

Over the years, I’ve tried southern food at various restaurants above or just below the Mason-Dixon Line. They always fall short. So when I heard that Bojangles’ fast-food chain was about to go public, all I could think about was fried chicken and how underwhelmed I was the one and only time I ate there.

There was no thought or love put into that food. It wasn’t fresh, and it certainly wasn’t homemade — at least in the way I think of homemade. But what can you expect? After all, it’s a fast-food chain, where quality typically takes a backseat to fast calories.

Of course, just because I think the food is mediocre at best doesn’t mean I’d be opposed to picking up a few shares when this thing goes public.

The Next Chipotle?

It seems every time a new fast-food restaurant files to go public, the first thing I read is, “Is this the Next Chipotle?”

For the record, it never is.

Although many analysts continue to believe the illusion that all fast-food stocks somehow fall into the same category, nothing could be further from the truth.

Chipotle (NYSE: CMG) has been insanely successful because of its ability to cater to a growing market of consumers that demand higher-quality food and a certain level of sustainable business practices.

It’s a new world, and more and more we’re seeing millennials and baby boomers alike choosing quality and business ethics over empty calories, value meals, and marketing gimmicks.

It should also be noted that you can’t discount the advantages of appealing to cultural demands. El Pollo Loco (NASDAQ: LOCO) is a perfect example of this.

The tasty chicken restaurant is extremely popular in Latino communities, and it is insanely profitable. El Pollo Loco is an excellent case study in the connection between cultural identification and profitability.

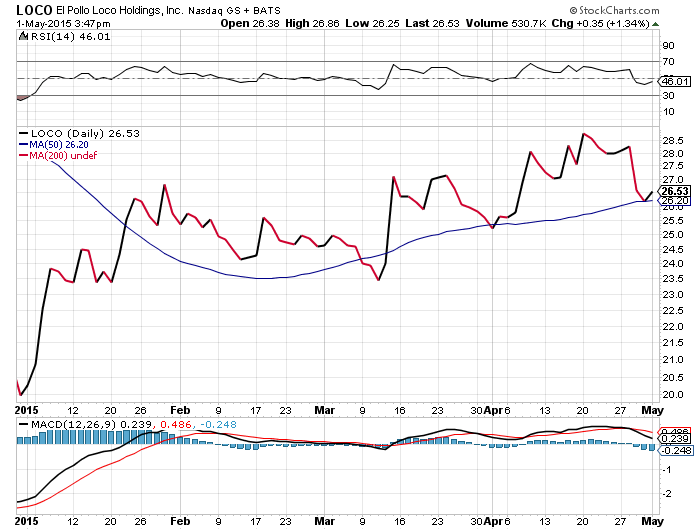

Incidentally, El Pollo Loco has been performing quite well this year. Check it out…

Bojangles also enjoys a cultural connection that I believe gives it a leg up in comparison to other fast-food chicken restaurants.

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”

It contains full details on why dividends are an amazing tool for growing your wealth.

Although you won’t find a Bojangles anywhere near my office in Baltimore, these things are all over the South. And the company is making a killing by identifying with Southerners that crave southern food at a reasonable price, with the added bonus of fast service.

Of course, most southern food is not made “fast.” At least, not good southern food.

In any event, Bojangles is no slouch when it comes to the fast-food game. In fact, the company has delivered 19 consecutive quarters of system-wide comparable restaurant sales growth since Q2, 2010. Also worth noting…

- Restaurant count has enjoyed a compounded annual growth rate (CAGR) of 7% from FY, 2011 to FY, 2014.

- Total revenues have grown from $299.9 million in FY, 2011 to $430.5 million in FY, 2014, representing a CAGR of 12.8%.

- Net income has grown from $4.6 million in FY, 2011 to $26.1 million in 2014.

Bojangles is looking to sell 6.25 million shares at a price of between $15 and $17 a share. That’s actually a pretty reasonable valuation, although I suspect we’ll see something much higher the day it goes public — assuming the broader market cooperates.

I’ll personally be looking to pick up shares after the smoke clears. This is actually a solid outfit with reputable management, a recent history of impressive growth, and the ability to cater to southern taste buds better than any other fast-food chain out there.

Bojangles will trade on the NASDAQ under the symbol “BOJA.”

To a new way of life and a new generation of wealth…

Jeff Siegel

@JeffSiegel on Twitter

@JeffSiegel on Twitter

Jeff is the founder and managing editor of Green Chip Stocks. For more on Jeff, go to his editor’s page.

Want to hear more from Jeff? Sign up to receive emails directly from him ranging from market commentaries to opportunities that he has his eye on.